The market has calmed down following Monday’s broad bullish comeback, with Bitcoin price extending the bullish leg a step further towards the critical resistance at $38,000, but stalling around $37,625.

Altcoins like Ethereum moved along with the BTC price, resulting in a move above the vital support of $2,000. Binance Coin is one of the tokens in the green on Tuesday, up 4.5% to $258.

However, there has been a general correction among altcoins in the last 24 hours led by Solana’s 6.3% drop to $56. The rest of the digital assets in the top ten are in the red, apart from the two stablecoins; USDT and USDC.

Meanwhile, bitcoin price remains relatively unchanged over the same period, while bulls launch frequent attacks on the immediate resistance at $38,000.

According to Twitter-posting trader and analyst @CryptoFaibik (now

If $BTC bulls successfully surpass 38k resistance and next stop could be 41k.#Crypto #Bitcoin #BTC #BTCUSDT pic.twitter.com/X26xCLX9oG

– Captain Faibik (@CryptoFaibik) November 20, 2023

Bitcoin Price Prediction: Bulls Struggle to Clear $38,000 Hurdle

Bitcoin is trading between two important levels; seller congestion at $38,000 and support at $36,000. Trading on either side of this range could be bullish or bearish for BTC.

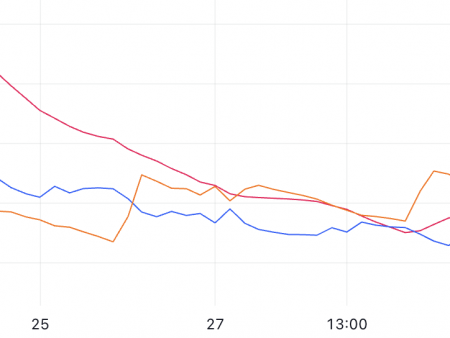

Based on the technical outlook of the Moving Average Convergence Divergence (MACD) indicator, profits above $38,000 are likely rather than a pullback to $36,000 in the near term.

Note that the momentum indicator gives a buy signal and also remains above the neutral zone. If the blue MACD line continues to move up while staying above the red signal line, the path of least resistance could remain to the upside.

Weekly Bitcoin Price Prediction Chart | Commercial view

The ongoing bullish crossover in the weekly period further increases the bets in favor of the bulls. As noted, the 50-week exponential moving average (red) has flipped above the 200-week EMA (purple), forming a golden cross pattern.

Traders use this pattern to confirm the generally bullish outlook of the market. Its presence on a higher time frame like the weekly chart reinforces the long-term bullish thesis.

Recommended for you: Ethereum Price Targets $3 Billion as Options Open Interest Rises to $6.7 Billion

Bitcoin price is expected not to react to the release of the Federal Reserve’s release of the November 1 FOMC meeting. A trend has been forming in which BTC does not react to the actions of the Federal Reserve, especially when the committee members have stopped interest rate hikes for several months.

Although the Federal Reserve has insisted on a one-time rate hike before the end of the year, weak economic data released after the meeting has significantly raised expectations that there will be no more rate hikes.

According to ING analysts, the release of the minutes today “is likely to impact the market less than usual, given the weakness in post-meeting data.”

“We have already heard from several Federal Reserve officials who have welcomed the direction of the numbers, but have commented that they want to see more of the same to be sure that inflation is on the path to 2%,” added the analysts in a note dated November 17. .

Bitcoin Halving Coming in 5 Months

On the other hand, the backlog will surely increase, as there are only five months left to halve it. Investors could spend the next few weeks buying the dips to capitalize on the pre-halving rally.

According to crypto analyst and investor @Rekt Capital, “historically, any deeper pullbacks that occur during this period tend to generate fantastic ROI for investors in the months following the halving.”

#BTC

5 Phases of the Bitcoin Halving

1. Pre-halving period

There are approximately 5 months left until the Bitcoin Halving in April 2024

Historically, any deeper pullbacks that occur during this period tend to generate fantastic ROI for investors in the coming months… pic.twitter.com/YuhxffF0Ei

– Rekt Capital (@rektcapital) November 20, 2023

Ideally, a pre-halving rally would occur 60 days before the halving event. Investors buy BTC en masse due to expectations of how the halving could drive up prices.

Bitcoin price tends to experience several rallies before and after the halving, with a parabolic uptrend several months after the actual event.

Related Posts

- Breaking: $1B Tether deposit in UK company sparks High Court dispute

- Pro-XRP Lawyer Asks Charles Hoskinson to Prove ADA’s Non-Security Status Amid SEC Scrutiny

- Court rules in favor of US SEC in Terra Daubert hearing and Do Kwon lawsuit