Bitcoin opened on April 12, 2025, bargaining from $ 83,53 to 83,856, with a market capitalization of $ 1.65 trillion and a 24-hour trade volume of $ 29.74 billion. The movement at prices in the intraday price was from 81,675 to 84 056 US dollars, signaling the session marked by measured volatility and consolidation within several terms.

Bitcoin

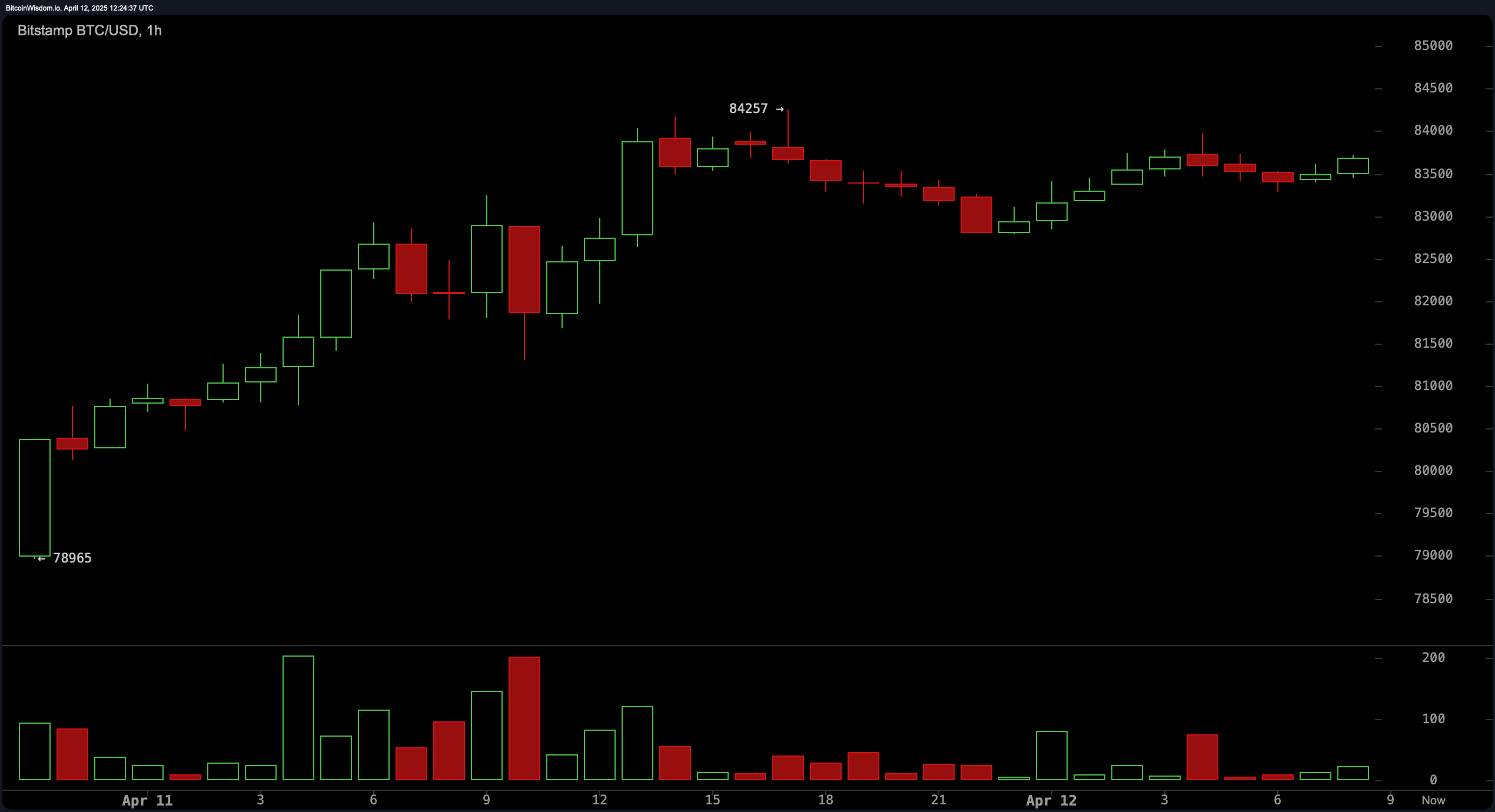

The hourly schedule Bitcoin (BTC) was traded in a narrow lane from about 83,000 to 84,200. The pricing action showed signs of compression after the previous bull impulse from $ 78,965 to US dollars to US dollars. Since then, this step has cooled down, with a decreasing volume of a hint of a decrease in a short -term pulse. A breakthrough above 84,200 US USA can potentially initiate a new leg up, while a breakdown below $ 83,000 can cause local bearish moods. An hourly setting favors trading based on the range with clearly defined stop parameters.

