In recent days, the level of price correlation between Bitcoin and the Nasdaq stock index has reached its lowest level in 2 years.

The king of the cryptocurrency market is moving increasingly differently from US stocks, especially for those belonging to the technological world, which during the cryptocurrency bear market have performed decidedly well.

Is this decoupling from the logic of the US stock markets a good thing for Bitcoin or should it be perceived as a negative factor?

Let’s see all the details below.

Bitcoin and Nasdaq: minimal correlation between prices

Over the past month, the price of Bitcoin is up approximately 25%, while the Nasdaq shows a less pronounced increase of 9.73%, highlighting a divergence in the correlation between the two assets.

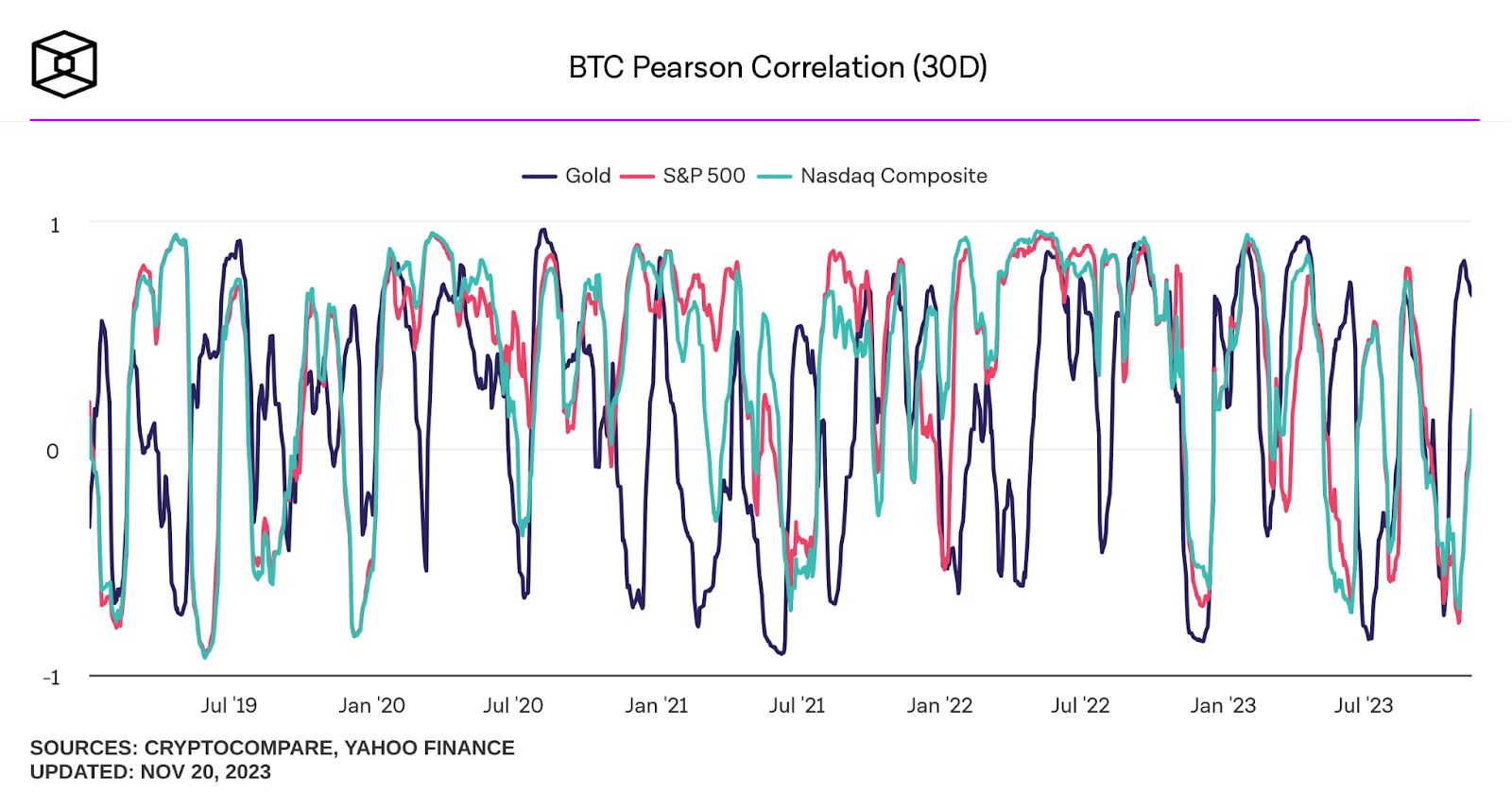

This is not the first time such a situation has occurred: historically, the crypto market’s main currency has alternated between moments of strong connection to US indices and periods in which the price action has developed completely on its own.

