This is a segment from the information bulletin of the empire. To read full publications, SubscribeField

You probably already heard that ETH is a damned asset. Doomed.

Maybe you read tweets that say that Ethereum is destined to go on the path of Intel, which has collapsed in a cost of two-thirds over the past five years, while competitors (NVIDIA and AMD) have flourished compared.

This is a double that works only if you focus exclusively on the price and ignore how much activity is stored in Ethereum and its surrounding web of layer-2 and level 3.

Air received only 30% last year, while its direct competitor, SOL, is about half.

Even XRP easily won ETH today. XRP has currently increased by more than 600% since the last bear market in November 2022.

BTC otherwise received about 500% and SOL is almost 1500%. ETH seems terribly boring compared.

Here is an alternative theory: a relative super -tag coins, such as SOL and XRP, has nothing to do with ETH.

Let’s start with XRP. The continuing collision of Ripple Labs with SEC (which began in December 2020), had a retreat of the XRP on almost the entire market cycle, not to mention its non -fulfillment within the 2021 Bull Run.

Thus, whatever the XRP, made in the light of Trump’s victory in November, is more connected with the catch -up of the market, which is especially special in the asset itself.

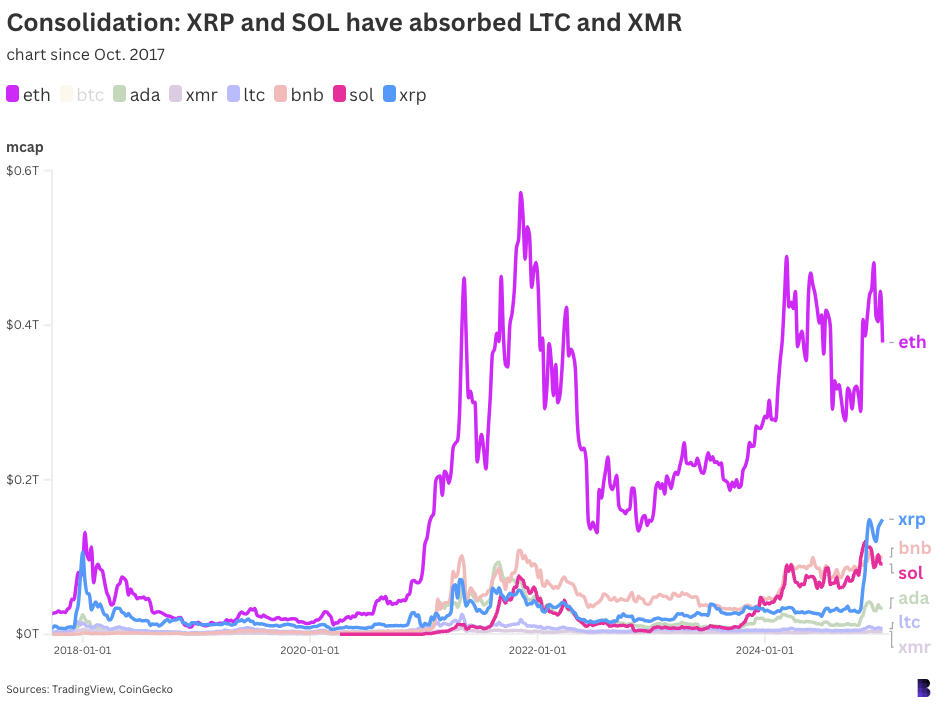

As for SOL, it is worth looking back at how the upper end of the crypto actually looked around.

As a rule, the three best coins remain more or less the same since 2016: BTC, ETH, and then XRP.

In 2017, the following were the most valuable Litecoin (LTC) and Monero (XMR). These were those, plus bitcoin cash (BCH) and Cardano (ADA) in 2018; EOS in 2019; BNB in 2020.

LTC is currently in 27th place -much further on the market -while Monero in the 37th and bitcoans Cash 23.

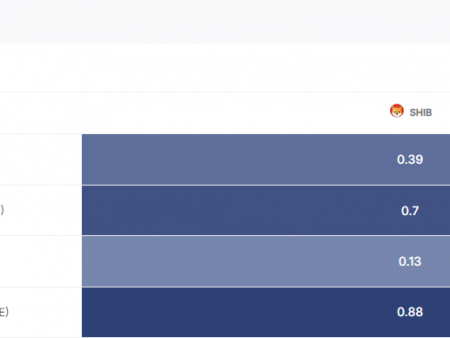

Compare the diagram above with the first, which only applied the price on the card. It monitors market capitalizations of the upper market – and it is clear how much the smallest of these coins are for ETH.

It is natural that they would surpass ETH in certain parts of the cycle. While liquidity is not necessarily combined with market capitalization, smaller assets, as a rule, need a much smaller amount of fresh capital to move the needle.

It is also not a coincidence that LTC, XMR and BCH, all the alternatives of the bitcoins, so sharply fell between the cycles.

Bitcoin won the race as a cost, and the stub was ecologically cleaned to better perform the option of using digital payments than Litecoin.

Whatever the mind and the market, the main coins from past years, which have never found a market product on a scale, just to be transferred to Solan.

Thus, Solan Renaissance is little about the expected Ethereum death, and is more associated with the abbreviated value of much more old coins.

As for whether Ethereum will also become one of those “much more old coins” once in the future – entertainment that requires a completely different Cope. Let me return to you.