Bitcoin (BTC) regained the $102,000 price level on Jan. 6 after rising 4% on the day amid a broader market rally as accumulation continues to outpace profit-taking, according to CryptoSlate data.

At press time, the flagship cryptocurrency was trading at $101,630 after failing to maintain upward momentum as US markets closed for the day. According to the latest Bitfinex Alpha report, the recovery comes as liquidity on the sell side continues to tighten. report.

Bitcoin’s return to the $102,000 range comes after a sharp 15% correction from its all-time high (ATH) of $108,100 reached on December 17, 2024. The correction follows a 61% rally driven by the November 6 US election results. 2024, indicating strong market optimism.

While analysts had predicted a deeper pullback in the first quarter, the report noted that new indicators suggest bearish pressure may have eased to a large extent.

Liquidity on the sell side is at a record low

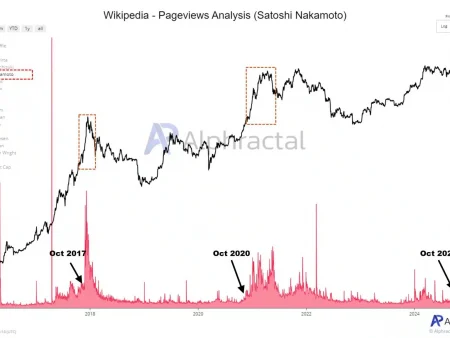

A key driver of Bitcoin’s price movement is the rapid decline in liquidity on the sell side. The liquidity reserve ratio, a measure of how long current supply can satisfy market demand, fell to 6.6 months from 41 months in October.

The sharp drop reflects the tightening of liquidity seen during Bitcoin’s rally in the first and fourth quarters of last year, signaling tighter availability during periods of high demand.

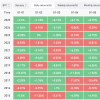

In addition, miners – a significant source of selling pressure – have contributed to the current liquidity dynamics as their spot sales have declined following the 2024 halving.

Historically, miners sold Bitcoin to fund operations and upgrade equipment, but since April 2024, miner flows to the exchange have slowed significantly. Although miner flows increased last November, these levels remain well below previous peaks.

According to Bitfinex, miners are now in a strong position, supported by significant unrealized profits. This holding behavior has further restricted liquidity, supporting Bitcoin’s upward trajectory.

The data suggests a broader trend of miners holding on to their BTC holdings as they anticipate higher prices or seek to optimize their positions amid favorable market conditions.

Start strong

The report highlights that Bitcoin is starting 2025 on a solid footing, supported by positive on-chain performance. He added that the interaction between decreasing liquidity on the sell side will remain a key factor in Bitcoin price movements.

While the risk of a deeper pullback still remains, liquidity metrics are at multi-year lows and miners are signaling confidence in their ownership models, suggesting much of the downward pressure has eased, setting the stage for potential further gains.

At the time of printing 22:10 UTC, January 6, 2025Bitcoin ranks first in market capitalization and price up 3.33% in the last 24 hours. Bitcoin has a market cap $2.01 trillion with 24-hour trading volume $51.66 billion.

Bitcoin

22:10 UTC, January 6, 2025

US$101,678.38

3.33%

At the time of printing 22:10 UTC, January 6, 2025The overall cryptocurrency market is valued at $3.58 trillion with daily volume $132.93 billion. Bitcoin dominance is currently at 56.23%.