BNB has decreased by 8% over the past 30 days, but its correction remains noticeably less serious than the adjustments of BTC, ETH, XRP and SOL. The total crypto -market today has fallen by almost 10%, while the BNB remains stable.

Despite the bear trend, the BNB ecosystem remains strongThe Pancakeswap field, its largest DEX, has generated more fees in the last seven days than Uniswap and Hyperiliquid. IN In the coming weeks, BNB can break through above $ 586 and target levels of about $ 635 or even $ 680.

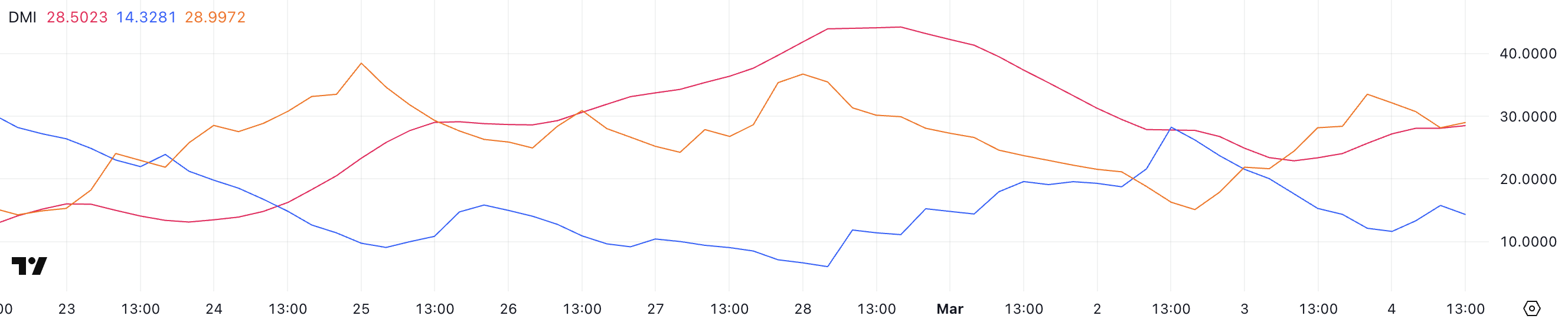

BNB DMI shows that sellers returned to control

The BNB (DMI) directional index shows that its average direction (ADX) index is currently 28.5, which is increasing from 22.8 yesterday, which signals that the current trend is intensifying.

ADX measures the strength of the trend, but not a direction, which means that whether they are bull or bear, the growing ADX involves an increase in the impulse.

In this case, it remains in the descending trend, and the strengthening of ADX indicates that the bear pressure is becoming more and more dominant. If the purchase does not go, the descending movement can accelerate.

+DI (positive directed indicator) fell to 14.3, from 28.2 two days ago, signaling that the bull impulse is significantly weakened.

Meanwhile, -DI (negative direction indicator) increased to 28.99, compared with 15 days ago, confirming that the sale of the sale increases.

C -di is now much higher than +di, the bears are completely under control, and the BNB price will probably remain under pressure. If this trend continues, BNB may face further decrease if the bulls did not come into action in order to change the impulse.

ICHIMOKU CLOUD shows a bear installation for BNB

The ICHIMOKU cloud for BNB shows that the price is currently trading significantly below the cloud, which confirms the bear tendency. A sharp decline began after it was rejected from Tenkan-Sen (Blue Line), which now leans down, increasing short-term weakness.

In addition, Kijun-Sen (red line) remains above the price, signaling this impulse favors the bears. If the BNB does not restore these key levels, the descending trend can continue on the upcoming sessions.

The future cloud remains red, assuming that bear conditions can remain. When the price is below the cloud, this indicates a clear downward trend, and the gap is higher, this must again change the speed.

At the moment, BNB is faced with resistance to Tenkan-Sen and Kijun-Sen, and the inability to return these levels can lead to a further shortage. If the BNB remains below the cloud, the sales pressure may continue, which complicates the restoration of control.

