Table of Contents

CONSUMER CPI INFLATION (AUG) 2023

Consumer Price Index (CPI) (YoY) (Aug)

FACT: 3.7%

FORECAST: 3.6%

PREV.: 3.2%

Consumer Price Index (CPI) (mom) (Aug)

FACT: 0.6%

FORECAST: 0.6%

PREV.: 0.2%

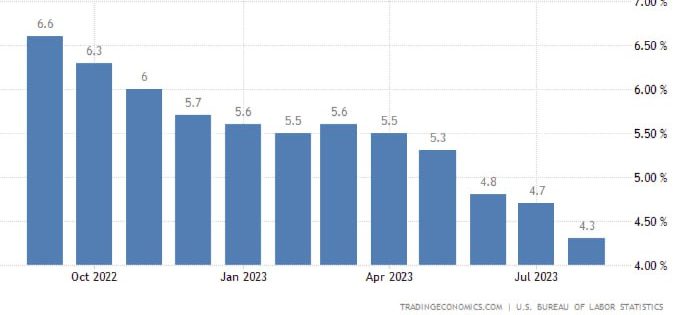

Basic Consumer Price Index (CPI) (YoY) (Aug)

FACT: 4.3%

FORECAST: 4.3%

PREV.: 4.7%

Basic Consumer Price Index (CPI) (mom) (Aug)

FACT: 0.3%

FORECAST: 0.2%

PRE: 0.2%

The US Consumer Price Index (CPI Core) — core inflation, excluding food and energy, fell to 4.3% year-on-year in August from 4.7% in July.

On a monthly basis, the basis of inflation increased by 0.3%, which is slightly higher than the consensus forecast (0.2%).

In short and in fact, despite the increase in inflation in August in the consumer price index, in the basic version (the Fed is looking at it. everything is quite predictable and the market took it neutrally).

The Fed and the market

The slowdown in inflation is positive, since it reduces the risks of the Fed raising interest rates. Inflation still remains significantly above the target 2%, which will limit the growth of the stock market. The dynamics of the Fed are fine, but the data released today show that it will not be easy.

In August, fuel prices rose, so the CPI growth does not surprise anyone particularly and there was no tragedy in the market, all this was expected in the forecast. The slowdown in the growth of the base index is also expected, and only the data for the last month can be confusing here.

Globally, data on neutrality, taking into account past data on the strength of the economy. The Fed will not raise the rate in September, but if such data is repeated, we should expect an increase in November or December. And this fact will force us to overestimate the prospects for the 4th quarter of 2023. (the chance of another raise at the moment looks like 50%)

How did the market react?

At the moment, more positive (until November-December) is still far away, and there were a lot of negative factors in September. Everyone knows that until the very meeting (20.09), no one will hear the Fed’s position, add. there will be no “all is lost” factors. The flat will continue, with minimal positive. The crypt will not win back this movement, the correlation with the fund is about zero. Let me remind you once again about the September effect.

Guide to Understanding the USA Consumer Price Index (CPI)

The Consumer Price Index (CPI) is a crucial economic indicator that measures changes in the prices of a basket of goods and services over time. It helps gauge the overall cost of living for the average American and provides insights into inflation and economic trends. Understanding the USA CPI is essential for individuals, businesses, and policymakers. Here’s a comprehensive guide to help you grasp its significance and how it works.

1. What Is the CPI?

The Consumer Price Index is a statistical measure that tracks the average change over time in the prices paid by urban consumers for a fixed basket of goods and services. It is expressed as a percentage increase or decrease from a base year.

2. Importance of the CPI

Inflation Measurement: The CPI is a critical tool for monitoring inflation. It helps determine whether prices are rising or falling and at what rate, influencing decisions about monetary policy.

Cost of Living: It reflects changes in the cost of living for the average household, which is crucial for budgeting, salary adjustments, and financial planning.

Indexing: Many contracts, such as Social Security benefits and labor union agreements, are indexed to the CPI, ensuring they keep pace with inflation.

Economic Indicator: The CPI is used by economists, businesses, and policymakers to analyze economic trends and make informed decisions.

