This is an excerpt from the Forward Guidance newsletter. To read full editions, subscribe.

Just days into the new year, the price of Bitcoin has returned to six figures.

On Monday morning, the asset’s price rose above $102,400. At 2:00 pm ET, it was hovering around $101,750, up nearly 9% from a week ago.

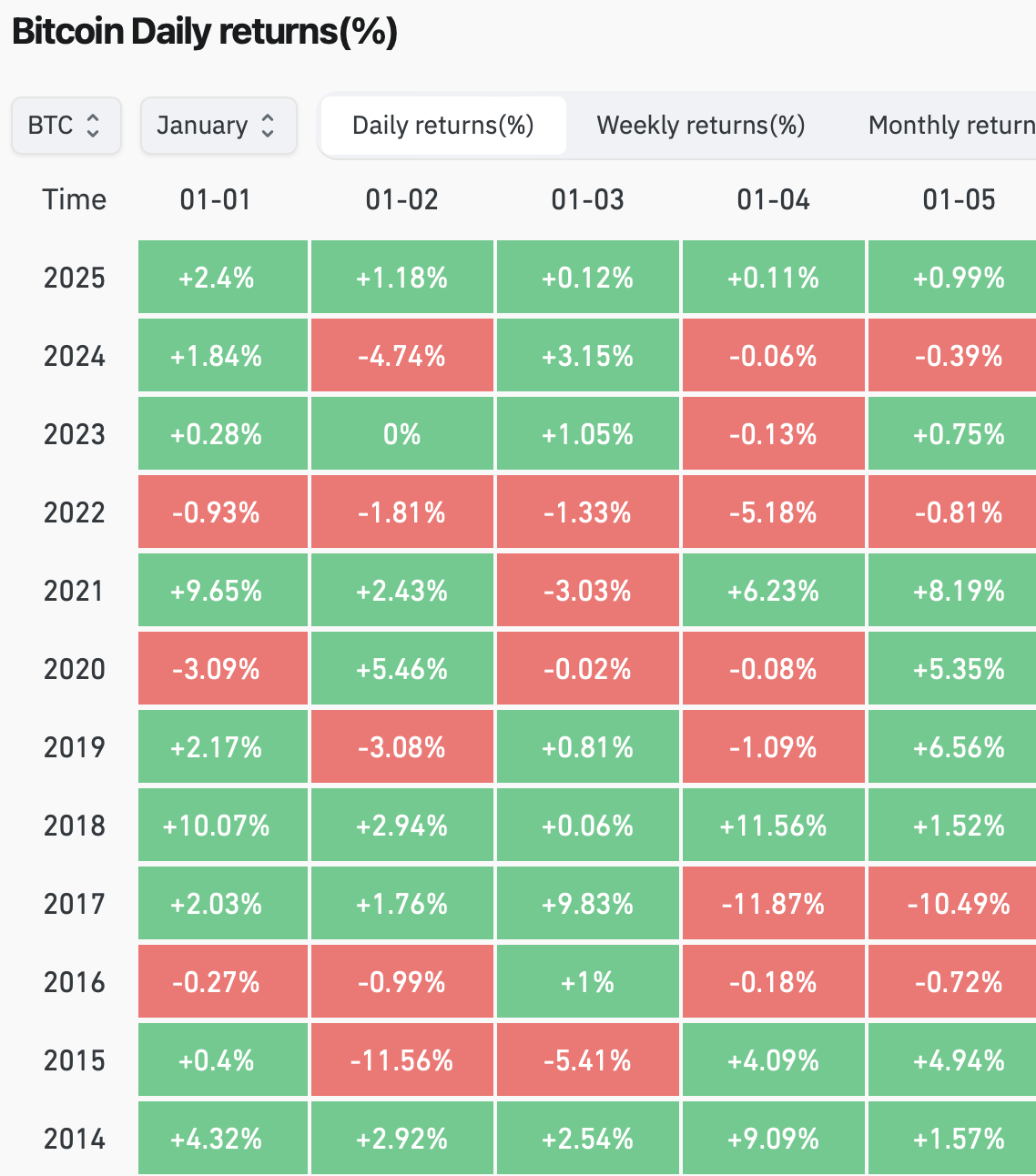

Crypto has so far seen its own “January effect,” a term that hints at a potential rise in stock prices during the first month of the year. Data from CoinGlass shows that the price of Bitcoin rose—albeit marginally—during each of the first five days of the month. This hasn’t happened since 2018.

You already know about BTC’s historic rise to an all-time high of $108,000 just over a month after Trump won the election. Then came what some called a “healthy” correction driven by hawkish Fed sentiment and profit-taking: BTC fell below $92,000 on December 30th.

Head of Grayscale Research and Research Raihaneh Sharif-Askari noted that temporary drawdowns during bull markets are common, pointing to a 6% decline in the FTSE/Grayscale Crypto Sector Market Index in December.

“However, strong demand from US-listed Bitcoin ETPs and Treasuries such as MicroStrategy could support the price of Bitcoin,” she said when asked about forecasts for January.

U.S. Bitcoin ETFs received $908 million in net new assets on Friday, recovering from cumulative outflows of $940 million over the previous four trading days, according to Farside Investors.

96% of financial advisors surveyed by Bitwise received a cryptocurrency-related question from clients in 2024. This finding is consistent with the expected continued influx of capital driven by asset managers into the crypto segment.

Regarding Sharif-Askari’s mention of Treasuries, MicroStrategy’s last Bitcoin purchase (December 30-31) was 1,070 BTC, worth approximately $100 million. While the company has bought less BTC in previous weeks, it also just announced that it plans to raise $2 billion in capital through perpetual preferred stock offerings to acquire more BTC.

In this regard, Metaplanet CEO Simon Gerovich has just noted that his company plans to increase its BTC holdings (currently at 1,762 BTC) to 10,000 BTC in 2025. Then there’s KULR Technology Group, which said Monday it bought an additional $21 million in bitcoin.

Of course, Trump’s inauguration is also scheduled for January. And with members of the 119th Congress sworn in last week, hearings on the president-elect’s Cabinet nominees are expected to begin soon.

According to Sharif-Askari, the confirmation hearings and subsequent signals about the pace and degree of future regulatory clarity for the cryptocurrency could impact the price of BTC throughout the month.

“Delays or announcements of restrictive policy could dampen sentiment,” she said, before adding: “Macro factors, including the Federal Reserve’s interest rate signals and the market’s reaction to a stronger U.S. dollar, could also play a role.”