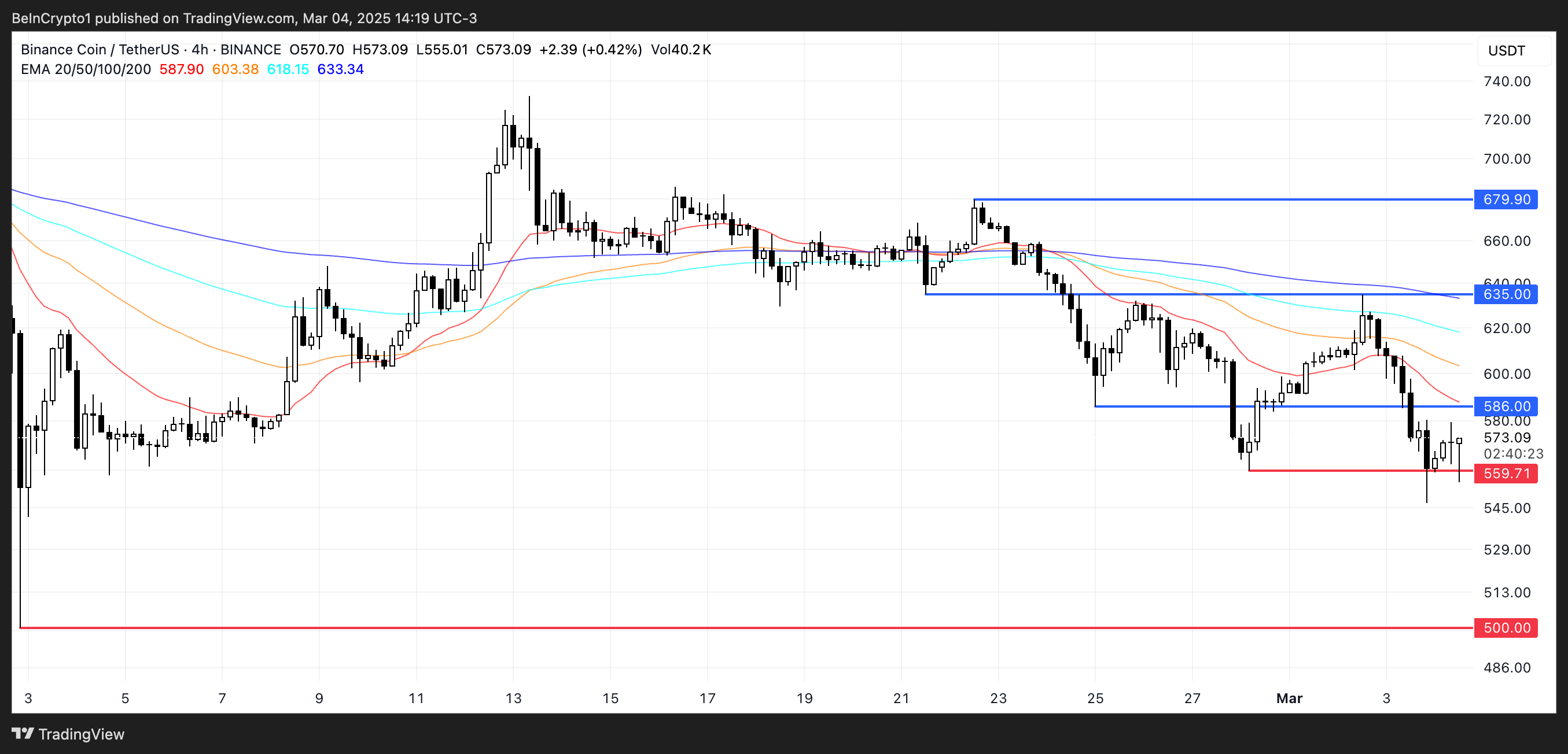

BNB is currently trading between two important key levels

The BNB price is currently traded between the support of $ 559 and the resistance of $ 586, while the price action is consolidated in this range. If support in the amount of $ 559 is checked and lost, BNB can decrease further to $ 500, which is a key level.

A break below 500 dollars would be significant, since it will celebrate the first time it is trading below this level since September 2024.

With the indicators of the pulse, which still prefer bears, the further drawback remains the opportunity if the purchase pressure does not increase.

On the other hand, if it can break above $ 586, it can gain an impulse to a resistance of $ 635.

Successful movement for this level signals a stronger upward trend, potentially pushing BNB to $ 680.

In order for this scenario to unfold, the bulls must restore key levels of resistance and turn the current bear. A steady breakthrough above $ 635 would be the first sign of a trend shift.