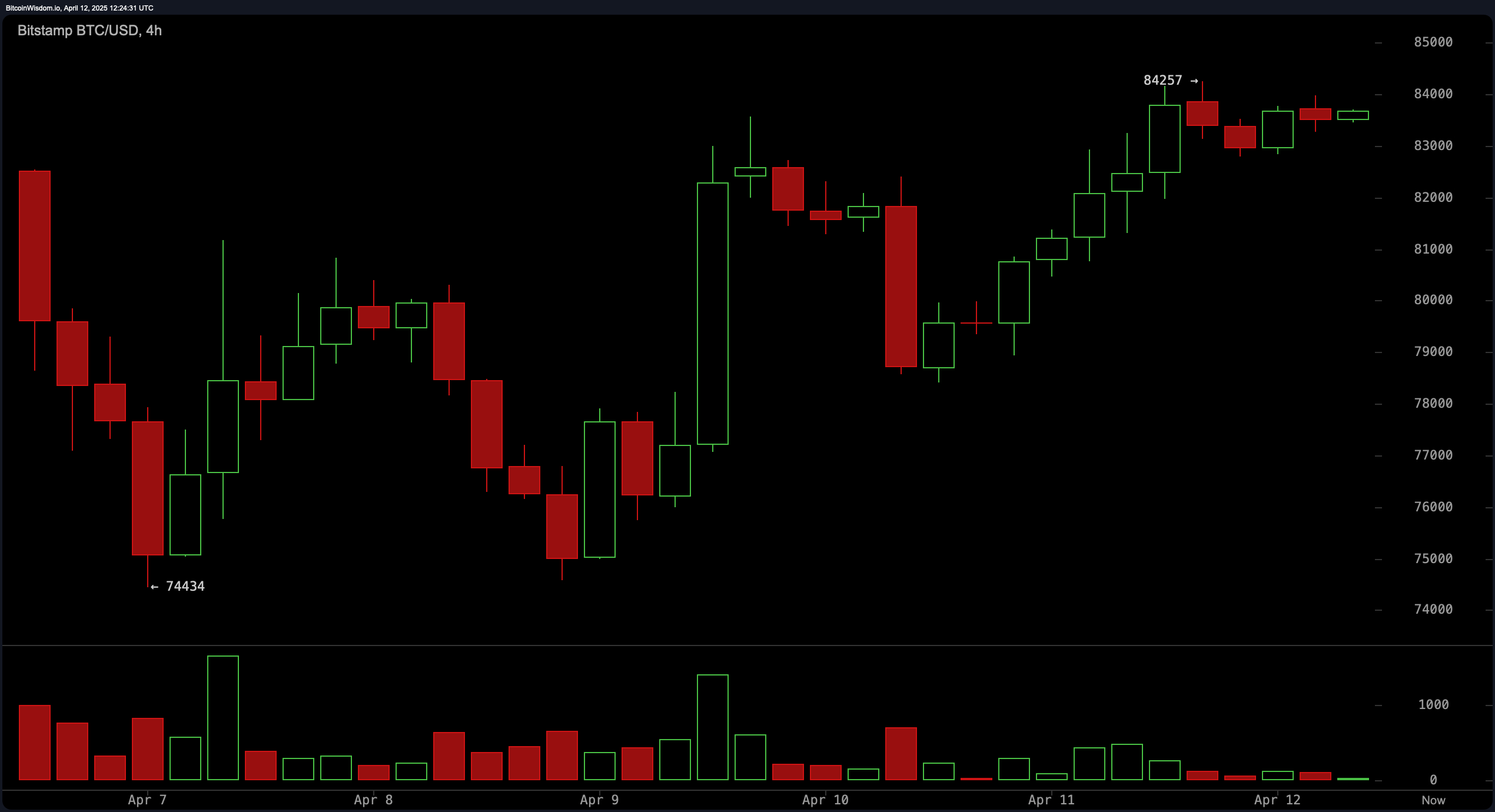

On a 4-hour schedule, the structure indicates a bull bias supported by V-shaped recovery after a recent minimum $ 74,434. Bitcoin forms higher minimums against a background of consolidation with a low volume of volume, which suggests that the bulls gradually absorb pressure. The resistance of $ 84,500 remains key, and a stable breakthrough can aim at the zone from $ 87,000 to 88,000 US dollars. Conversely, the inability to hack higher can lead to re -testing the support region from 80,000 to 81,000 US dollars. Traders are recommended to carefully monitor the increase in volume and models of candles to confirm the breakthrough.