For much of 2020 the price correlation between Bitcoin and Nasdaq was very pronounced, while in 2021 we saw a completely opposite trend.

In 2022, months of affinity were followed by periods of very pronounced decoupling from price action, until As of May 2023, we observe a clear trend in this metric.

In fact, the correlation between digital gold and the US stock index has been increasingly fading until reached -0.20%typically indicative of two totally disconnected charts.

Consider the fact that this level had not been touched since August 2021, when the price of Bitcoin was shooting higher in the second bullish phase of that year’s bull run, while the Nasdaq was growing at a much slower pace. .

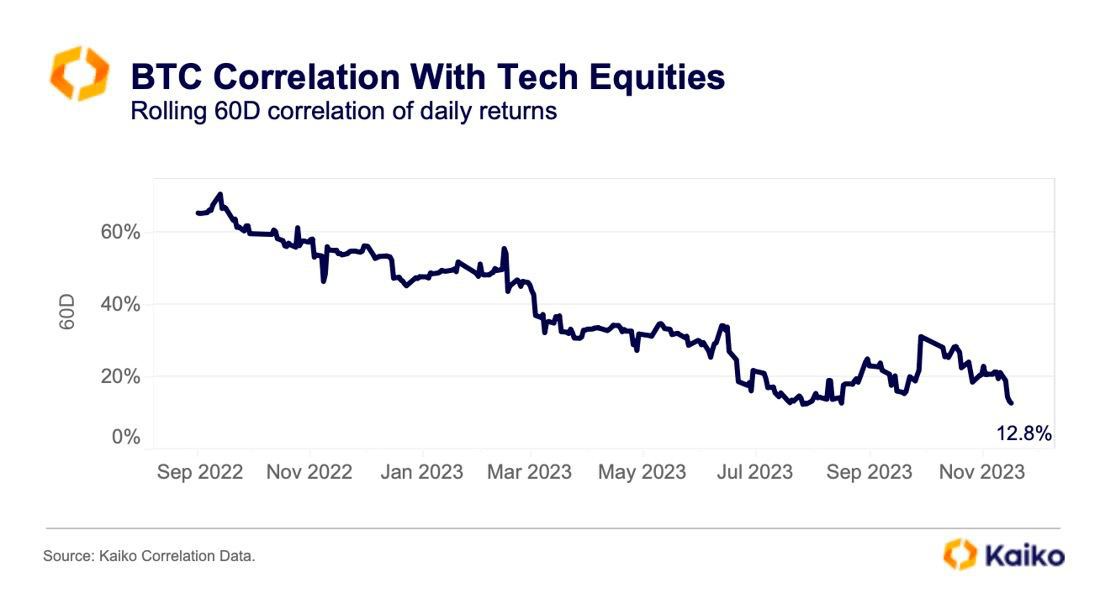

We can observe the same situation, but with a much more pronounced picture, in the relationship between the price of Bitcoin and the price of US technology stocks.

Compared to Alphabet, Amazon, Apple, Intel, Meta, Microsoft, Nvidia and the rest of the technology stocks, Bitcoin’s performance in the markets is increasingly different and records a 60-day drop. average correlation currently at the level of 12.8%, its lowest level in two years.

Until March 2023 this value was 40% higher and in September 2023 it was 60%.

In itself, this data means nothing more than that. Bitcoin has finally reached a level of maturity such that it is traded according to a consistency of its own.different from the reasons that drive listed markets.

It will be interesting to follow this in the coming months to see if this trend will be even more pronounced or will subside until returning to levels considered “normal” according to the history of the cryptocurrency.

For now, looking at the cryptocurrency graph, we can say that this correlation situation, as occurred in the middle of summer 2021, is creating a positive environment for price growth.

Note also how Bitcoin is currently getting very close to the performance of safe haven assets like gold, as also happened in April and February of this year.

The general outlook for Bitcoin

Bitcoin closed last week with its price over $37,000clearly in much better shape than stock indices such as the Nasdaq and the S&P 500, which despite registering slight price increases cannot be compared to the king of the cryptocurrency market.

Bitcoin capitalization amounts to $666.9 billion with volumes in the last 24 hours that are around $18.5 billion, 35% more than yesterday.

