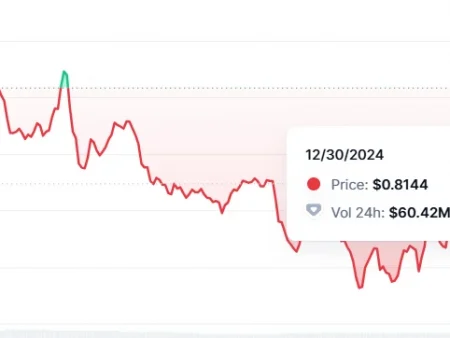

Dogecoin price is currently down -34% from its December 8 high of $0.4843. But according to crypto analyst Kevin (@Kev_Capital_TA), DOGE has one of the “prettiest” charts at the moment. In a new broadcast on X, he offered an in-depth look at Dogecoin, the broader market environment and key technical indicators.

Dogecoin: Price Discovery or Disaster?

Despite the current pullback, Kevin believes that Dogecoin’s chart “looks very good at the moment” and looks stronger than many other cryptocurrencies: “It is a stronger coin compared to most of the market. I mean, Doge looks really good here. […] Will things really look bad in a week? Of course it can, but at the moment it looks very good.”

However, he highlighted the possibility of a short-term pullback—something that could see Dogecoin fall to the $0.026 level: “In the short term, could we go back down and test 26 cents? That I’m going to throw it out there […] I see no real reason to be too bearish […] but is it possible that we will return here? Certainly.”

The $0.26 to $0.28 range was a critical point for Dogecoin’s short-term outlook: “We remain above that 28 to 26 cent level for now. […] I see no reason for great fear. If we pass this level […] A loss of $0.26 cents to close the week would be catastrophic.”

Kevin dated this particular target back to November, when he first suggested that Dogecoin would return to the gold pocket around $0.26. Many were skeptical, he said, but the level was eventually reached: “I had to feel really bad about making that call back in early November when we were at 45 cents. […] We ended up going back and checking it out.”

Looking up, Kevin identifies a significant area of resistance between $0.30 and $0.35, calling it “big, big resistance.” After that, he calls $0.94 to $1.00 his “next big zone,” although he cautioned traders against a guaranteed upside.

For Dogecoin to break past all-time highs and truly enter a “full-scale price discovery,” Kevin wants to see a break above the .703 and .786 Fibonacci levels—roughly .53 and .59 cents, respectively: “I don’t see anything that would keep Dogecoin from coming back after full-scale price discovery […] We want to break 53 cents […] and then .786 at 59 cents. If we break out of this 60 cent zone for a long time, I don’t see anything holding Dogecoin back.”

Drawing parallels to past market cycles, Kevin highlighted how Dogecoin has historically tested its “bull market support band” and macro support levels before rallies: “We’re back, we tested structure support. […] bull market support streak this cycle. This is very similar to [the previous cycle]. You can’t deny the similarities.”

He described how Dogecoin’s current chart “almost crazily” mirrors its cyclical patterns, referring to a breakout followed by a falling wedge, an initial rally, and a retest of macro support: “Cryptocurrency has this crazy innate ability to follow its cyclical nature of performance. […] It’s really amazing, really.”

Despite Dogecoin’s cyclical consistency, Kevin reminded viewers that external market factors and the performance of Bitcoin (which he called a “market leader”) can always disrupt patterns: “Clearly, we need Bitcoin for collaboration. We cannot allow any crazy situations to happen all over the world.”

Kevin also examined the DOGE/BTC pair, noting the macro trendline and the gold pocket test: “We have this macro trendline. […] we overcame it and came back. We are currently in the support band of the bull market. […] We went back and tested the macro gold pocket again.”

He emphasized that if Dogecoin stays above this zone on the DOGE/BTC chart, it should go higher. However, a breakout could lead to trouble: “Something like that 26-cent level. […] if we get down and break […] this will coincide with a breakout of the bull market support band and that macro gold pocket, in which case we could be in some pretty deep shit.”

Kevin also delved into the macroeconomic and geopolitical factors that could impact Dogecoin and the broader crypto space. He said President Donald Trump’s return to the White House in January would be “very optimistic” if it leads to better regulation, less conflict and policies that promote economic growth: “Trump will be in office in January, which means we will have a crypto-friendly administration […] If we can end the war between Ukraine and Russia, it will be bullish for the markets. […] We can get inflation down to 2% and then start cutting interest rates faster.”

When and how high will DOGE rise again?

Kevin noted that from December’s downturn to first-quarter optimism, market participants are often ahead of expectations by about a month. He suggested that if January turns out to be volatile, February could be the point when markets begin to really rally: “Everyone thought October would be bullish. October was not bullish. November was bullish. Now everyone thinks January will be bullish […] Perhaps February will be bullish.”

When asked for specific price targets, Kevin pointed to several Fibonacci extensions and the Pi Cycle Top indicator on the Dogecoin chart: “If we break through previous all-time highs, the next resistance zone would be $0.94 to $1.32. […] If we break through $1.32, the next big resistance area I see is $2.19 to $2.78.”

However, he made it clear that any long-term price forecasts depend heavily on technical indicators and confirmations. He highlighted several monthly indicators – MACD, RSI, Stoch RSI and Pi cycle top – as potential exit signals: “I don’t care what the price is at this point. […] once we get to this zone, I will take the profit off the board. If the period lights start flashing, I’m going out.”

At press time, DOGE was trading at $0.32.