Share:

- Coinbase could be the de facto crypto exchange for investors as Binance navigates negative publicity, likely impacting its spot dominance.

- Having proceeded cautiously with some regulations and compliance, the US-based platform’s approach could finally bear fruit.

- COIN shares rose 5% on the day as investors, including Ripple’s lawyer, snapped up more Coinbase shares.

The Coinbase exchange, the main market rival against the Binance exchange after the collapse of FTX, is the clear favorite after the largest cryptocurrency exchange and its CEO Changpeng Zhao (CZ) capitulated before the US Securities and Exchange Commission. US (SEC).

Coinbase could be the de facto crypto exchange after the Binance debacle

The Coinbase exchange stands to benefit the most, now that the Binance exchange has succumbed to the US SEC, with CZ officially stepping down as CEO and inadvertently appointing Richard Teng, former global head of regional markets, as new executive director.

Today I stepped down as CEO of Binance. It’s true that it wasn’t easy to let go emotionally. But I know it’s right. I made mistakes and I must take responsibility. This is what is best for our community, Binance and me.

Binance is no longer a baby. Is…

– CZ Binance (@cz_binance) November 21, 2023

With Binance in trouble, Coinbase CEO Brian Armstrong has brought the exchange to the stage, saying: “We now have the opportunity to start a new chapter for this industry… Americans should not have to go to unregulated offshore exchanges to profit.” of this technology. “

Armstrong, who pushes the United States as the legitimate center for cryptocurrencies, says that Coinbase believes in economic freedom, demonstrating his belief that the American democratic system will eventually get things right.

Since Coinbase was founded in 2012, we have taken a long-term view. I knew we needed to embrace compliance to become a generational company that would stand the test of time. We obtained the licenses, hired the legal and compliance teams, and made it clear that our brand was built on trust…

– Brian Armstrong ️ (@brian_armstrong) November 21, 2023

Ripple lawyer John E. Deaton appears to agree with Armstrong, acknowledging that “Coinbase will be a big winner.” His speculation is based on the exchange-traded fund (ETF) narrative that essentially rests on the shoulders of Coinbase.

@coinbase will be a big winner. I hope to see BlackRock and Vanguard buy more. By the way, 90% of @GaryGensler’s $120 million fortune is in Vanguard. Do you see how this works? https://t.co/WHWGNY4vQJ

– John E Deaton (@JohnEDeaton1) November 21, 2023

Specifically, Coinbase Inc. has been featured in spot ETF applications from multiple institutional players, including BlackRock, Chicago Board Options Exchange (CBOE), Fidelity, and Vanguard, listed in its Shared Surveillance Agreement (SSA), as noted in the Nasdaq 19b- index. 4 way. Its position as the largest US crypto exchange is probably the driving force behind its popularity.

Gensler was asked in a webinar today about Coinbase being at the center of ETF filings. He was unable to comment on the filings, but was quite negative about crypto exchanges, saying they operate “conflicting services” and have “limited risk monitoring.” Here’s the full quote via @TheBlock__ pic.twitter.com/iCVl906GyF

– Eric Balchunas (@EricBalchunas) July 12, 2023

An SSA, short for Surveillance Sharing Agreement, defines an agreement between crypto exchanges and regulators or market surveillance providers such as the SEC. Improves the integrity and transparency of the crypto market by sharing trading information and data.

Coinbase operates a significant portion of the US-based Bitcoin spot trading platform, representing a substantial portion of US-based, US dollar-denominated Bitcoin trading. CBOE ETF started on June 21st.

At one point, the feature was a complication, with the SEC citing cryptocurrency exchanges operating “conflicting activities” despite having “limited monitoring.”

If spot ETFs are approved, institutional players could share trading data with the commission and accounting information, among other relevant market data. This would help quell or reduce the SEC’s suspicions of market manipulation and allow it to confirm the lack thereof.

With Coinbase likely to become the favorite, Deaton has revealed that he has added to his pool of Coinbase shares by acquiring more COIN.

I just bought more $COIN

– John E Deaton (@JohnEDeaton1) November 21, 2023

Coinbase COIN Shares Rise as the Exchange Takes the Stage as a Likely De Facto Crypto Platform

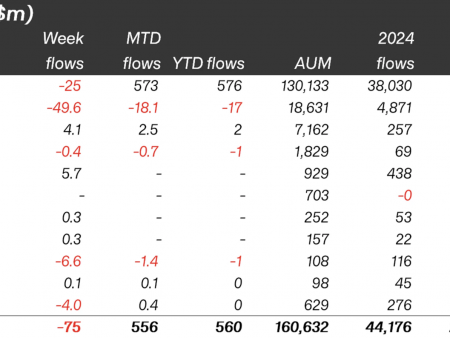

Coinbase (COIN) shares are up at least 5% on news of the Binance exchange saga, testing the supply zone that extends from $105.31 to $110.01. At the time of writing, COIN is trading at $105.54.

To confirm the trend continuation, the price must break and close above the midline of the supply barrier at $107.38, potentially setting the tone for COIN price to break above the range high at $114. $.43, levels last tested on July 14.

COIN 1-day chart

Crypto ETF FAQs

What is an ETF?

An exchange-traded fund (ETF) is an investment vehicle or index that tracks the price of an underlying asset. ETFs can not only track a single asset, but a group of assets and sectors. For example, a Bitcoin ETF tracks the price of Bitcoin. ETF is a tool used by investors to gain exposure to a certain asset.

Is Bitcoin Futures ETF Approved?

Yes. The first Bitcoin futures ETF in the US was approved by the US Securities and Exchange Commission in October 2021. A total of seven Bitcoin futures ETFs have been approved, and more than 20 They are still waiting for permission from the regulator. The SEC says the cryptocurrency industry is new and subject to manipulation, which is why it has been delaying cryptocurrency-related futures ETFs for the past few years.

Is Bitcoin Spot ETF Approved?

The Bitcoin spot ETF has been approved outside the US, but the SEC has yet to approve one in the country. After BlackRock filed for a Bitcoin spot ETF on June 15, interest around crypto ETFs was renewed. Grayscale, whose application for a Bitcoin spot ETF was initially rejected by the SEC, scored a victory in court, forcing the US regulator to review its proposal again. The SEC’s loss in this lawsuit has fueled hopes that a Bitcoin spot ETF will be approved before the end of the year.

Share: Cryptocurrency Feed