Silvergate Capital, a cryptocurrency-focused bank, announced on Wednesday that it had fully repaid all remaining deposit liabilities, Reuters reported. The recent move follows the bank’s decision to cease operations earlier this year.

According to the report, Silvergate announced in March that it intended to voluntarily liquidate after suffering losses as a result of the sudden collapse of crypto exchange FTX. Currently, the bank has less than $10,000 in holdings.

In a statement, the company reiterated its commitment to the planned liquidation. “Silvergate continues to focus on implementing the Bank Settlement,” he said.

The bank, once an industry darling, was hit hard by the FTX collapse that worsened already bearish conditions in the crypto market last year. As noted in the report, investors spooked by the FTX catastrophe withdrew more than $8 billion in deposits from Silvergate. As a result, the bank declared a quarterly loss of $1 billion before making the decision to close.

According to the report, the cryptocurrency market in 2022 lost more than $1 trillion in value. In addition to multiple institutional collapses, rising interest rates and concerns also contributed to the bearish turn.

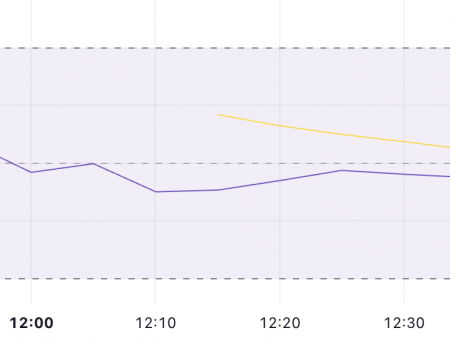

Meanwhile, conditions in the cryptocurrency market appear to have stabilized, driven primarily by speculation surrounding the possibility of the US Securities and Exchange Commission approving a spot Bitcoin ETF for the first time. While the top tokens started the week slowly, they regained gains lost during the slowdown.

Looking at cryptocurrency data tracker CoinMarketCap, Bitcoin has added more than 2% gain in the last 24 hours. At press time, the token was trading at $37,286 each. Likewise, the price of Ether increased more than 3% in the same period.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of using the content, products or services mentioned. Readers are advised to exercise caution before taking any action related to the company.