Coinbase has released the newest report on Crypto. The study was conducted by IPSOS. It observes how cryptography and blockchain technology are considered in Argentina, Kenya, Philippines and Switzerland, and how it affects people’s lives in these countries.

For most of the study, it is based on surveys from 4000 adults (not indicating age indicators) in Argentina, Kenya, Philippines and Switzerlands conducted on behalf of Coinbase. The choice of countries is aimed at giving the prospect of society living in noticeably different socio-economic conditions in different parts of the world (none of these countries belongs to one continent, and the Philippines are a country based on the archipelago).

The similarity between these countries is mainly the Christian population and government systems rotating around the republic’s model. Nevertheless, countries have amazingly different areas, positions on the map, historical experience, culture, languages, climate, economic states, etc.

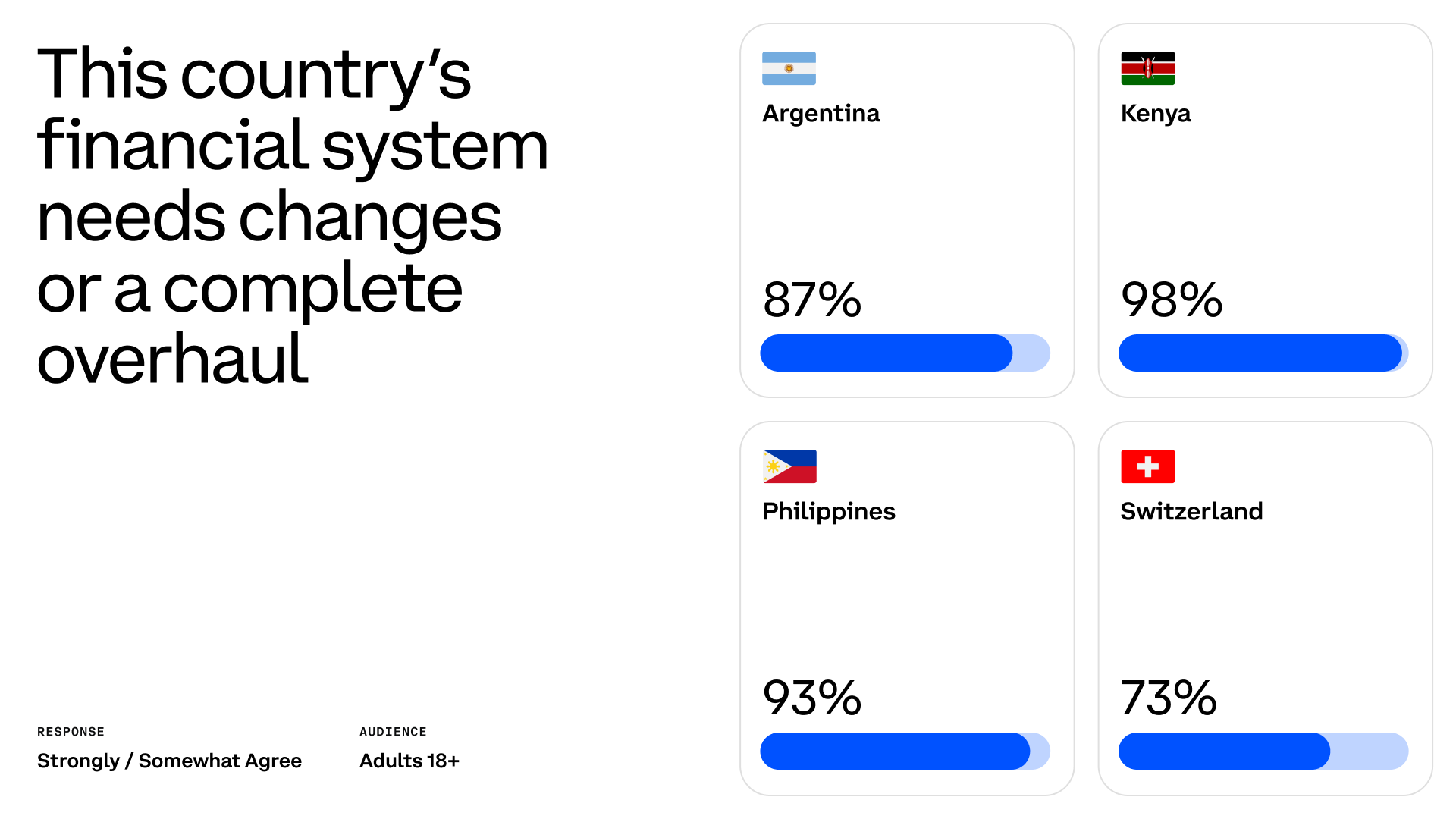

Coinbase, however, outlines in general terms another similarity between Argentina, Kenya, Philippines and Switzerland: according to the exchange team, the inhabitants of these countries believe that local financial systems should be improved. Moreover, as a rule, surveyed residents consider cryptocurrencies and blockchain as tools that can improve their lives from the point of view of financial wealth and, in general, give more freedom and independence.

The state of the economy in these countries

The report begins with statistics that demonstrates that in each country less than half of all respondents believe that the current financial direction in their country will force them to live better than the previous generation. Nevertheless, even fewer people believe that they will live worse than their parents in Argentina and the Philippines.

Therefore, it is fair to say that in Kenya and Switzerland people do not approve of the current financial policy, unlike recent years, while Argentina and the Philippines are rather not like the current and previous efforts, believing that now things are slightly better, than before. Respondents in all these countries agree that the local financial system should be changed or revised completely. They call the financial systems of their countries “slow”, “expensive” and “unstable” ones. They also called the lack of innovation as one of the problems.

