The largest cryptocurrency in the world can be at risk Shock of sentences Since the demand from the United States (USA) Spot Bitcoin Exchange Trade Funds (ETFS) grew far beyond the expectations. In December 2024, the volume of BTC, acquired through Spot Bitcoin ETFS More than tripled the amount mined during the same month, emphasizing a serious imbalance between demand and supply.

Spot Bitcoin ETFS launches the risk of supply shock

In December 2024, US Spot Bitcoin ETFS Bought Surprisingly 51 500 BTC. On the other hand, BTC miners produced only 13,850 coins for the same period, according to data from Blockchain.com. This indicates that Bitcoin ETF purchased almost four times more than the amount BTC miners It is generated and delivered to the market this month.

In accordance with ReportsDemand for ETF in December was nothing more than unusual, exceeding an affordable offer by about 272%. This is massive Increase demand for ETF Spot Bitcoin ETF I increased fears about the potential shock of the BTC proposal, and analysts suggest that this can happen in the near future.

In particular, Lark Davis, Crypto -Analytic, announced Earlier, in December, “a huge shock of sentences is inevitable.” The analyst founded this alarming forecast for a significant accumulation of BTC from US Spot Bitcoin ETFThe field Davis said that at some moment in December, BTC ETFS bought 21 423 BTC; Meanwhile, miners produced only 3150 BTC at about the same time.

Analyst also marked This BTC ETFS on a global scale spent about 1,311,579 BTC as of December 17, 2024. This amount worth 139 billion dollars is 6.24% of the total BTC offer in the amount of 19.8 million. Given this stunning figure, Davis predicts that at the stages of the peak in the SPOT BITCOIN ETF Bull market, 10-20% of Full supply of BTC, Increasing greater concerns about serious supply shock.

The concentration of the point tributary BTC in December

Data From Glassnode showed that Spot Bitcoin ETF has registered a total clean influx of $ 4.63 billion. The United States in December, almost doubleting the average monthly average 2024 in the amount of 2.77 billion dollars. USA. It is noteworthy that Glassnode said that the surge in Spot Bitcoin ETF influx was more concentrated during the first half of the month, while the second half outflowFrom December 26, is an exception.

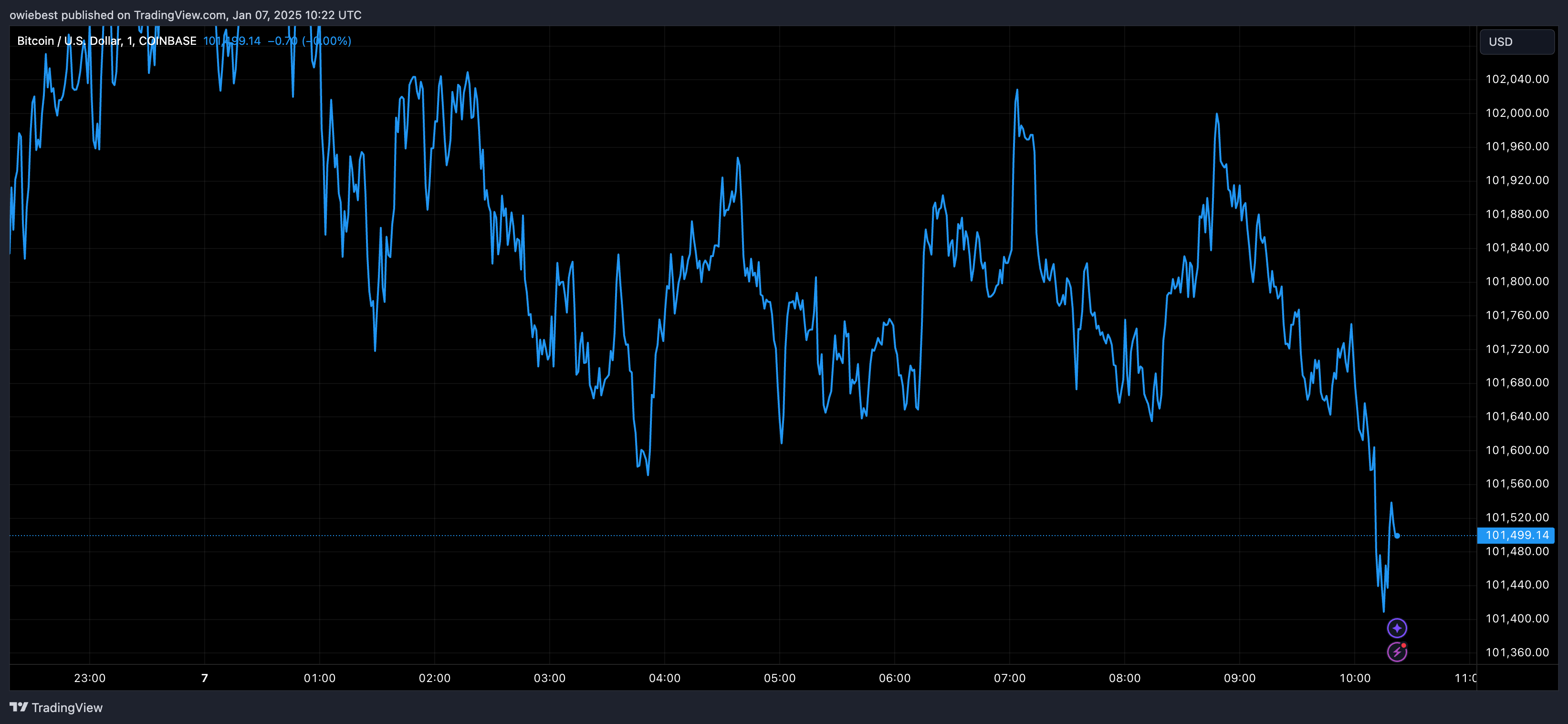

It is not surprising that the time for this surge and subsequent Reducing the influx of bitcoins ETF Corresponds to the price movements of BTC in December. At the beginning of the month, the BTC experienced an upward impulse, quickly flying up to New ATH above $ 108,000 December 17, fed by a hype in the bull market and growing demand. However, after this peak, BTC price saw a sharp declineA drop that coincided with time of significant outflows from ETF Spot Bitcoin, according to Glassnode.

Despite the surge in demand for point bitcoins ETF in December, new data It shows that investors extended their tendency to accumulate in January 2025. On January 3, investors purchased BTC worth more than 900 million dollars through Spot Bitcoin ETF. More recently, US Spot Bitcoin ETFS has acquired an additional 9,500 BTC worth more than 966 million dollars. USA at the current market price.