Bitcoin price has recently experienced a noticeable volatility due to significant market events and the activity of investors. After the initial decline in recent days, the BTC has increased over $ 94,000 on Sunday.

This increase was caused by reports of the upcoming strategic crypto -tossed US, which includes BTC and other large digital assets. Nevertheless, today the BTC is trading just below $ 93,000, signaling an unstable upward pulse in the cryptography market.

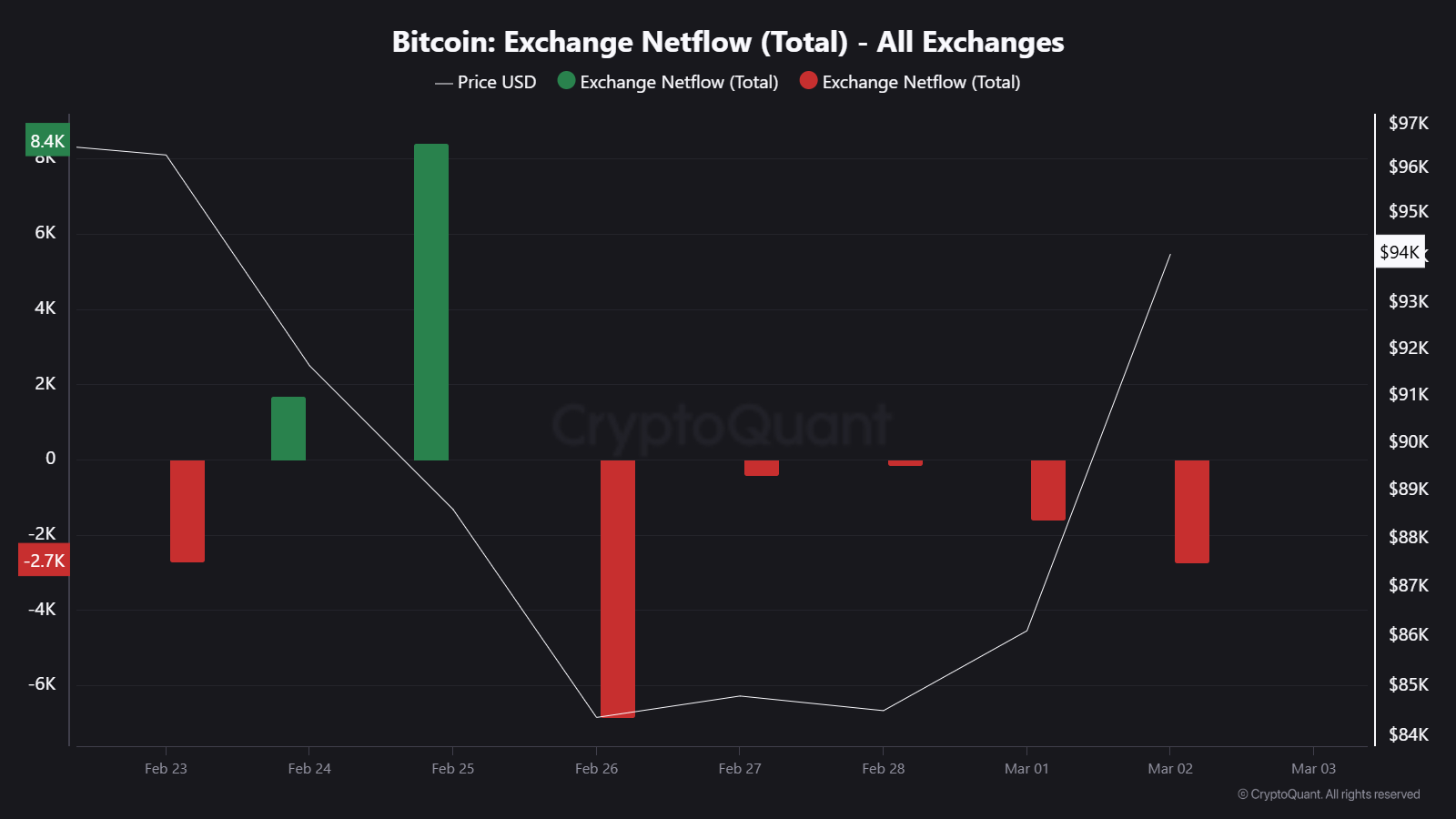

Against the backdrop of this price movement, a recent analyst of the Kriptobaykusv2 crypto analyst, highlights the developing scheme of the bitcoin pure exchange, offering an idea of the mood of investors. These data indicate that the influx and outflow of exchange can play a decisive role in the formation of a short -term direction of Bitcoin’s price.

Bitcoin exchanges and investor moods

According to Kriptobaykusv2, February 25, Bitcoin saw a significant influx for exchanges, and approximately 8,400 BTC were postponed. Historically, large influxes suggest increasing sales pressure, since traders move assets for exchanges in preparation for liquidation.

