ELYSIA, a leading real-world asset (RWA) tokenization firm, plans to launch US Treasury Bills (TBILL tokens) on the XRP Ledger blockchain network. The firm wants to combine the best of decentralized finance (DeFi) and traditional finance (TradFi) through RWA tokenization.

In a post on X (formerly Twitter), ELYSIA said that by early next week, users will be able to stake XRP to receive TBILL tokens and earn income on the underlying asset. This gives the digital asset XRP greater utility, which has risen significantly over the past few weeks, reaching multi-year highs.

Elysia is pleased to introduce our latest tokenized real asset: US Treasury Bills on the XRP ledger.

Starting next week, users will be able to stake XRP to receive TBILL tokens and earn income on the underlying asset.

Our first tranche will open on December 19 at 03:00 UTC, at… pic.twitter.com/gFp7NMD1uI— ELYSIA (@ELYSIA_HQ) December 13, 2024

The first tranche will open on December 19 at 03:00 UTC in collaboration with Infiniteblock, a VASP licensed company. This is the first time that the RWA project appears on the XRP Ledger blockchain network in South Korea. This is “the first of many RWA-focused products” the company plans to launch in the region.

In addition, ELYSIA offers products including Ripple’s latest RLUSD, a stablecoin pegged to the US dollar. The RWA project aims to “demonstrate the potential of real-world asset tokenization for XRP Ledger users” with the upcoming launch of RLUSD, which recently received approval from the New York Department of Financial Services.

XRP Price Analysis

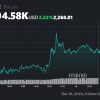

XRP is trading at $2.34, down 3.64% in the last 24 hours and down 38.9% from its all-time high of $3.84 seven years ago, according to data from CoinMarketCap. The digital asset has jumped 257.97% over the past 30 days to hit a multi-year high of $2.86.

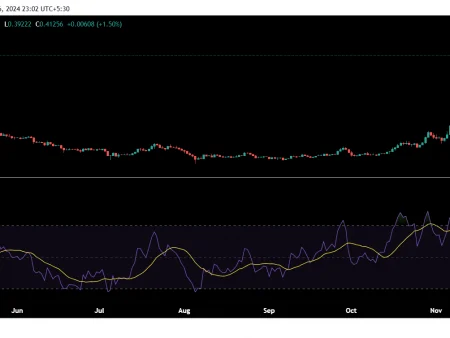

The Relative Strength Index (RSI) for XRP is 62.94, which means bulls are in control of the digital asset’s price movement. The direction of the line suggests that the sideways movement will continue in the short term before the digital asset moves higher.

Disclaimer: The information provided in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any damages incurred as a result of the use of content, products or services mentioned. Readers are advised to exercise caution before taking any action related to the company.