Dogecoin price has risen 2% over the past 24 hours, trading between $0.39 and $0.41. Data shows that 5.8 billion previously idle DOGE tokens were recently moved. The surge comes after a sluggish week that saw the meme coin lose nearly 6%, missing out on Bitcoin’s recent gains.

The increase in token circulation and decrease in net exchange flows suggest an increase in speculative activity and holding behavior among investors.

Dogecoin Sees Increased Investor Activity

Dogecoin’s price is up 2% over the past 24 hours as Bitcoin recorded a 4% gain over the same period. According to CoinGecko, the meme coin maintains a 24-hour price range of $0.39 to $0.41. The gain comes after DOGE lost nearly 6% last week despite Bitcoin’s stellar rally.

A positive factor for the Dogecoin price is the increase in circulation of tokens over the last day. According to a Santiment chart provided by online analyst Ali Martinez, 5.8 billion DOGE was added to circulation.

5.8 billion idle #Dogecoin $DOGE tokens have come to life, changing hands in the last 24 hours. pic.twitter.com/4gSkVhAAcO

— Ali (@ali_charts) December 16, 2024

Millions of Dogecoin tokens were previously dormant tokens that recently became active when transferred. This kind of movement, especially from long-term tokens, can signal either profit taking or repositioning on the part of large holders or whales. Notably, as we see a surge in circulation along with rising prices, this could also mean increased speculative activity.

Dogecoin May Join Bitcoin Price Rally A Little Late

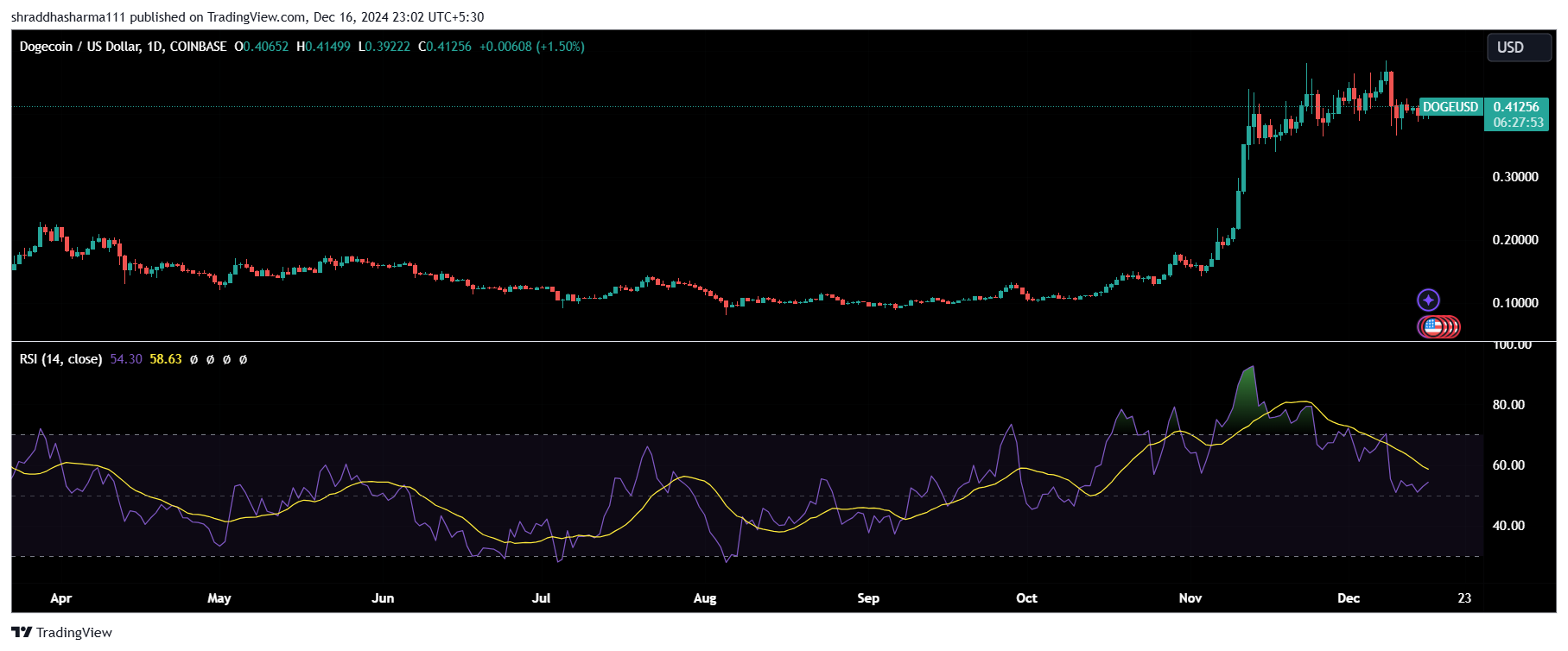

We also looked at the Dogecoin Relative Strength Index (RSI) to get more information about its price movement. At the time of publication, the RSI is in the neutral zone, which means it is neither overbought nor oversold. Since November, the RSI has been moving down from the overbought area, indicating that prices have cooled for the month. However, the RSI is now indicating a slight reversal to the upside, which could signal some buying momentum in the coming days. Coinglass data also shows moderating behavior.

Net exchange flows as of December 16 were -$67.35 million, indicating that more DOGE was withdrawn than deposited to exchanges. Negative net flows can also reduce selling pressure or at least stabilize the price. Given that DOGE did not participate in the $100K Bitcoin rally and did not experience a similar ripple effect on the meme coin’s price.

Amid DOGE’s weak price performance, co-author Billy Marcus defended DOGE’s original purpose. In his post on X, he said: “Everything that came after Dogecoin was the success of Dogecoin and was created to make money, so none of them have the same soul.”

From Scratch to Web3 Pro: Your 90-Day Career Start Plan