The study reveals four main problems of respondents named in polls: lack of justice (discrimination), centralization, reduction in the cost of the national currency and too much hard work to earn enough or save money.

The distribution of problems varies from the country to the country, and Kenya and the Philippines are most important for centralization, discrimination and slavery of wages. Switzerland is least concerned about many of these issues, being careful with the dependence of the government on banks. The Argentines have the biggest problems of trust with their financial institutions and the problem of saving money.

Crypto as a medicine

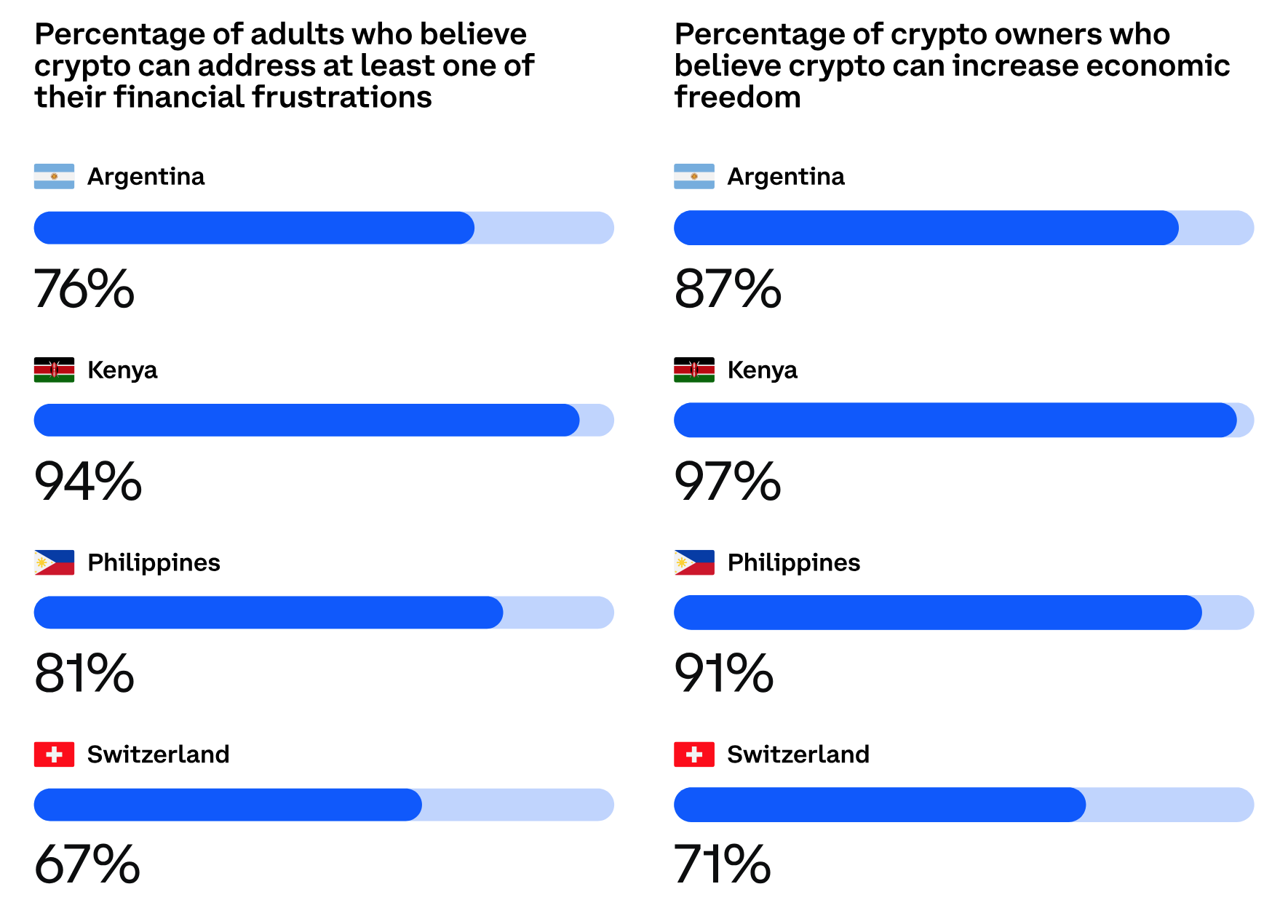

Most people surveyed by IPSOS for research want to be responsible for their financial condition and get more freedom and control over their money. 7 out of 10 respondents consider cryptocurrency and blockchain as a way to achieve these goals. Moreover, as the owners of the crypto, and those who do not have a crypto, agree that digital currencies can help them get more freedom and control their wealth.

The Swiss are noticeably less interested in crypto than respondents from other countries. Nevertheless, more than 70% of cryptography owners in Switzerland believe that Crypto offers them more control and freedom. Less than half of the Swiss residents surveyed without crypto, believing that they need it.

The wider blockchain acceptance is also considered as a favorable factor that can improve local financial systems and individual wealth. Most respondents believe that blockchain contributes to innovation and facilitates control over individual finances. Respondents hope that the blockchain will make the system faster and affordable.

In all surveys, Switzerland is presented with a lower number. It reflects lower expectations associated with bitcoins and blockchain, and a lower level of dissatisfaction with the financial status -KVO.

Looking into this study, you can notice a strong connection between the level of satisfaction of the financial direction of the country and the level of support of cryptocurrencies and blockchain. Residents of Switzerland and Argentina are less concerned about the current financial condition of their countries, and they are not in Crypto than Kenya and the Philippines. This is probably one of the reasons why not only Kenya, but also in Africa as a whole, where the population has practically no access to banking services, but has smartphones, are usually considered the driving forces of the massive introduction of cryptocurrency and blockchain -based solutions as a substitute for traditional banks.