This was followed by a decrease in bitcoin price, agreed with previous market trends, where an increase in supply on exchanges often leads to a reduced price.

The next day, February 26, Bitcoin survived the shift, and a significant amount of BTC was withdrawn from exchanges. Large -scale outflow usually indicates preference to retention, reducing affordable offers on exchanges and potentially maintaining price stability.

This shift coincided with the support of Bitcoin’s price and began to recover, reflecting the confidence of investors in the long -term prospects of the asset. The analyst noted:

Thus, those who carefully monitor Bitcoin’s metabolism should take note: a large inflow in exchange can indicate increased pressure of sales, requiring caution. On the other hand, significant outfills suggest that investors prefer to hold, which can lead to price raising. We will see in the coming days how these trends continue.

Short -term sales and market trends

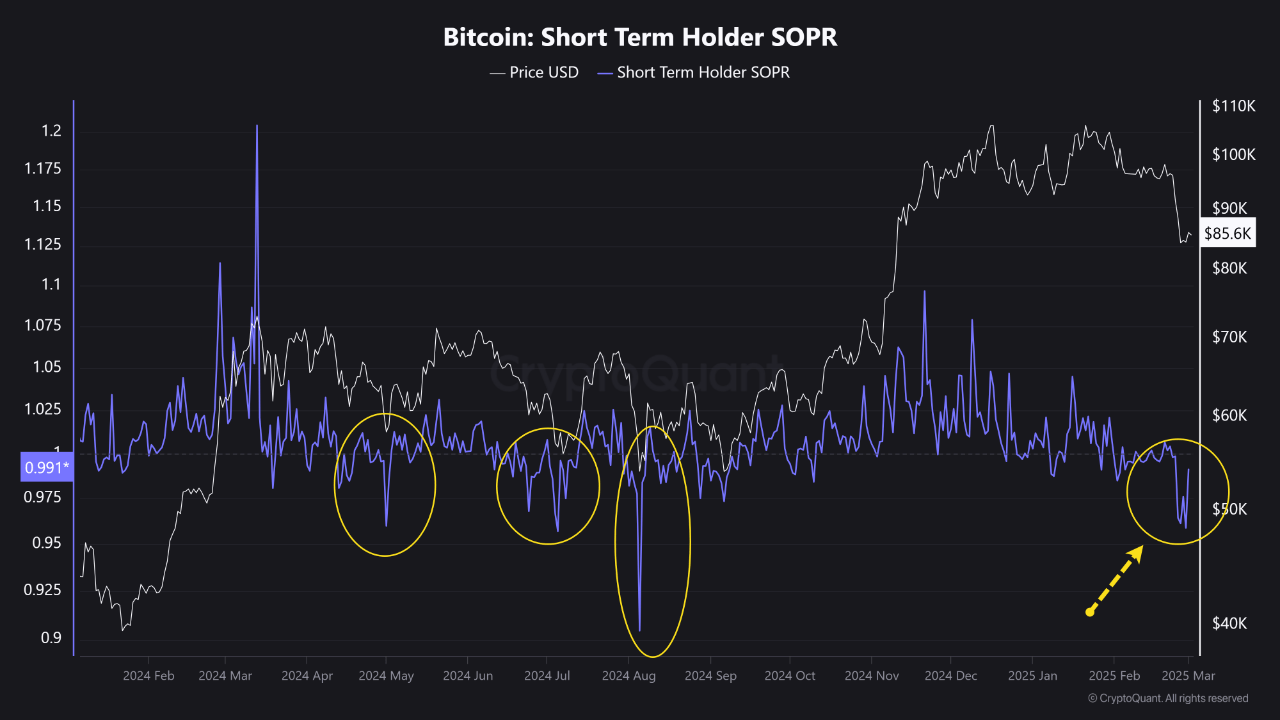

Meanwhile, a separate analysis of another cryptocurrency analyst, Abramchart, suggests that the holders of bitcoins began to sell with a loss. The coefficient index of a spent weekend profit (SOPR), which measures the profitability of short -term investors, according to the analytics recently recorded a value of 0.95.

This level, the lowest since August 2024, suggests that more traders sell BTC with a loss, which indicates surrender. Historically, the market restoration followed such periods, since the pressure in the sale is facilitated and the accumulation phases begin. Cryptoquant analyst wrote:

SOPR measures the share of bitcoin -koselov, which contained bitcoins for more than 1 hour or less than 155 days. The values compared to “1” indicate that more short -term investors are sold with profit. The values below “1” indicate that shorter investors are sold with a loss, which is a sign of surrender and return to the upward trend.

Shown image created with Dall-E, a diagram from TradingView