Share:

- Dogecoin price plunged 14% in the last three days, erasing a portion of the recent 48% gains.

- Bullish DOGE traders were left disappointed as the drop triggered long liquidations worth $4 million.

- Positive funding rates on stock markets show that there is still some optimism among investors regarding a recovery.

Amid the Binance fiasco that took place on Tuesday, the market still witnessed optimism among DOGE investors even though the price of Dogecoin fell over the past three days. Investors are currently suffering losses but appear optimistic about a recovery, which is evident in their derivatives positions.

Dogecoin price falls for the third day

The price of Dogecoin, which was trading at $0.0749 at the time of writing, fell 14% in the last three days. The meme currency generated significant benefits for its investors after skyrocketing 48.12% in four weeks, a percentage that is now about to be lost.

Around a third of the gains seen by DOGE holders have already been wiped out, and the altcoin is likely to witness a fresh decline. This is evident by the Moving Average Convergence Divergence (MACD) indicator showing a bearish crossover as well as a red bar on the histogram, confirming bearish momentum.

This could lead to DOGE falling to test the crucial support level marked at $0.0700, a loss that would not only undo half of the gains seen by investors in recent days but also allow for a drop to $0.0602. .

DOGE/USD 1-day chart

However, if investor optimism proves stronger than broader bearish market signals and DOGE rebounds off $0.0747, it could recoup most of the recent losses. As a result, the bearish thesis would also be invalidated, allowing the meme coin a chance to reclaim $0.0800.

DOGE holders remain optimistic

Dogecoin investors have faced losses, but they are not alone as DOGE traders have also witnessed the opposite of gains over the past three days. Traders who held long positions waiting for the recovery lost more than $4 million in the last 24 hours and even more in the last three days.

Dogecoin Liquidations

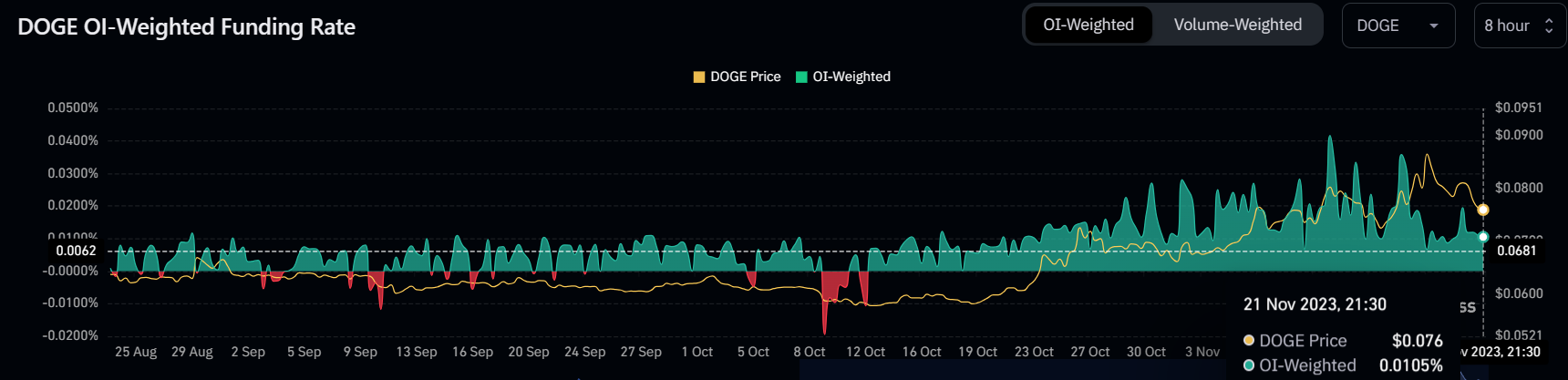

Despite such a large number of prolonged liquidations, traders do not seem to have given up. The positive funding rate demonstrates that Dogecoin is still seeing long contracts higher than short contracts at this time.

Dogecoin Funding Rate

A positive funding rate indicates that more traders are taking long positions and expect the asset price to rise in the future. Therefore, if the price of Dogecoin conforms to the wishes of its traders and investors, a crash could be avoided; Otherwise, further losses are likely.

Share: Cryptocurrency Feed