Bitcoin Traders’ BTC Price Drop Targets Now Include $30.9K Bottom

Bitcoin is giving many traders the feeling that a new test of support could be next, but BTC’s price strength is winning over altcoins.

Bitcoin (BTC) hovered around $36,000 after the Wall Street open on November 16, as analysis expected a deeper BTC price drop.

Bitcoin Traders Plot Potential Bottoms

Data from Cointelegraph Markets Pro and TradingView followed a pullback from intraday highs of $36,600.

Having failed to establish a breakout beyond 18-month highs during the week, Bitcoin proved uninspiring to market participants, some of whom were hoping to see a fresh correction to retest lower levels.

“I would be delighted to see this latest rally complete the round trip to $35,000. I would be even happier to see a new $33K test,” Materials Indicators monitoring resource. wrote in part of comment X of the day.

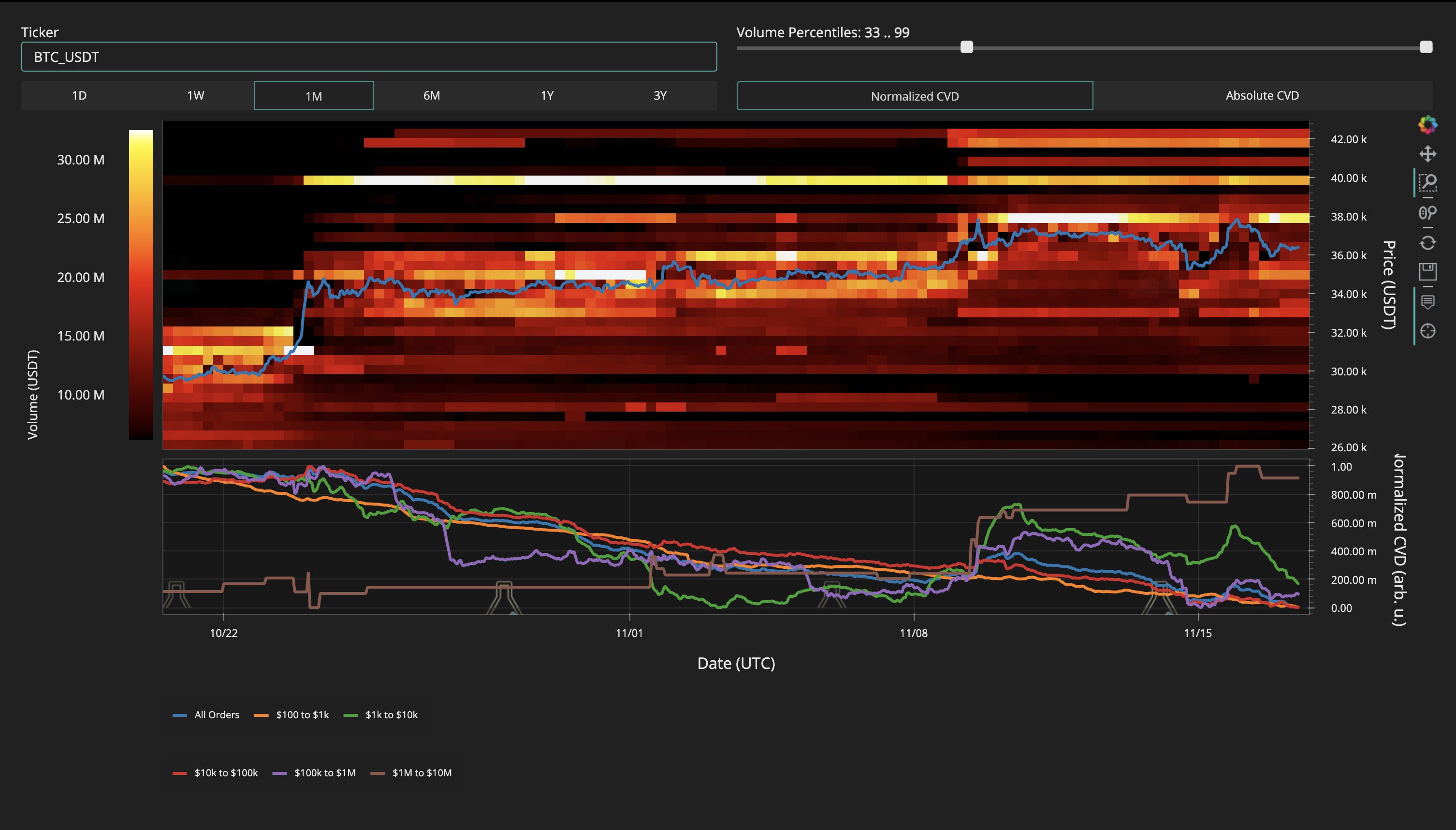

A snapshot of BTC/USDT order book liquidity showed support building at $35,000.

Continuing, Material Indicators co-founder Keith Alan added that Bitcoin’s rising 21-day simple moving average (SMA) had been serving as support in recent days.

“BTC continues to struggle for the range above $36.5K,” he said. commented.

“Local support is forming around the 21-day MA, which is currently around $35.7k. Which side do you think breaks first?

Popular trader Daan Crypto Trades also noted $35,700 and $38,000 as the main downside and upside levels to watch, respectively.

my point of view on #Bitcoin. I can’t make it easier than this range.

It’s pretty clear which levels are most important here: the low of ~$35.7k and the high of ~$38k.

Anything in between will be choppy.

Get up to $30K bonus on Bybit:

https://t.co/rIxsG0GIWl pic.twitter.com/B2jststQ7A– Daan Crypto Trades (@DaanCrypto) November 17, 2023

Meanwhile, fellow trader Gaah, a contributor to on-chain analytics platform CryptoQuant, warned that a steeper correction could bring the market closer to $30,000.

“As expected, $37,000 offers strong resistance to Bitcoin price!” he said X subscribers along with their latest analysis.

“The window for a further correction towards the bottom of the channel at $30.9k remains open as long as $37k continues to offer price resistance.”

Bitcoin dominance returns to 7-day high

Striking a more optimistic tone, popular trader and analyst Credible Crypto, known for his bullish stance on the market in the current environment, saw potential for BTC price to re-enter next.

Related: Bitcoin Bull Market FOMO Absent as BTC Price Nears Key $39,000 Profit Zone

This was due to a sharp pullback among altcoins, which underperformed Bitcoin on the day.

The largest altcoin, Ether (ETH), is down 3.8% in 24 hours at the time of writing, while XRP (XRP) is down 5% and Solana (SOL) is down almost 11%.

“Once I took the reins on alternatives, I have a feeling $BTC is ready to do its thing,” Credible Crypto. wrote in part of the X publications of the day.

Bitcoin’s crypto market cap dominance increased to hit one-week highs of 52.82%.

This article does not contain investment advice or recommendations. Every investment and trading move involves risks, and readers should conduct their own research when making a decision.

Add reaction