Bitcoin bounced up to 94,000 dollars after reports that Donald Trump was preparing to sign a parapet-executive orders on his first day.

These orders can refute key regulatory measures, including the SEC ballot for accounting 121 (SAB 121).

Trump is reported, preparing for a revision of the crypto -relay.

According to The Washington Post, it is expected that orders will be solved by the main problems that the crypto industry is faced with, such as banking restrictions and contradictory Sab 121.

This SEC bulletin requires that companies that have cryptocurrencies for customers register these assets as obligations on their balance sheets.

“SEC raised Sab 121 in each case for large banks, but not wide enough. Commissioner SEC Hester Pierce told me that this is failure, since this is an unfair crypto -a bell of Greenlit for a few. Veto on the veto Biden is bad against him. Exciting times! “, – wrote Zak Gusman.

Sab 121 was the center of criticism of the industry. Legislators tried to cancel the leadership last year.

Nevertheless, President Joe Biden put a veto on this measure, despite the two -party support in the congress. It is expected that the incoming administration of Trump will immediately return to this issue.

Currently, the Sab 121 policy is storing cryptography more expensive and risky for banks. Thus, they are less likely to offer a crypto -description or other services to their customers.

“Congress accepted the cancellation last year, but Biden put a veto. This is the third of the three Seilor catalysts for 5 million US dollars: ✅ Spot ETFS ✅ Counting fair value ✅ Banks can support Bitcoin (SAB 121 abolition), ”wrote Crypto -entrepreneur Julian Farer.

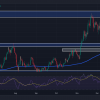

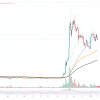

Bitcoin and crypto -market again become green

After the news of the crypto, the market showed a strong recovery after the initial failures at the beginning of the day. Bitcoin fell to $ 89,000, the lowest in two months. From the moment of this news, BTC has returned to 94,500 dollars at the time of reporting.

In addition, Ethereum followed a similar trajectory, recovering after a fall below 3,000 US dollars to 3100 US dollars. AAVE, Altcoin, associated with the supported by the World Liberty Financial (WLFI), saw a 5% jump for an hour.

In addition, additional reports suggest that Trump’s executive orders can allow the best banking access for crypto -business. His orders are likely to resist the fact that the leaders of the industry describe the practice as “de-banking”.

Vice -chairman FDIC Travis Hill recently condemned past bank restrictions on crypto -films. He called for more clear guidelines to support the industry.

At the same time, the Trump team is reported, offers the restructuring of FDIC and the unification of banking regulators to increase efficiency.

In addition to these events, there are other premises that expect on the day of the inauguration. David Sax will accept the role of the first in the history of the crypto cage, and the former regulator, favorable for Crypto, will be headed by SEC.

Meanwhile, large crypto -films, such as Ripple, MoonPay and Kraken, made a significant contribution to the events of Trump’s inauguration. These donations can provide them with early access to discussions with the administration regarding future crypto -politician.

In general, Trump’s inauguration, installed for the next week, is expected to be a turning point for crypto policy. The market, still staggering from earlier volatility, took the news as a sign of potential growth and stability under a more favorable for the crypto-friendly presidency.