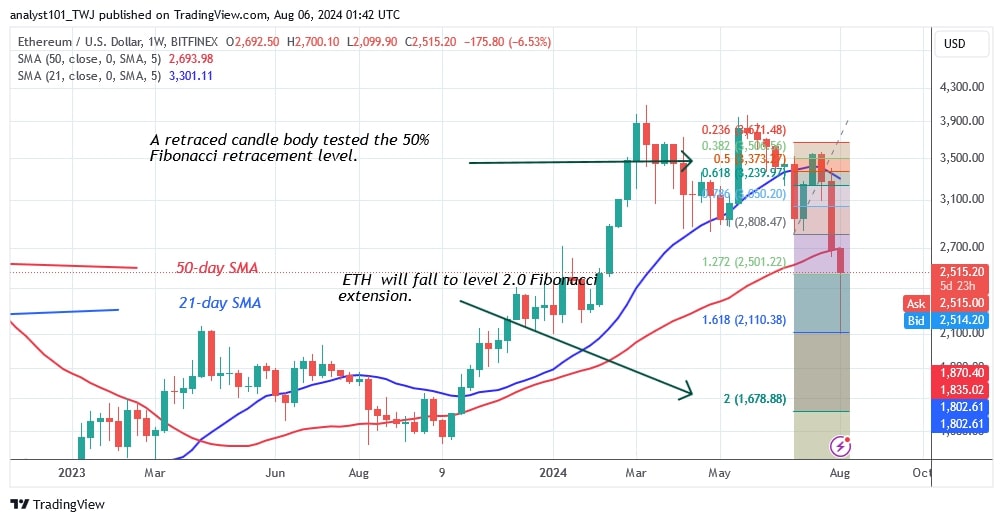

Ethereum (ETH) price fell below the moving average lines as buyers failed to sustain positive momentum above the moving average lines or the $3,600 resistance level.

Ethereum Long Term Price Analysis: Bearish

The largest altcoin falls sharply below its moving average lines. The altcoin fell to $2,116 before recovering.

The altcoin has been hovering above the $2,400 support level in the last 24 hours. It is correcting upwards, but the move may be rejected at the recent peak. According to price indicators, Ether is likely to fall further.

After the July 1 price drop, Ether corrected higher and tested the 50% Fibonacci retracement line with a declining candle body, Coinidol.com reports. The upward correction suggests that ETH will fall to the 2.0 Fibonacci extension level or $1,678.88. The altcoin fell to a low of $2,116 but recovered.

Ethereum Indicator Analysis

Ether price bars are below the moving average, suggesting that the cryptocurrency will continue to fall. On the 4-hour chart, the moving average lines have a bearish crossover, indicating a bearish signal. The moving average lines are horizontal, indicating a sideways trend since March 11.

Technical indicators:

Key resistance levels are $4000 and $4500

Key support levels are $3,500 and $3,000

What is the future direction of Ethereum?

Ether has fallen below its moving averages but remains above the $2,400 support level. The largest altcoin is above the $2,400 support level but below its moving averages.

The decline will continue if the current support level of $2400 is broken. However, if the current support level holds, the trend will continue in the trading range. At the same time, Ether is at risk of falling further.

Disclaimer: This analysis and forecast are the personal opinions of the author. They are not a recommendation to buy or sell cryptocurrency and should not be considered an endorsement by CoinIdol.com. Readers should do their own research before investing in funds.