Following unprecedented growth in decentralized exchange (dex) and perpetual contract volumes last month, trading volume on these decentralized finance (defi) platforms totaled $52.81 billion in the first four days of January 2025.

Uniswap and Hyperliquid will dominate Defi trading volumes in 2025

The new year is starting off on a promising note, with the net worth of the crypto economy surpassing last week’s and now stands at $3.51 trillion. While centralized exchanges led the way last month and ended the year on a high note, decentralized exchange (dex) platforms also saw significant volume growth. According to Defillama, December 2024 was the highest point for both exchange trading volume and decentralized perpetual contract volumes.

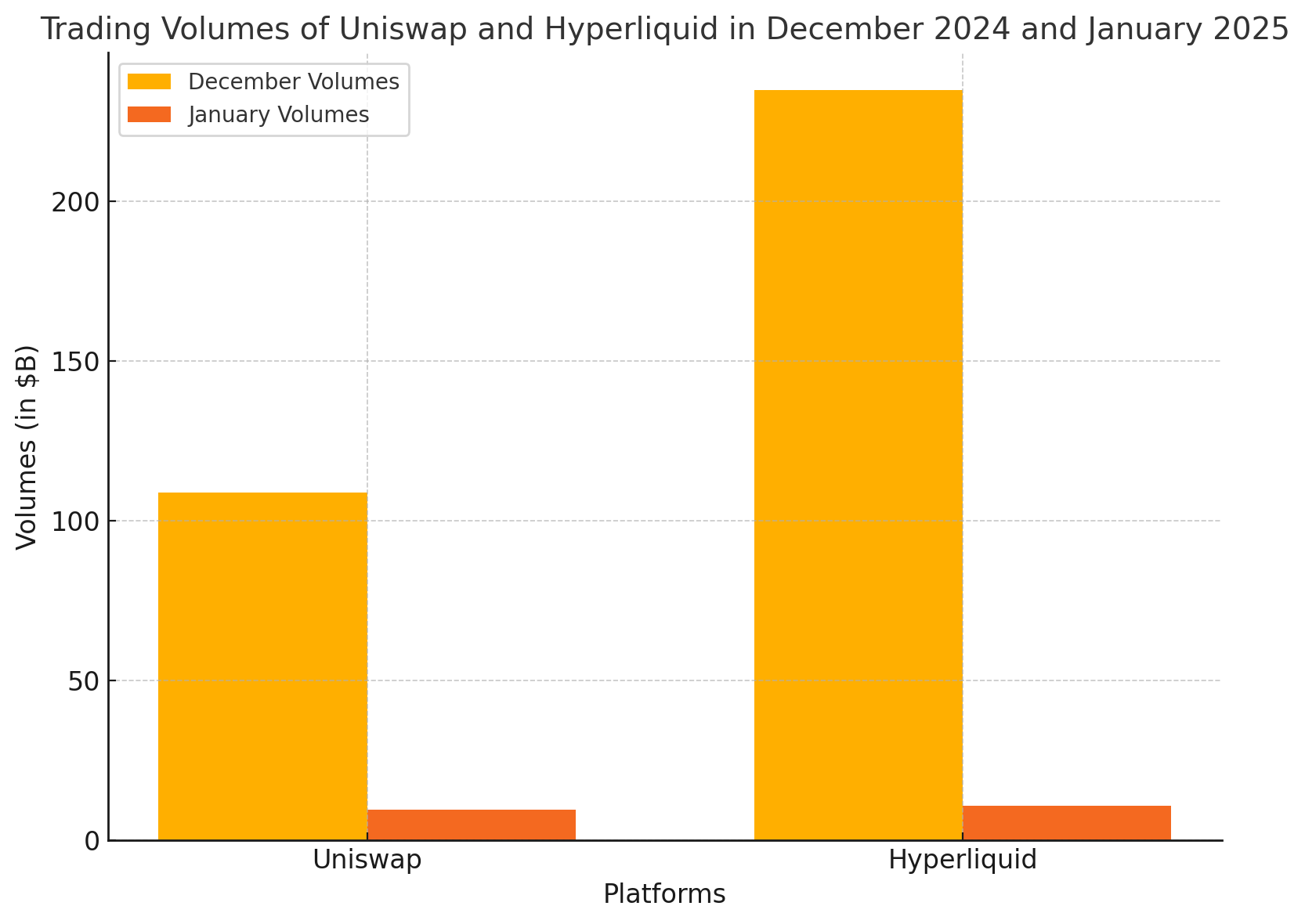

Dex trading volume grew to $322.25 billion in December, with Uniswap claiming the lion’s share, accumulating more than $109 billion. Uniswap, an exchange for spot cryptocurrency trading, operates on an automatic market maker (AMM) model, using liquidity pools for simple exchanges tokens. According to Defillama’s metrics, decentralized perpetual protocols have raised $369.4 billion. Hyperliquid led the way, raking in a staggering $235 billion last month.

Unlike conventional dex platforms such as Uniswap, Hyperliquid is a high-performance decentralized perpetual contract platform on its own layer-one (L1) blockchain, equipped with an on-chain order book for complex perps futures trading, characterized by low latency and high throughput. and professional grade tools. Both Uniswap and Hyperliquid dominated the volume over the past four days at $52.81 billion, with Uniswap receiving $9.48 billion and Hyperliquid receiving $10.75 billion.

Below Uniswap is Raydium, and in the early days of January 2025, the Solana-based protocol earned $8.61 billion. Like Uniswap, this dex uses AMM but integrates with Solana’s high-speed and cost-effective infrastructure, providing fast transactions and significant liquidity. Likewise, the second largest decentralized criminal exchange, Jupiter, is also built on the Solana blockchain for the same benefits. Jupiter Perpetual Exchange differs from traditional decentralized perpetual platforms such as Hyperliquid due to its “LP trader” model.

Instead of using order books, Jupiter relies on a pool of JLPs where liquidity providers act as counterparties to trades, providing zero slippage and high liquidity through the integration of oracles. Statistics show that in the last four days, Jupiter’s total trading volume was around $2.45 billion. Other leading criminal protocols include Synfutures, Apex Protocol, Satori Finance, Bluefin, Drift, GMX and JOJO. According to statistics from Defillama, in the last 24 hours, the total trading volume of 109 decentralized platforms was $6.611 billion.

In terms of dex, besides Uniswap and Raydium, well-known dexes include Pancakeswap, Aerodrome, Lifinity, Orca, Curve Finance, Cetus, Pump.fun and Dexalot. The total trading volume of these decentralized exchanges in the last day was $11.464 billion. The explosive growth in defi trading volumes in recent months signifies a transformational shift in the cryptocurrency markets, highlighting innovation and adoption of decentralized platforms. As participants reconsider trade dynamics, the challenge now is to maintain these dynamics until 2025. So far, volumes remain elevated.