Ethereum is on the verge of returning to the $4,000 level, approaching its all-time highs. The second-largest cryptocurrency by market capitalization has faced skepticism throughout this cycle, with some analysts predicting it will underperform compared to previous bull runs. However, Ethereum has surprised doubters: it has risen steadily in recent weeks despite market uncertainty.

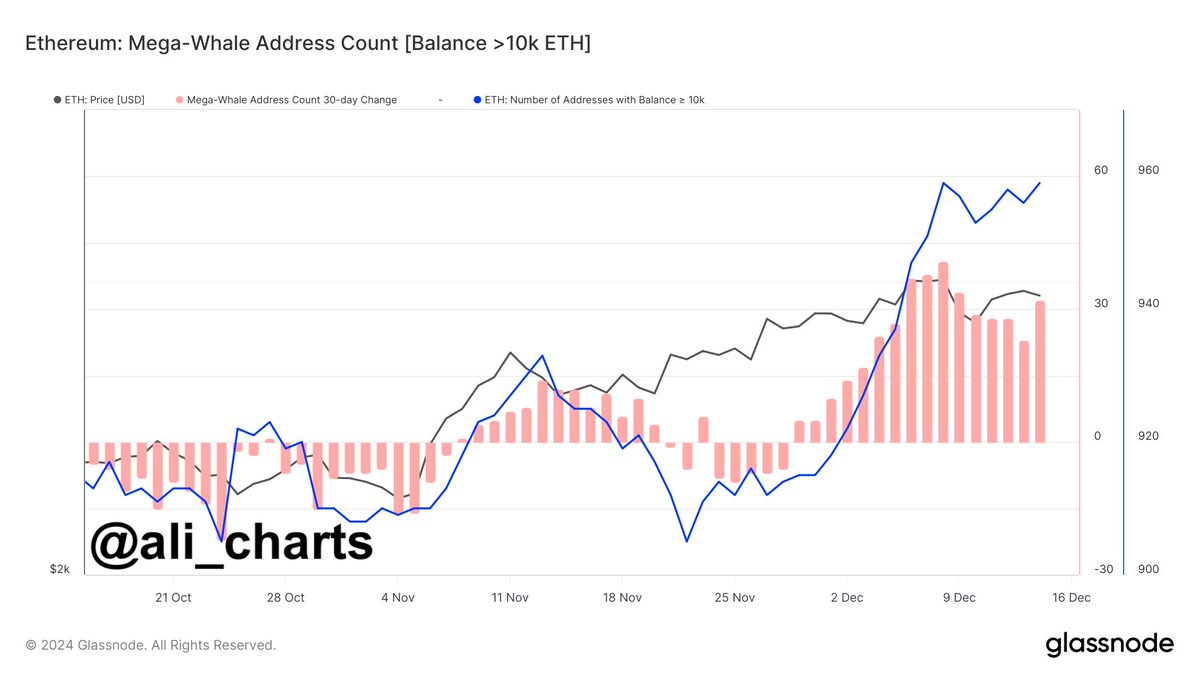

Key on-chain metrics from Glassnode show an important trend that could fuel further price increases: Ethereum whales have been accumulating aggressively since late November. That signals growing confidence among large bondholders as they brace for potential growth. Historically, whale accumulation has often preceded significant price movements, hinting at the possibility of a breakout in the near future.

While the market remains split on Ethereum’s trajectory, its ability to maintain upward momentum near the $4,000 mark will likely determine its performance in the coming weeks. Breaking this critical resistance could open the door to new highs and further cement ETH’s role as a leader in the ongoing bull cycle.

Ethereum Mega Whale Balances Are Growing

Since November 5, Ethereum has experienced a steady, albeit modest, rise, but it appears that the real fireworks for ETH have yet to ignite. As Bitcoin’s price soars and some altcoins outperform expectations, Ethereum investors are looking for clear signals of an upcoming bull run in the second-largest cryptocurrency.

Key on-chain data shared by lead analyst Ali Martinez on X provides intriguing insight into the current state of Ethereum. Martinez highlights that Ethereum whales—entities that own significant amounts of ETH—have begun accumulating aggressively since the price surpassed the $3,330 level.

This accumulation trend suggests the smart money is preparing for a massive upside move in the coming months. Historically, whale accumulation has often been a precursor to strong price gains, as these large investors tend to anticipate major market moves before retail traders.

However, the narrative is not entirely optimistic. While the whale aggregation may signal confidence, it also raises concerns about a potential bull trap. These large holders could quickly turn around, reallocating their ETH to other assets if market conditions change or if Bitcoin’s dominance suppresses altcoin growth. Such a move could catch small investors off guard and lead to a sharp correction.

For Ethereum, holding above critical levels such as $3,800 while breaking through key resistances could be the catalyst needed to begin a true bullish move. Until then, ETH remains a watchlist favorite, balancing potential and uncertainty.

Price testing of critical resistance

Ethereum (ETH) is trading at $3,950, trying to break above the critical $4,000 resistance level for several days. Despite this, the price remains stable, indicating strong market support. The passage of this level is necessary to confirm the continuation of the uptrend, as $4,000 represents a psychological barrier and a key resistance zone for the asset.

If Ethereum fails to break through the $4,000 mark, we can expect a pullback to lower demand areas around $3,500. This level has served as strong support in recent weeks, providing cushion during periods of increased selling pressure. A pullback into this area could allow buying momentum to resume, setting the stage for another breakout attempt higher.

However, recent market dynamics suggest that Ethereum may be poised for a significant move higher. The sharp rise in Bitcoin prices and growing optimism about altcoins have created a bullish environment. As whales continue to accumulate ETH, as shown by on-chain data, market participants are increasingly confident in Ethereum’s ability to retest and surpass its all-time highs.

Featured image from Dall-E, chart from TradingView