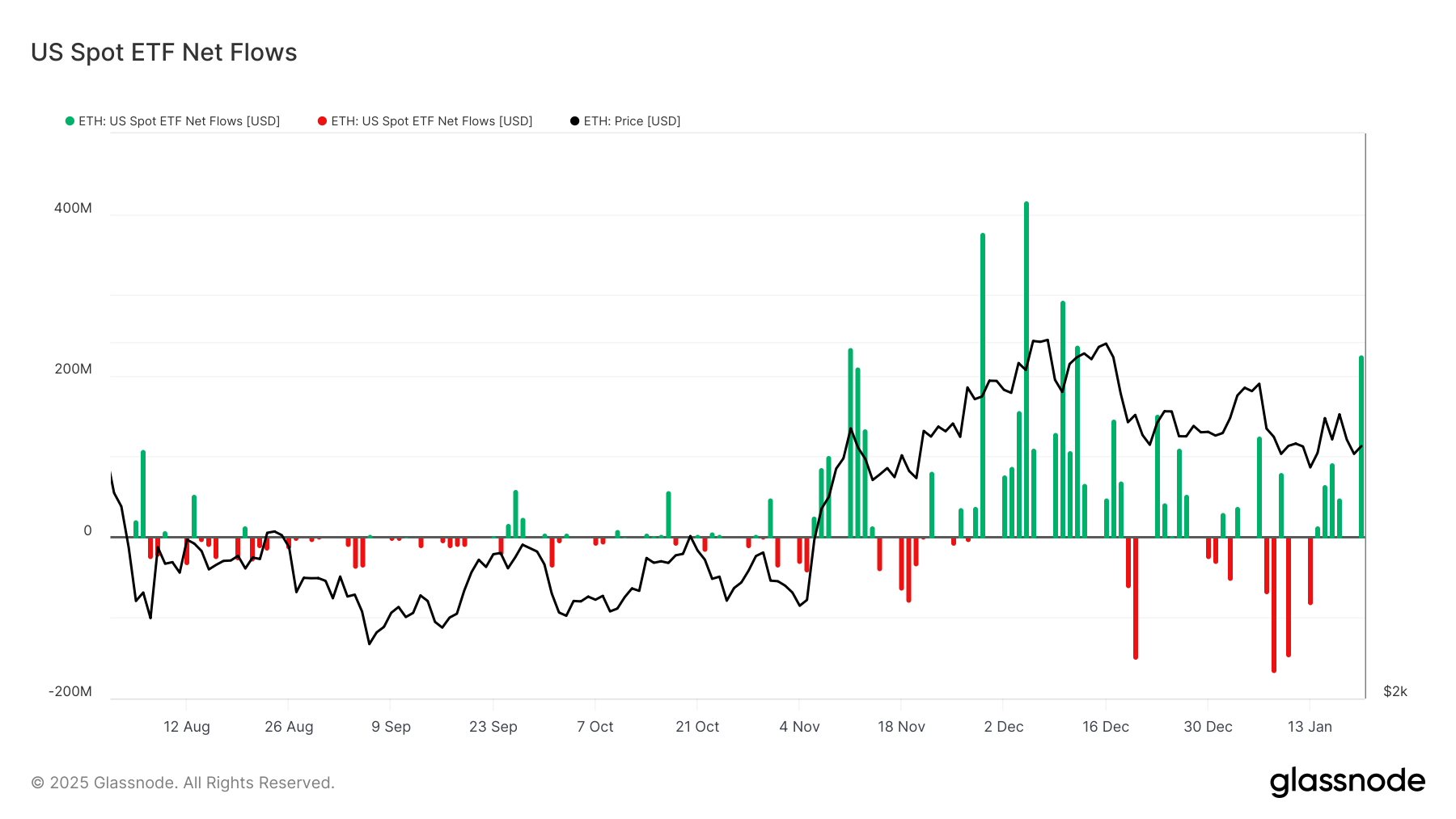

On Monday, Ethereum Trucked (ETFS) funds recorded their highest influx in 30 days. This signals the strong interest of investors, despite the weak price of ETH in recent weeks.

Soon in the investment, ETF coincides with increased market optimism after the inauguration of Donald Trump, which increased the confidence of investors.

Ethereum ETF surge

According to Glassnode, the influx of ETH ETF in the USA on Monday amounted to $ 227 million. This was the most one -day clean tributary from December 9. Spike in ETF tributaries appeared when Kricko Donald Trump was oath as the US president, which increased confidence in the general market conditions.

The growth of ETF tributaries emphasizes the growing institutional interest in ETH as a viable investment vehicle, even among poor prices for coins in recent weeks. By

This trend emphasizes the strengthening of institutional demand for altcoin, even despite the fact that its price continues to bargain within a narrow range.

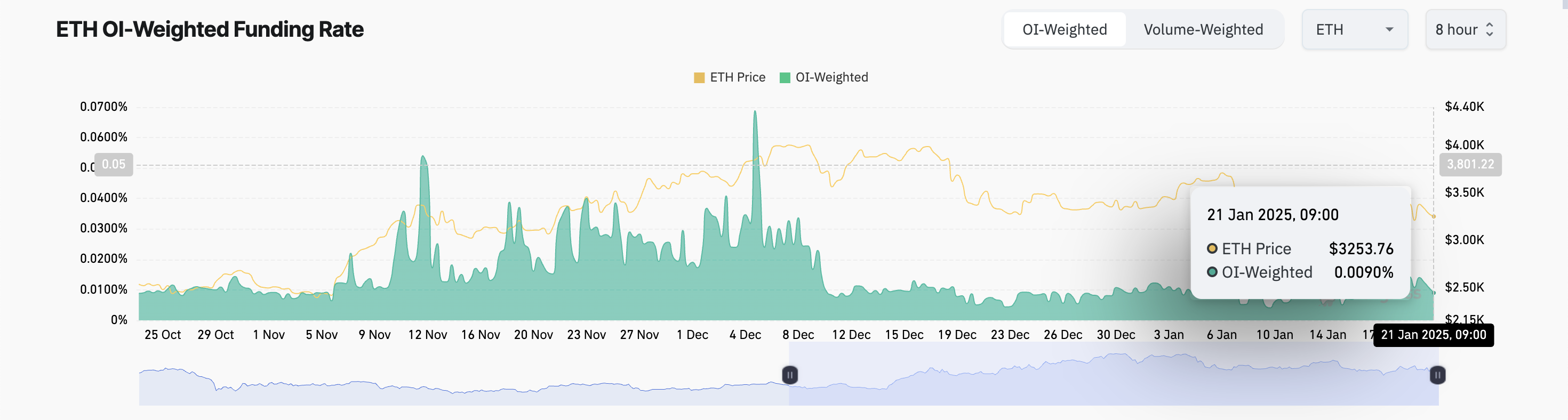

Moreover, a constant positive level of financing in the futures market confirms the bull bias to the coin, despite its performance. At the time of writing this article, this is 0.0090%, which indicates the preference of long positions among ETH derivatives.

The financing rate is a periodic fee that will exchange between long and short traders in futures contracts in order to maintain the levels of prices between futures and the basic asset.

As in the case of ETH, a positive level of financing indicates that long traders pay short traders, signaling the former moods, since more and more traders make bets on raising prices.

Price forecast: will market demand push it to $ 3,500?

ETH is currently trading at 3265 dollars. If the market demand for altcoin increases, its price will break out of the narrow range to bargain above $ 3,500 and amount to 3675 US dollars.

Nevertheless, if it remains in the range, and the bear enhances the pressure, the price of ETH can break to the deviation and fall to $ 3022.