Dogecoin (DOGE) attracted significant attention as its price hit the critical $0.50 mark. While technical indicators point to bullish momentum, warnings of a potential sell signal raise questions about its trajectory. This article examines the current market sentiment, price dynamics, and critical factors determining Dogecoin’s potential to reach new highs.

Dogecoin Price Analysis: Is DOGE Price Approaching $0.50?

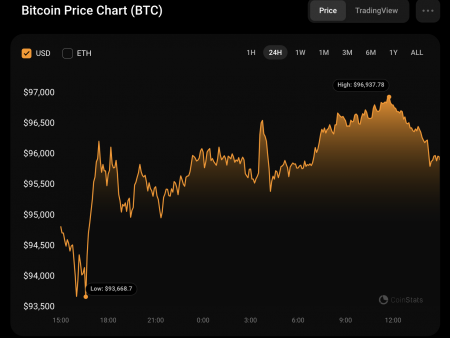

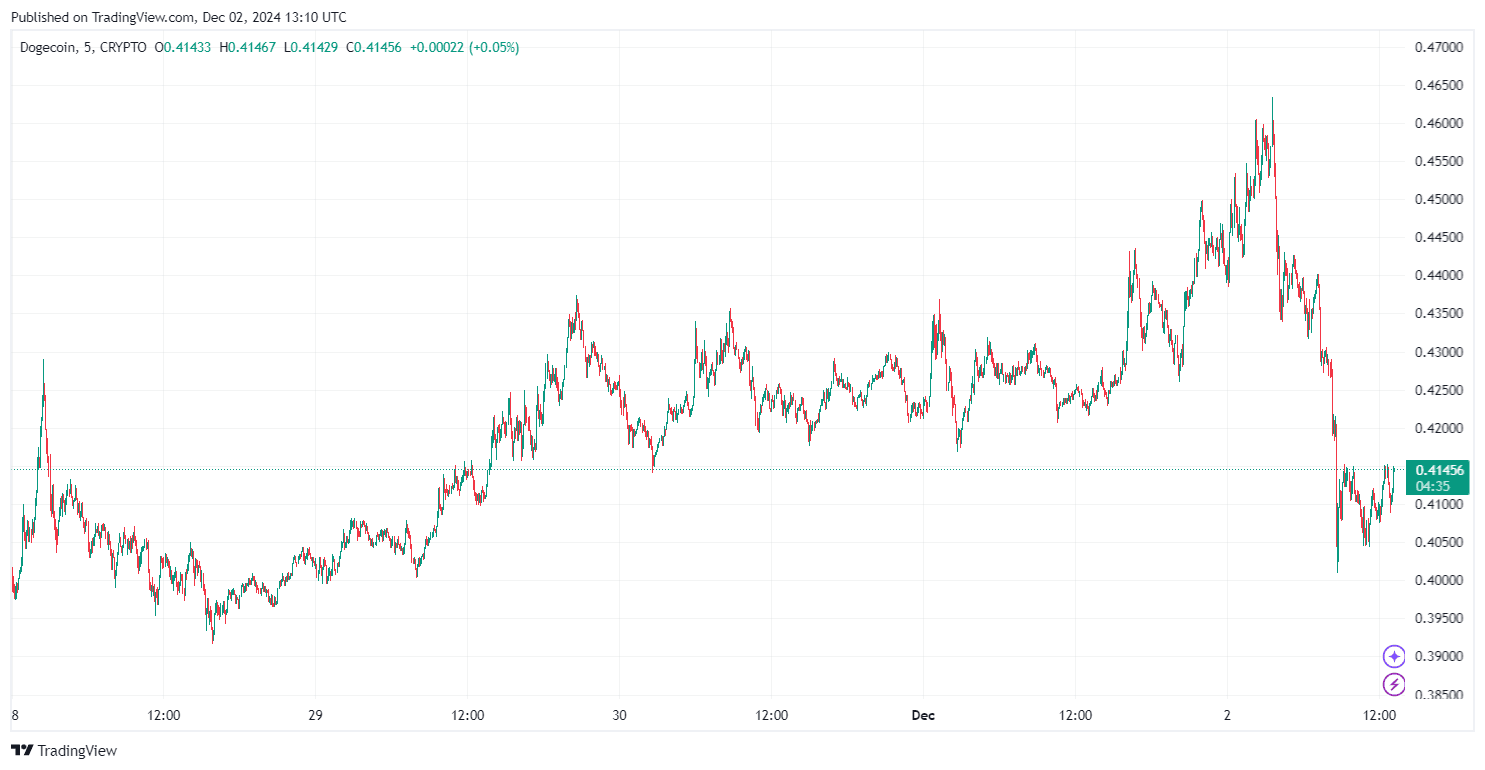

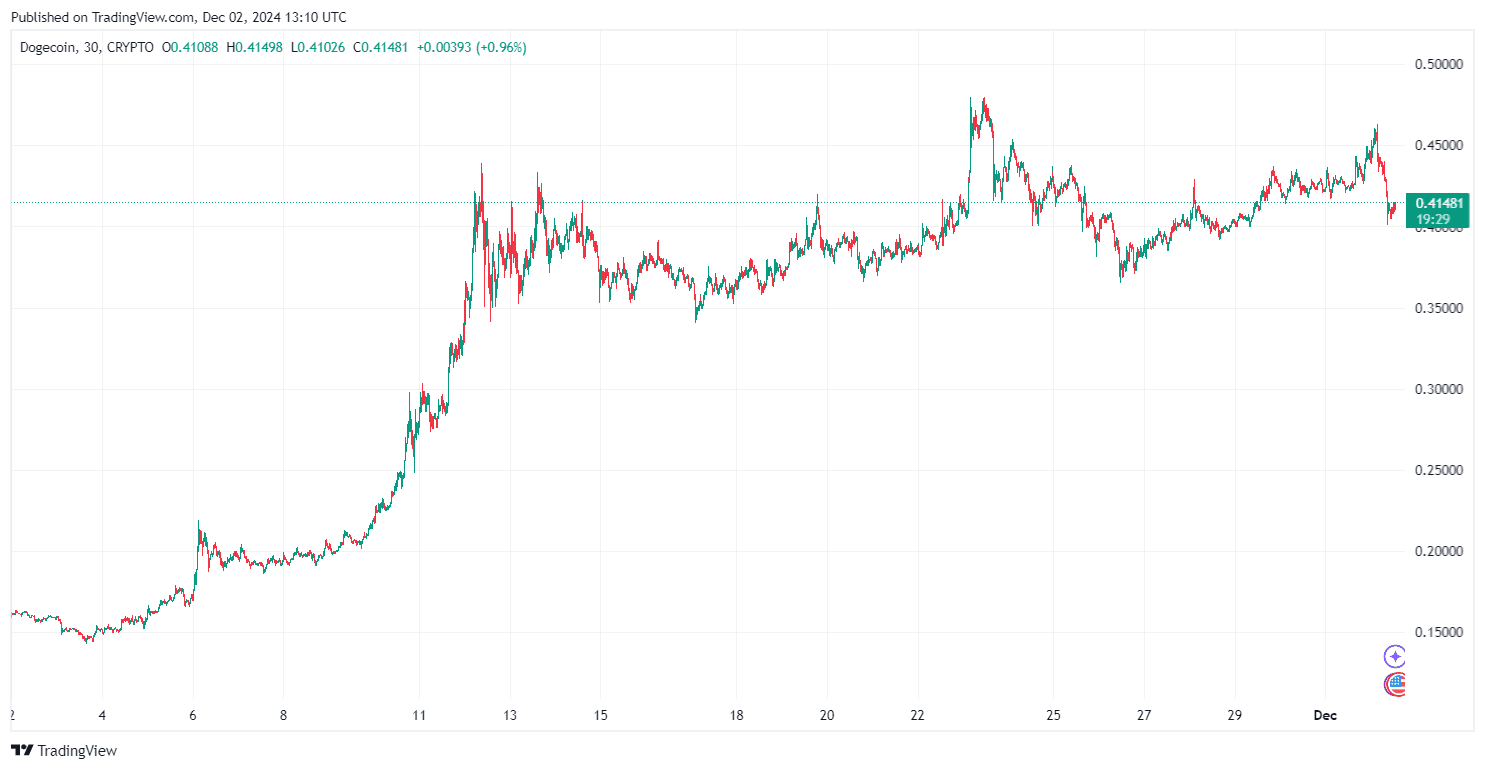

Dogecoin has seen strong gains recently, rising above the $0.4250 and $0.4400 levels supported by a strong bullish trendline. Currently trading above $0.4350 and the 100-hour simple moving average, the price is consolidating around $0.450. Immediate resistance is seen at $0.4550 and $0.4640, with a close above $0.4720 potentially pushing DOGE towards $0.50.

If the bullish momentum continues, Dogecoin could test the $0.5200 level. However, failure to break above $0.4500 could lead to a downward correction with support levels at $0.4400, $0.4300 and critical support at $0.4150. A fall below these levels could see DOGE fall near $0.4000 or $0.3800.

Dogecoin Price Prediction: Will $0.50 Be Reached Or Is A Pullback Coming?

1. Views of cryptanalysts: bearish signals on the horizon?

Despite recent gains, some analysts remain cautious. Cryptocurrency expert Kevin (@Kev_Capital_TA) warns of a potential sell signal as Dogecoin shows bearish technical indicators including a declining MACD and Stoch RSI approaching a bearish cross. Kevin notes that while the weekly chart shows bullish price action, downside risks remain.