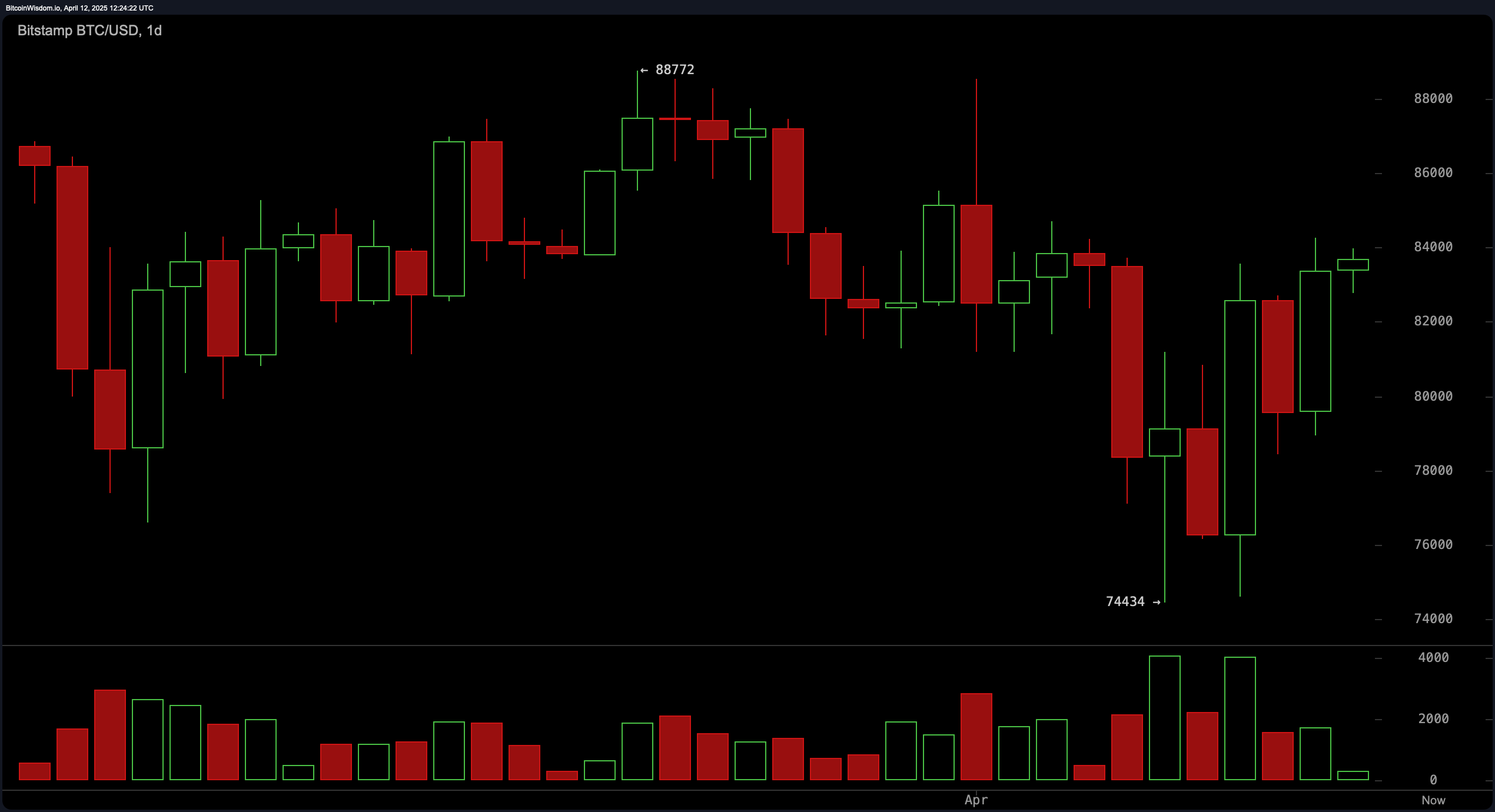

Daily terms provide a widest perspective of the developing trend of bitcoins. After a pronounced decrease, the assets showed signs of stabilization and recovery, as evidenced by the shift in the direction of higher closure and the recognition of the short -term downward trend. Strong support is observed from 74,500 to 76,000 US dollars, while the overhead resistance zone from 84,000 to 88,000 US dollars is a huge problem. Macro implies cautious optimism, with the means of least resistance, leaning up, if the price does not fall decisively below the level of $ 74,000.

From the point of view of the technical indicator, the oscillators remain largely neutral, with the relative force index (RSI), the stochastic oscillator, the index of product channels (CCI), the average direction (ADX) index and an amazing oscillator that signals a non -commercial displacement. Nevertheless, the impulse and divergence of convergence of the sliding medium (MACD) are on the territory of the purchase, offering moderate support of bull interpretations. These mixed signals emphasize the need for confirmation through the price action and volume before the start of directed transactions.