3. How Is the CPI Calculated?

The calculation involves several steps:

Selection of the Basket: Economists choose a representative basket of goods and services that reflect the spending habits of the average urban consumer.

Price Collection: Prices for each item in the basket are collected at regular intervals (monthly or quarterly) from various locations across the country.

Weighting: Each item’s importance in the average consumer’s budget is determined, and weights are assigned accordingly.

Calculation: The CPI is calculated using the formula:

CPI = (Cost of Basket in Current Year / Cost of Basket in Base Year) x 100

Base Year: The CPI is expressed relative to a base year, which is set at 100. All other years’ CPI values are compared to this base year.

4. CPI Components

The CPI basket typically includes various categories:

- Food and Beverages

- Housing

- Apparel

- Transportation

- Medical Care

- Recreation

- Education and Communication

- Other Goods and Services

5. Types of CPI

CPI-U (Consumer Price Index for All Urban Consumers): Measures the overall inflation experienced by urban consumers.

CPI-W (Consumer Price Index for Urban Wage Earners and Clerical Workers): Focuses on a subset of urban consumers, primarily wage earners and clerical workers.

Core CPI: Excludes volatile food and energy prices to provide a more stable measure of underlying inflation.

6. Limitations of the CPI

Substitution Bias: The CPI assumes that consumers don’t change their spending habits when prices rise, which may not be accurate.

Quality Changes: The CPI doesn’t always account for improvements in the quality of goods and services.

Geographic Variations: It may not accurately reflect regional price differences.

7. Uses of the CPI

Inflation Targeting: Central banks use CPI to set inflation targets and adjust interest rates accordingly.

Cost-of-Living Adjustments: Many government programs and contracts use the CPI to determine cost-of-living adjustments.

Investment Decisions: Investors use CPI data to assess the impact of inflation on their investments.

8. Accessing CPI Data

The Bureau of Labor Statistics (BLS) in the United States publishes monthly CPI reports on its website, providing access to historical data and analysis.

9. Conclusion

Understanding the USA Consumer Price Index is vital for gauging inflation, making financial decisions, and interpreting economic trends. Stay informed about CPI data to make informed choices in your personal and professional life.

The Consumer Price Index (CPI) is a measure that tracks changes in the prices of a fixed basket of goods and services over time. It reflects the average cost of living for urban consumers in the United States.

The CPI is crucial for several reasons:

- It helps gauge inflation and price trends.

- It influences monetary policy decisions.

- It determines cost-of-living adjustments for various programs and contracts.

- It provides insights into economic conditions and consumer behavior.

The CPI calculation involves selecting a basket of goods and services, collecting their prices over time, assigning weights to reflect spending habits, and then comparing the cost of the basket in the current year to a base year, expressed as a percentage change.

The CPI basket typically includes categories such as food and beverages, housing, apparel, transportation, medical care, recreation, education, communication, and other goods and services.

There are three main types:

- CPI-U (Consumer Price Index for All Urban Consumers): Measures inflation for all urban consumers.

- CPI-W (Consumer Price Index for Urban Wage Earners and Clerical Workers): Focuses on wage earners and clerical workers in urban areas.

- Core CPI: Excludes volatile food and energy prices to provide a stable measure of underlying inflation.

Some limitations include:

- Substitution Bias: Assumes consumers don’t change spending habits when prices rise.

- Quality Changes: May not account for improvements in the quality of goods.

- Geographic Variations: Doesn’t reflect regional price differences accurately.

The CPI is used for:

- Setting inflation targets and adjusting interest rates.

- Determining cost-of-living adjustments for programs like Social Security.

- Assessing the impact of inflation on investments and financial decisions.

The Bureau of Labor Statistics (BLS) in the United States publishes monthly CPI reports on its website, providing historical data and analysis.

CPI data is typically updated monthly by the BLS, allowing for real-time tracking of price changes and inflation trends.

You can use CPI data to assess how inflation may impact your budget, savings, and investments. It’s a valuable tool for financial planning and understanding the changing cost of living.