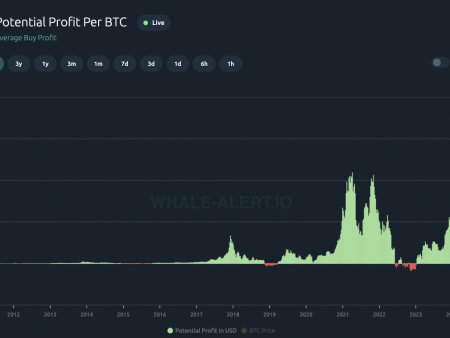

Cardano (ADA), the ninth-largest cryptocurrency by market capitalization, fell below $1 amid a broad market sell-off that saw $788 million worth of liquidations across various crypto assets over the past 24 hours. However, on-chain data suggests whales may be taking advantage of the opportunity to accumulate.

Cardano’s high transaction volume, often an indicator of whale activity, has increased slightly over the past 24 hours, according to analytics firm IntoTheBlock. This is in stark contrast to the overall decline in large transaction volumes in major cryptocurrencies such as Bitcoin, Ethereum and others amid the current market sell-off.

According to IntoTheBlock, Cardano’s large transaction volume totaled $14.22 billion, or 14.04 billion ADA, representing a 2.8% increase over the last 24 hours.

Cardano fell to a low of $0.917 on Thursday, part of a four-day decline that accelerated in yesterday’s session. The Federal Reserve on Wednesday cut its key interest rate by a quarter of a percentage point, the third in a row, but warned against further cuts in coming years.

While the immediate price action may seem discouraging for ADA holders, the increase in whale activity provides a ray of hope. If the accumulation trend is confirmed, it could pave the way for prices to rebound when market conditions improve.

Cardano Price Action

On December 16, Cardano took profit at a high of $1.12. At the time of writing, ADA is down 7.22% in the last 24 hours to $0.939 and down 17.19% in the last seven days. If today closes in the red, it will be the fourth straight day of losses for ADA.

The daily RSI is close to the midpoint, which means price movement may be limited in the near future. Bears may try to push ADA price closer to the daily SMA 50 at $0.845, which is expected to provide strong support.

The bulls could take control again after pushing and holding the ADA price above $1.20. ADA could rise to $1.24 and then to $1.33, where bears are expected to provide solid protection.

At the moment, Cardano’s yield above $1 may be determined by investor sentiment and the overall recovery of the crypto market.