The cryptocurrency market is bracing for increased volatility as nearly $1.6 billion worth of Bitcoin (BTC) and Ethereum (ETH) options expire today.

This development coincides with the Federal Reserve’s recent decision to cut interest rates by 50 basis points (bps).

Fed decision fuels cryptocurrency market rally ahead of major options expiration

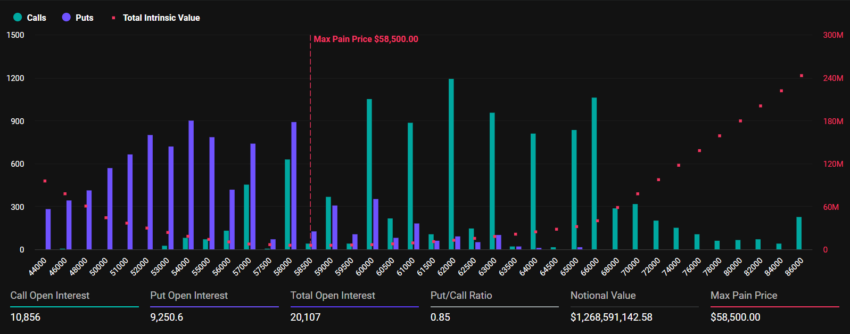

There are 20,037 Bitcoin options contracts worth about $1.26 billion expiring on September 20, according to Deribit data. These contracts have a put-to-call ratio of 0.85 and a maximum pain point of $58,500.

Likewise, the Ethereum options market expires with 125,046 contracts worth $308.16 million. Today’s expiring Ethereum contracts have a put-to-call ratio of 0.65 with a maximum pain point of $2,350.

In options trading, the maximum pain point refers to the price level at which option holders will suffer the greatest losses. Essentially, this is the price at which the largest number of options (both calls and puts) will expire worthless, causing traders the most financial “pain.” The put-to-call ratio, on the other hand, measures market sentiment by comparing the number of put options (bet that prices will go down) and call options (bet that prices will go up).

Greeks. Recent Live analysis revealed the impact of the Fed’s decision to cut rates on today’s expiring cryptocurrency options contracts. Analysts noted that the Fed’s decision was largely expected and was in line with macroeconomic forecasts.

“Implied volatility fell significantly across all major maturities, with ultra-short-term IV bonds falling more than 25% as large investors’ short-term short-selling expectations were dashed,” they wrote.

Looking ahead, greeks.live also noted that there will be another interest rate meeting on November 8 and December 19 this year, at which the market expects a cumulative rate cut of 100 bps. The next rate cut could coincide with the US election, raising the possibility of increased market volatility.

BeInCrypto reported that this week’s rate cuts had a positive impact on the cryptocurrency market. Following this decision, Bitcoin rose from $59,000 to above $63,500.

Likewise, Ethereum also experienced significant growth during this period. The data showed that ETH soared from $2,293 to $2,482.

However, both assets have now stabilized. At the time of writing, Bitcoin and Ethereum are trading at $62,890 and $2,450 respectively.

Despite the positive dynamics, traders are advised to remain cautious. Historically, option expirations often lead to short-term market instability. The next few days will be critical in determining whether Bitcoin and Ethereum can maintain their upward trends or whether a period of correction is inevitable.