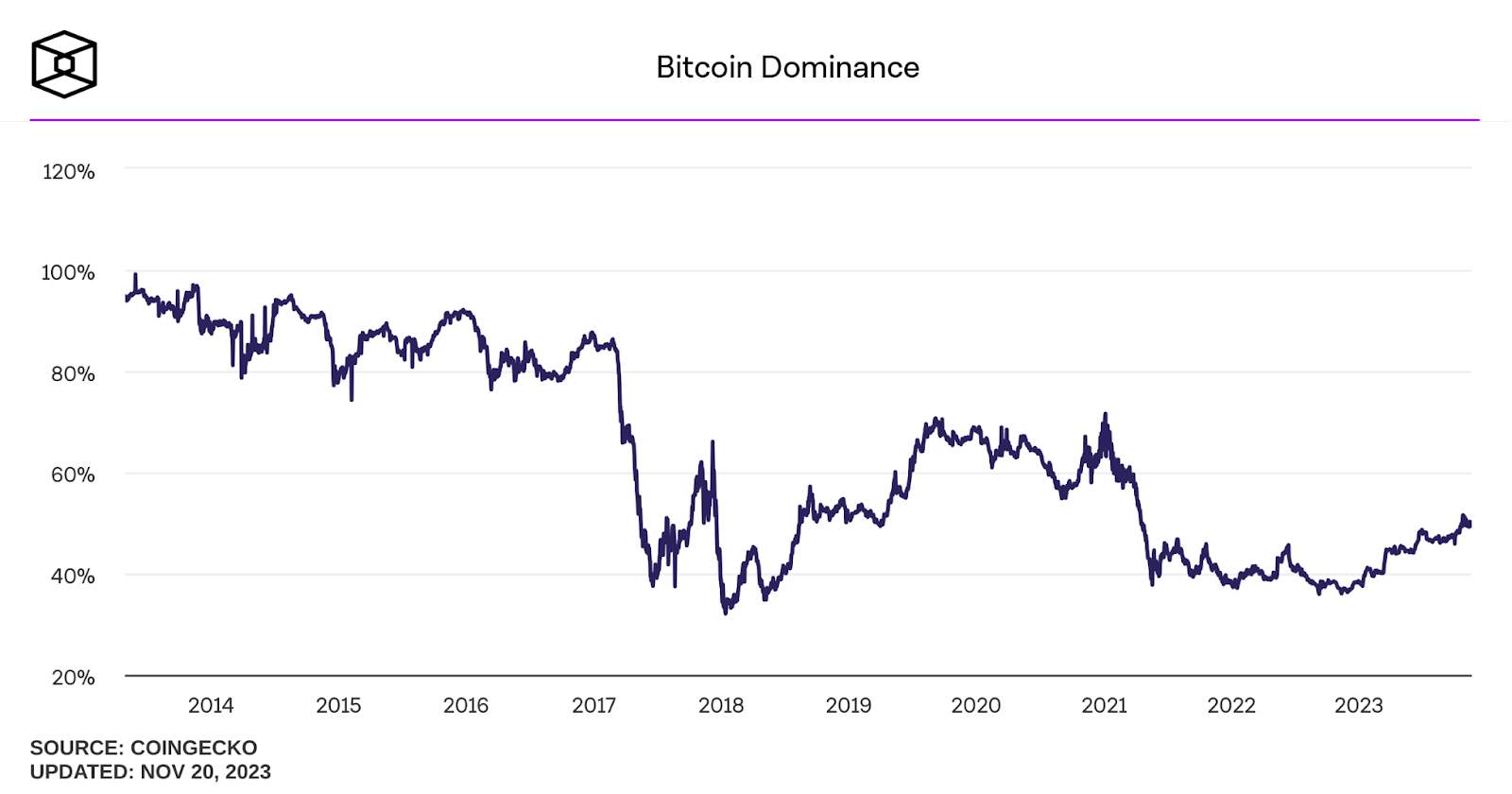

The coin’s dominance, currently at 49.36%, appears to be heading into a bull season, typical of pre-bull market periods, when BTC’s dominance index initially rises on its own and then gives way to the rest of the altcoin sector. .

The same scenario was observed in late 2019/early 2020, where Bitcoin dominance reached the 70% threshold before beginning a slow decline to 40% in May 2021, when the so-called alt season broke out.

