Bitcoin continued to receive significant support at the level of $ 90 thousand. USA, which caused a slight recovery.

Nevertheless, the prevailing bull impulse seems insufficient to cause a fresh rally to a new record maximum, which implies the probability of consolidation in this area in the short term.

Technical analysis

Shayan

Daily diagram

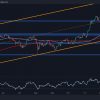

After the period of reduction, Bitcoin discovered strong support in the critical field of 90 thousand dollars. The USA, emphasizing the presence of customers at this level. This support is consistent with the average threshold of its long -term rising channel, enhancing its value.

Despite a slight increase in the pressure of the purchase, which leads to a slight bull rebounds, the current impulse remains suppressed, which indicates the continuation of consolidation near this support zone.

In order for Bitcoin to initiate a new rally and strives for a new record maximum, the market must be indicated by increased demand and a stronger bull impulse.

4-hour table

On a 4-hour schedule, the support level for 90 thousand dollars appears as a key defense zone, as evidenced by its role in stopping the pressure down in recent months.

The price action has recently formed an inverted head and shoulders template near this level, accompanied by a phase of accumulation, signaling a potential bull reviving.

Nevertheless, BTC requires an increase in market demand and purchasing demand and aim at a significant resistance of 108 thousand dollars. Until then, cryptocurrency will probably be consolidated in the area of 90 thousand dollars, waiting for a more obvious directional movement.

Analysis on the chain

Shayan

American investors, especially American institutions, play an important role in the movement of the market. Consequently, an analysis of their behavior can give valuable information about forecasting short -term market trends.

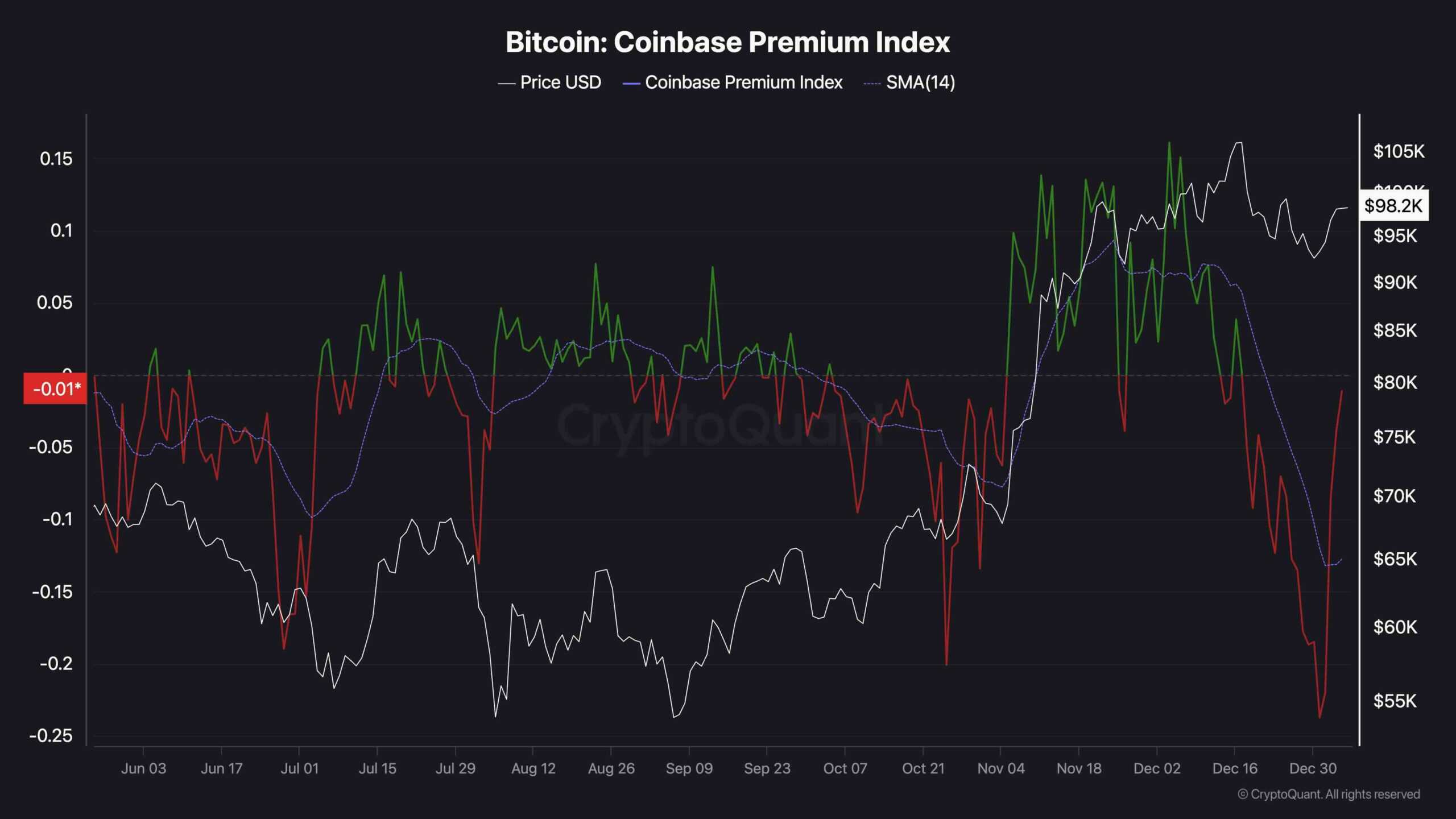

The premium Bitcoin Coinbase index is a critical indicator that compares the pressure on the purchase and sale of Coinbase, focused on the USA against Binance.

The diagram shows that the Coinbase premium index has recently observed a noticeable increase, which for the first time in recent months exceeded a 14-day simple sliding average. The index approached zero values, which indicates a shift in the dynamics of the market, and American buyers demonstrate the resumption of interest and exert pressure on the purchase.

If the Coinbase premium index supports levels above its SMA14 and switches to a positive territory, this will signal that investors in the United States become dominant in the Bitcoin market activity. This scenario can lead to a bull Methy, caused by increased demand from these key market participants.