Bitcoin could continue to slip, since the inflation data in the United States, which were expected, caused fears that President Trump could be more diligent in tariffs, which could actually restore inflation in the long term.

On Friday, Bitcoin (BTC) fell below $ 80,000 and still decreased by about 1.6% over the past 24 hours during printing. This happened even when the US consumer price index (CPI) for March showed that inflation drops to 2.4%, compared with 2.8%in February and slightly better than 2.5%predicted by analysts.

The IPC, released by the monthly bureau of labor statistics, is the key importance of inflation and affects decisions on the monetary policy of the federal reserve system. As a rule, lower inflation reduces the need to increase bets, which benefits at risk assets, such as cryptography and shares.

However, despite the positive reading of the IPC, the markets did not rally. S&P 500 and NASDAQ sharply opened and closed the day by 3.4% and 4.3%, respectively.

The total market capitalization of Crypto has also fallen by 2.8% over the past 24 hours, which suggests that wider problems overshadow any relief from cooling inflation.

Trump’s trading policy remains a key problem. On April 9, President Trump announced a 90-day pause for planned campaigns to tariffs and introduced 10% of the mutual tariff for most countries, but especially excluded China, where he raised tariffs for Chinese imports to steep 125%, accusing Beijing of inability to respect world trade standards.

This step briefly reassured the markets, sending Bitcoin more than 7% to $ 82,000, since investors welcomed a temporary softening of trade tension.

Nevertheless, this optimism quickly disappeared after China answered 84% of the US goods, starting on April 10. This retribution resumed fears about a long trade war in the United States and Whale, which can significantly take into account the trust of investors, especially after the end of the 90-day window.

According to experts in a letter from Kobeissi, a combination of a strong report on workplaces and cooling inflation can actually give Trump more than a political room for further exposure to tariffs, potentially canceling the progress achieved in inflation.

At the same time, the probability of reducing the interest rates of the federal reserve system in the near future seems thin. The FedWatch Cme Group indicates 81.5% probability that the Fed will have bets stable at its meeting on May 7. Without the expected reduction in bets, at least June, the macro -photograph background remains uncertain for bitcoins.

The influx of capital in Bitcoin also slowed down this year. The Glassnode analytical platform recently noted that the influx fell more than 90% from a peak of $ 100 billion to $ 6 billion. As a rule, this is a sign that the interest of investors can be cooling from the current uncertainty.

Technical indicators also indicate a potential drawback. If Bitcoin cannot hold the level of $ 80,000, Glassnode analysts warn that he can return to lower support zones, perhaps a 356-day exponential sliding average of 76 thousand dollars.

The next key levels that can be observed below this price point are an active realized price of $ 71,000, and if something worsens, the true market means about $ 65,000. These are the main support zones in which long -term holders usually enter. But if the BTC loses this range, this may mean more disadvantages.

Analysts remain hopes

Nevertheless, not everyone considers Bitcoin’s recent rollback as a sign of weakness. Some analysts claim that Bitcoin, in fact, is surprisingly good compared to traditional markets.

While the seven-day Bitcoin’s realized volatility has doubled to 83%, it still remains much lower than in S&P 500, development that hints at the potential evolution of the asset in the hedge with low level of beta against traditional actions. On a 30-day basis, Bitcoin seems noticeably less volatile than the S&P 500.

In addition to this, some data on the chain show that large players buy a fall.

According to the centiment, 132 new wallets “sharks”, which held more than 10 BTC, appeared in the last 24 hours.

Cryptoquant data also show that about 48 575 BTC, worth about $ 3.6 billion, moved to the wallets for accumulation. This is the greatest activity of the whale, observed since 2022, which may mean that large holders have positioned themselves for a long -term game, even when short -term uncertainty is delayed.

Nevertheless, although many are still on the verge, others begin to see signs of potential recovery on the graphs.

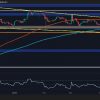

According to Merlidge Trader, Bitcoin has just finished the double lower template, which is a classic sign of trend change. Now that it is traded above 81 thousand dollars. The United States has already bounced from the level of 79,900 US dollars, a potential breakthrough can be on a horizon with potential targets of about 86 thousand dollars. USA.

If the BTC manage to publish weekly closing above 86 thousand dollars. The USA, some analysts believe that this can make a path for bulls in order to aim at $ 94 thousand. USA. See below:

$ BTC update: (macro)

A more detailed confirmation with recent PA for checking macro tables.

1. Any weekly closure below 78 thousand = 4D OB

2. Any weekly closure above 86 thousand = 94kThe 78-86K range can be as a phase of “anger” or “late anxiety”. Macroeconomic data and global changes can change … https://t.co/36eq2bzjoq pic.twitter.com/xzyqsvmnxhh

– Ahmed (@cryptobheem) April 10, 2025

However, if any form of resolution is not reached between the US and China, this tug of the rope by tariffs will probably continue to pull on the markets.

Disclosure: This article does not submit investment tips. The content and materials presented on this page are intended only for educational purposes.