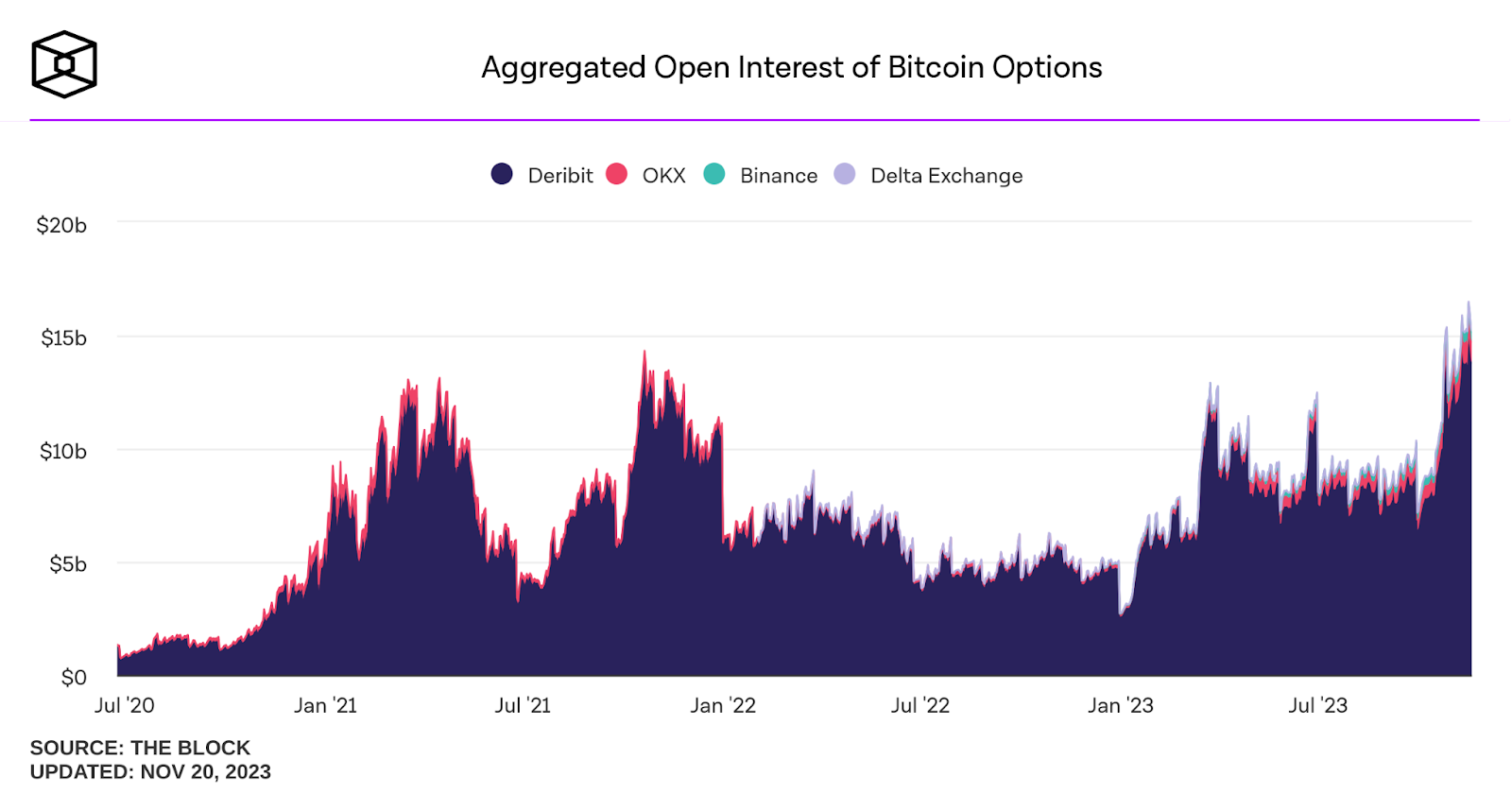

On the derivatives market front, Trader interest in October and November became much more substantial.So much so that the currency’s daily open interest reached an all-time high of $16.5 billion.

Compared to January 2023, the sum of the contracts not yet closed here represented a value more than 6 times lower than the current one.

All this contributes to a positive situation. Outlook for Bitcoin and all other crypto assetsThey are seeing active participation in buying and selling in recent days with growing institutional interest in this market.

The enthusiasm of financial traders over the likely upcoming approval of a spot exchange-traded fund for Bitcoin is giving the right boost to cryptocurrency prices, which, however, may have already priced in such an event beforehand.

At the moment, the situation remains uncertain, although the odds are in favor of a bullish continuation of BTC.

In any case, the market now has to deal with spot market volumes that are as insubstantial and incapable of exploiting those of the futures/options niches, and with a macroeconomic outlook that is still not at all encouraging.

Before the start of the true bull market that will open the door to a new all-time high for Bitcoin, a few months of slight pain may pass.