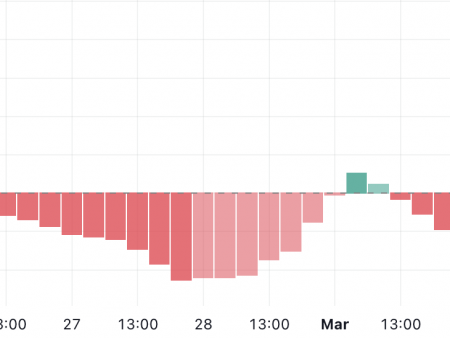

According to Binance Trading, Ethereum (ETH) fell to $ 1,993, and then recovering to $ 2050. Token reached its lowest level since April 2023, correcting recent hopes for recovery.

Ethereum (ETH) continues to slide, with a recent short -term fall of Binance. The asset decreased to $ 1993, the lowest price since April 2023. Currently, he is returning to the territory of the bear, despite the expectations of favorable efficiency in the first quarter.

EnIt fell with the rest of the market, although I also encountered its own pressure set. The asset slipped further to 0.025 BTC, also delaying a breakthrough against the leading coin. Soon after plunged at $ 2000, ETH recovered up to $ 2,138.65. The break has not yet proved the change in relation, since the crypto -market is still traded in fear.

During the last fall in prices, there were again several theories of price action. The main reason was the general weak mood for altcoins. Crypto also tracked the stock markets with another slide, responding to recently forced trade tariffs according to President Trump’s plan.

ETH Open PENEST enters levels in November last year

The current effect at the price of ETH takes place with an open percentage of $ 9.8 billion. ETH in December defeated the story of elections in the United States, with an open percentage reached above $ 16 billion.

Interest in ETH is simply slower, as traders see a long -term loss in the asset. ETH also glides along with the rest of the altcoins market. Loss of token also means less users of the Ethereum network and common doubts about its future utility.

This fell because Altcoin’s index slipped to a lower range of 22 points. The index later recovered 24 pointsBut most previously hot assets have already passed through deep discontent, and merchants remain careful.

ETH is traditionally considered the driving force of the altcoins season, but fatigue from trading the meme and the total volatility in the markets gives additional caution for traders. ETH is also an exception, as most other assets have a transition to bull moods. Both retail and smart money became bearish on ETH on the last day.

$ Eth mood

Crowd = bear

MP | #SMARTMONYY = BEARISH#ITHEREUM

Check the mood and other crypto -statistics at https://t.co/hqdybnuzek#crypto #marketprophit pic.twitter.com/ihxnni1dwvv– Market Prophit (@marketprophit) March 4, 2025

Last year, Eth also fell after his long -term vision was challenged. Token remained inflationary, while the Ethereum Foundation did not create a scaling tool. Traffic and liquidity have also switched to L2 chains. The main utility of Ethereum was to wear a binding (USDT) and offer a platform for the main activity of Uniswap. ETH holding is also necessary to provide the network and serve as security, although these functions are already filled with old whales.

Sellers can deliberately destroy ETH

Another theory is that ETH is pressure on point sales, in order to eliminate the remaining long positions. Despite the fall in prices, more than 74% of ETH positions are long. Liquidity increased to 1900 dollars.

This also made a quick recovery that raised short positions over $ 2,000. However, the risk of long liquidations remains high.

ETH seems attractive in the price range of $ 2000, especially if the long -term rally is still expected. The purchase of whales continues, although even smart money was stuck from the unexpected accidents.

We caught a caught whale – yes, even the whales stuck!

This whale, which previously bought a low level, sold a high level and earned $ 33.67 million per $ ETH, is now fighting.After adding positions and obtaining #TRApped, they just bought another 2000 ETH ($ 4.1 million) to try to reduce their average price. pic.twitter.com/jyk9i6m0xj

– Endonchain

(@eyeonchain) March 4, 2025

Smaller whales too Buying a fallfor purchases up to 10 million dollars. ETH can be considered shaky, but the accumulation continues for whales that can afford to wait for a breakthrough.

Another theory is that the world freedom of Trump can be capable of rocking markets. In February, the fund put forward most of its ETH of its wallets and, possibly, prepared for sale. Currently, sellers can also re -purchase at a lower price. Eth Dip also allows whales to cover loans.

This also saw the pressure of sales from the BYBIT hacker, which managed to change almost 500 thousand floor for several days.