Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is for informational purposes only. U.Today is not responsible for any financial losses incurred when trading cryptocurrencies. Do your own research by contacting financial experts before making any investment decisions. We believe all content is accurate as of the date of publication, but some offers mentioned may no longer be available.

The second-largest cryptocurrency by market capitalization, Ethereum (ETH), could risk a 16% drop from its current price if a critical price level is missed.

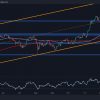

Alia crypto analyst, spots a sell signal presented by TD Sequential on Ethereum’s three-day chart as the second-largest cryptocurrency tests a major resistance zone between $2,000 and $2,150 within an ascending triangle pattern.

A break below this resistance level could lead to a drop towards the triangle’s hypotenuse at $1,700 before the uptrend resumes.

Ali identified the price of $2,150 as the crucial level to watch as a sustained three-day candle close above this level could offset the bearish outlook.

At the time of writing, ETH was down 0.75% in the last 24 hours to $2,019. This is because the cryptocurrency market had a mixed price reaction after lower-than-expected inflation statistics were released on Tuesday.

The consumer price index (CPI) rose 3.2% in the year through October, according to the latest report from the Bureau of Labor Statistics. Economists predicted the index would rise 3.3% year over year, up from 3.7% posted last month.

The US Federal Reserve chose to keep interest rates stable this month in a target range of between 5.25% and 5.50%, its second consecutive pause.

As the overall crypto market remains stable, Santiment, a new on-chain analytics company, recommends keeping an eye on the growing social volume of BTC and ETH as well as large caps as more traders seem interested in the markets again. .

Meanwhile, Ethereum fees have risen back to their highest levels in four months as network usage grew. ETH fees rose to $5.72 per transaction on Sunday, the highest since July 4, Santiment reported.