Elon Musk is attacking one of Washington’s biggest targets: the Internal Revenue Service. The eccentric billionaire, joined by entrepreneur Vivek Ramaswamy, plans to empty the agency’s budget and rethink the way Americans handle taxes.

The duo’s ambitions don’t end there. They are orchestrating $2 trillion in federal spending cuts, targeting agencies they consider bloated or outdated through their Department of Government Effectiveness (DOGE).

“The IRS is a mess,” Elon said, pointing to the inefficiencies and scandals that have plagued the agency for years. He offers a free app for filing taxes, suggests audits and calls for mass layoffs to reduce what he calls “administrative sprawl.”

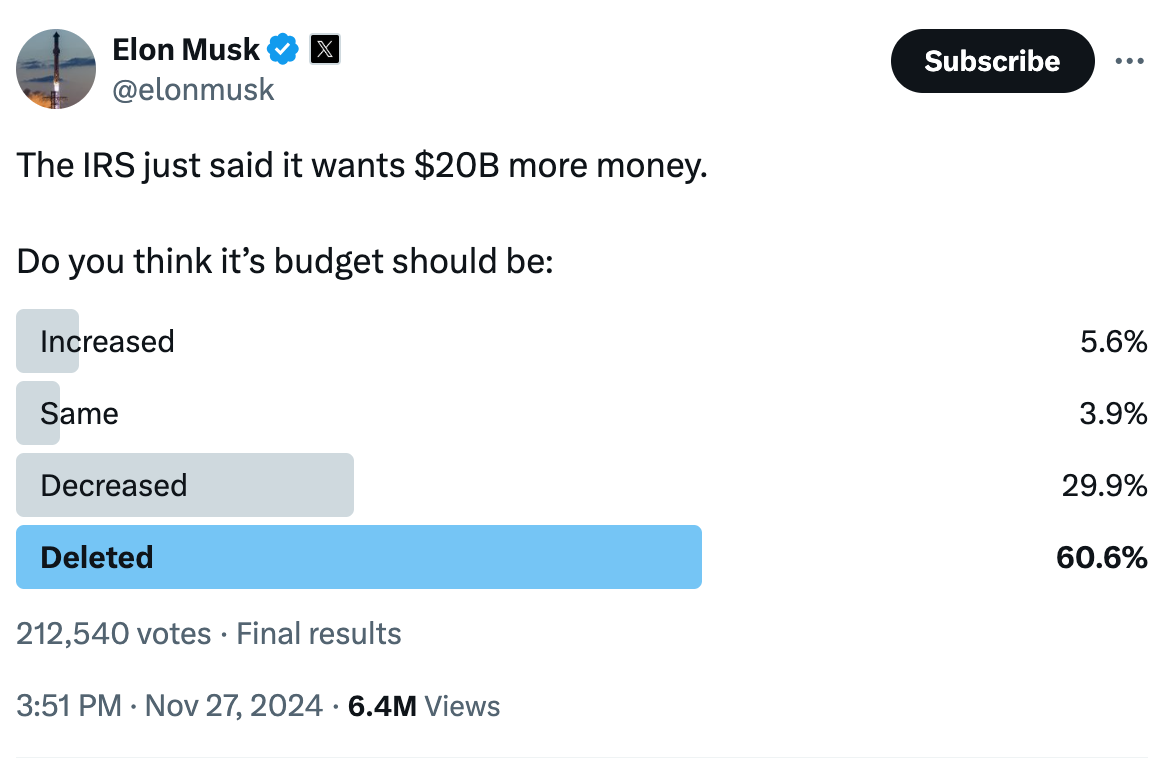

He did a poll on X asking people what he should do about the IRS, and over 60% voted to remove his budget entirely.

In addition, DOGE plans to cut federal funding to other agencies, including the Consumer Financial Protection Bureau (CFPB) and the Department of Education.

Cutting federal spending

DOGE targets multiple agencies and programs as part of $2 trillion in spending cuts. The CFPB, the financial watchdog agency, is at the top of Elon’s list. “Remove CFPB,” Elon wrote on X, sparking debate about the future of the bureau.

Critics say the agency duplicates others, making it unnecessary. Project 2025, a Trump-era initiative, also pushed for its elimination.

The Department of Education is not safe either. Vivek proposed “massive cuts”, to the point where entire agencies could be eliminated. Trump, who has advocated dismantling the department for years, appears to be pushing his allies to redouble efforts to achieve that goal.

Even the Pentagon’s huge $1 trillion budget is not prohibitive. Vivek has criticized the Defense Ministry for what he calls rampant waste. He claims the Pentagon spends $125 billion annually on bureaucracy.

Ironically, Elon’s SpaceX, with its $3.6 billion in federal defense contracts, hasn’t gone under the knife—yet. DOGE also plans to redirect $535 million currently allocated to the Corporation for Public Broadcasting (CPB), which oversees PBS and NPR.

Elon and Vivek argued in the Wall Street Journal review article that this funding was not authorized by Congress. They see it as yet another example of reckless federal spending.

IRS under fire

According to Wall Street Journal sources, Elon was in talks to develop a government-backed tax filing app. Idea? Streamline your tax season and disable third-party services like TurboTax, which have faced allegations of misleading taxpayers.

Elon and his DOGE team want to simplify the tax code altogether, making it less painful for the average American. The IRS has long been a lightning rod for criticism.

In 2013, he was accused of politically targeting conservative tea party groups, leading to public outrage and congressional investigations. Ernst, who leads the DOGE caucus in the Senate, called the agency a symbol of inefficiency. “The IRS is wasting taxpayer money. It’s time for accountability,” she wrote on X.

DOGE’s plans include an audit of the IRS and an analysis of its spending. Elon and Vivek want to downsize their workforce, eliminating what they call “administrative sprawl.” Elon has also proposed moving agencies like the IRS out of Washington, hoping to reduce its influence and operating costs.

DOGE’s aggressive strategy could result in significant job losses. Elon and Vivek proposed introducing DOGE appointees into agencies to assess minimum staffing requirements. The goal is simple: find out who is important and fire the rest.

“Massive layoffs” are part of the plan, along with severance and early retirement benefits. Elon also proposed implementing a strict return-to-work policy for federal employees, requiring them to report to work five days a week. He expects many to leave voluntarily.

The Department of Justice, Federal Trade Commission and Securities and Exchange Commission are also on DOGE’s radar. While specific plans for these agencies have not been disclosed, cuts are expected.

In addition, the agency also faced allegations of mismanagement and inefficiency. Critics point to outdated technology and delays in processing tax returns. In November 2024, a former IRS employee pleaded guilty to filing fraudulent tax returns, adding to the agency’s list of problems.

Another problem is fraudulent tax return preparers. A 2014 study found that many return preparers filed incorrect returns, often overstating their refunds. Attempts to regulate the practice have run into legal challenges, leaving taxpayers vulnerable to fraud.

The IRS has also been accused of denying claims without adequate justification, especially during the COVID-19 pandemic.

These controversies have undermined public trust. Elon’s criticism is consistent with a broader view that the IRS is bloated, ineffective and prone to abuse.

Get a High Paying Job at Web3 in 90 Days: The Ultimate Action Plan