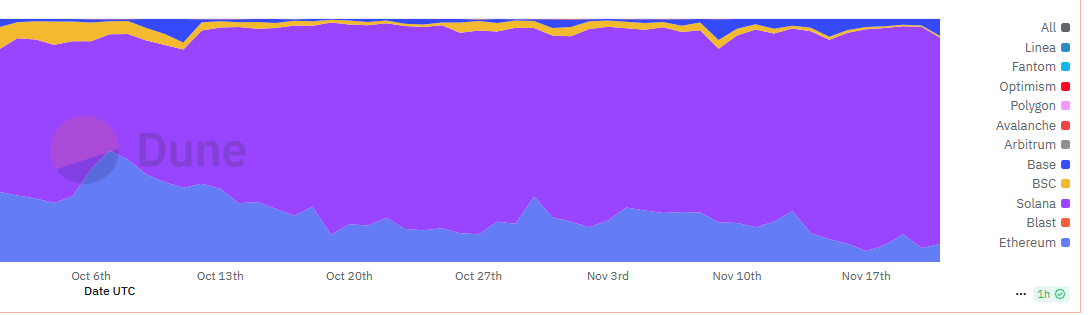

The Solana meme token boom continues to shift the balance, with DEX activity catching up with Ethereum activity. It reached about 57% of activity levels on the Ethereum blockchain. However, Ethereum retains the advantage in terms of higher liquidity and wider adoption through Uniswap.

Solana activity on DEX has gradually increased throughout 2024, catching up to Ethereum levels. The last quarter saw a new boom in meme tokens with corresponding influx into Raydium, with DEX volumes now at 57% of Ethereum levels.

The biggest story on Solana is the power of Raydium, which now rivals Uniswap, and its presence on 23 chains. Raydium is a single-chain DEX that is quickly becoming the top crypto app in terms of fee generation, volume, and usage.

Solana still has a smaller lending sector compared to Ethereum, but it is also growing as Sky Ecosystem may move some of its assets.

According to DappRadar, Raydium is the most popular app as of November 21st. Jupiter DEX is also moving up in the rankings, and Meteora is expanding the scope of the Solana ecosystem.

Trading Solana DEX appears to be cheaper than Ethereum, although traders may face hidden costs and hurdles due to the need to bribe validators to gain favorable MEV block position to complete their swaps.

Raydium is catching up with Uniswap

Uniswap V3 on Ethereum is still processing $1.8 billion worth of daily volumes. Raydium recently increased its activity to $4.5 billion in 24 hours, driven by the prevalence of several meme token trends. Raydium also sees much more active top pair fluctuations as the DEX reacts immediately to new memes.

Raydium is valued at $2.2 billion, following new SOL inflows and a higher market price. The DEX is second only to Uniswap, which has the edge with $5.6 billion in value locked.

Raydium’s fees peaked on the day of November 20th, generating over $15 million in daily fees. A day later, it returned to $12.47 million, trailing Tether (USDT), although activity is still close to its peak.

Is SOL undervalued?

After years of sideways movement in bear markets, the SOL price has finally reached the $230 level again. Recent DEX activity and USDC inflows have raised the question of whether SOL is undervalued.

SOL traded at $242.04, while Ethereum (ETH) maintained its position above $3,100. Considering the market capitalization as a whole, Solana tokens are valued at 33% of the total value of ETH. If network growth, user numbers, and fees continue to rise, it could mean that the entire ecosystem is undervalued compared to Ethereum.

Solana also competes with Ethereum’s family of L2 leading chains, which have emerged to scale the L1 network. However, DEX trading is a fluctuating metric, meaning this is a temporary achievement.

In other metrics, Solana lags in terms of the total number of stablecoins as well as the total value locked. Some of the activity revolves around trading blue chip tokens, but the focus remains on meme launches and early-stage risk trading.

Solana bot activity outpaces Ethereum

Most memes on Ethereum also restart or restart on Solana. However, there are questions about the network’s future value, its sustainability and its ability to attract more users. Etheum still has around 500k daily active users, while Solana continues to set new records with over 6.02 million daily active wallets.

Solana remains a bot-run network with an almost constant DEX bot war. This means that even a small increase in DEX activity will increase problems between bots. Solana has over 82% overall trading bot status, up from 47% in October.

Bot activity on Solana also outpaces Ethereum activity, although at the beginning of October both networks were at almost the same level. However, over the past two months, Solana has dramatically changed the use of Ethereum bots, processing more $438 million in daily bot trading.

Bots play a key role in the early detection of new memes, as well as predetermined quick trades, beating other users through bribes and priority JitoSOL commissions.

A step-by-step system for starting your Web3 career and landing a high-paying cryptocurrency job in 90 days.