From the point of view of sliding average, Bitcoin is traded above its short -term trends. The exponential sliding average (EMA) (10) and a simple sliding average (SMA) (10), as well as EMA (20) and SMA (20), all indicate a purchase signal. Middle range indicators, such as EMA (30) and SMA (30), also support upward shift. However, long-term signals-SMA (50), SMA (50), EMA (100), SMA (100), EMA (200) and SMA (200)-bring a tilt of bear, which could take on a steady pulse, unless shorter trends attract the average values. This discrepancy between the terms requires a nuanced, sensitive to the time of a trading approach.

Bull’s verdict:

If Bitcoin retains its position above $ 83,000 and decisively breaks through the resistance zone 84.200–84 $ 500, supported by bull impulse indicators and buy signals in short -term sliding medium, probably a continuation of 87,000–88,000 US dollars, probably, appears. Sustainable accumulation and higher minimums on a 4-hour graphicate enhance the bull trajectory, depending on the support of the volume and wider market moods.

Bear Verdict:

The inability to keep above 83,000 US dollars, especially if the volume increases during breakdown, can cause recovery to the zone $ 80,000–81,000, with a deeper risk of correction to the level of 78,000 US dollars or even $ 74,000. Long -term sliding medium, reflecting bear signals and neutral oscillators, suggest that without an updated bull volume, a lack of pressure can quickly restore itself.