He highlights $0.60 as a critical resistance level, arguing that a break there would mark a significant bullish breakout. Meanwhile, macroeconomic trends, such as a potential altcoin season driven by Bitcoin dominance falling below 55%, could serve as a catalyst for DOGE’s strength.

2. Pi Cycle Top Indicator: A Tool for Making Long-Term Decisions

Kevin also highlights the Pi Cycle Top Indicator, a tool commonly used for Bitcoin, as a reliable predictor of DOGE market tops. This method, which tracks the crossover of the 111-day and 350-day moving averages, has accurately signaled previous Dogecoin cycles. Kevin plans to reduce his holdings once these indicators align with the elevated monthly RSI, signaling a likely market top.

3. Short-term optimism versus long-term uncertainty

Despite the looming bearish signals, Dogecoin remains in a favorable position in the short term, posting its highest close of the month. However, the convergence of bearish indicators and resistance levels highlights the need for caution among traders. The $0.50 target remains plausible, but breaking through $0.60 is critical for sustained bullish momentum.

Dogecoin price dynamics identify the delicate balance between bullish aspirations and bearish risks. While near-term targets such as $0.50 appear within reach, key resistance levels and macroeconomic factors will determine its long-term trajectory. Traders should closely monitor technical indicators, support levels, and broader market trends to navigate DOGE’s volatile environment.