1- bitcoin January 2025: prospects for the fight BTC

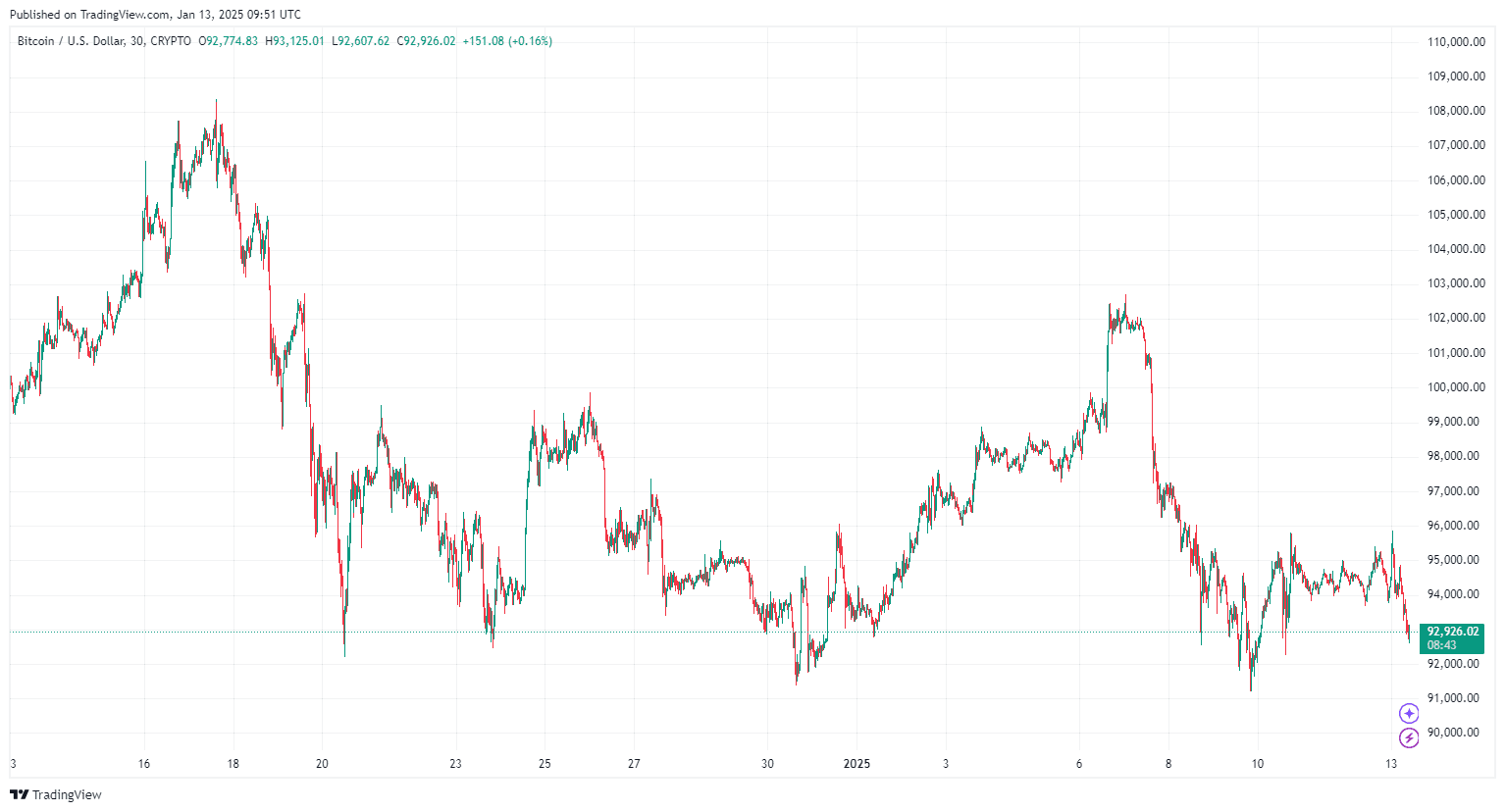

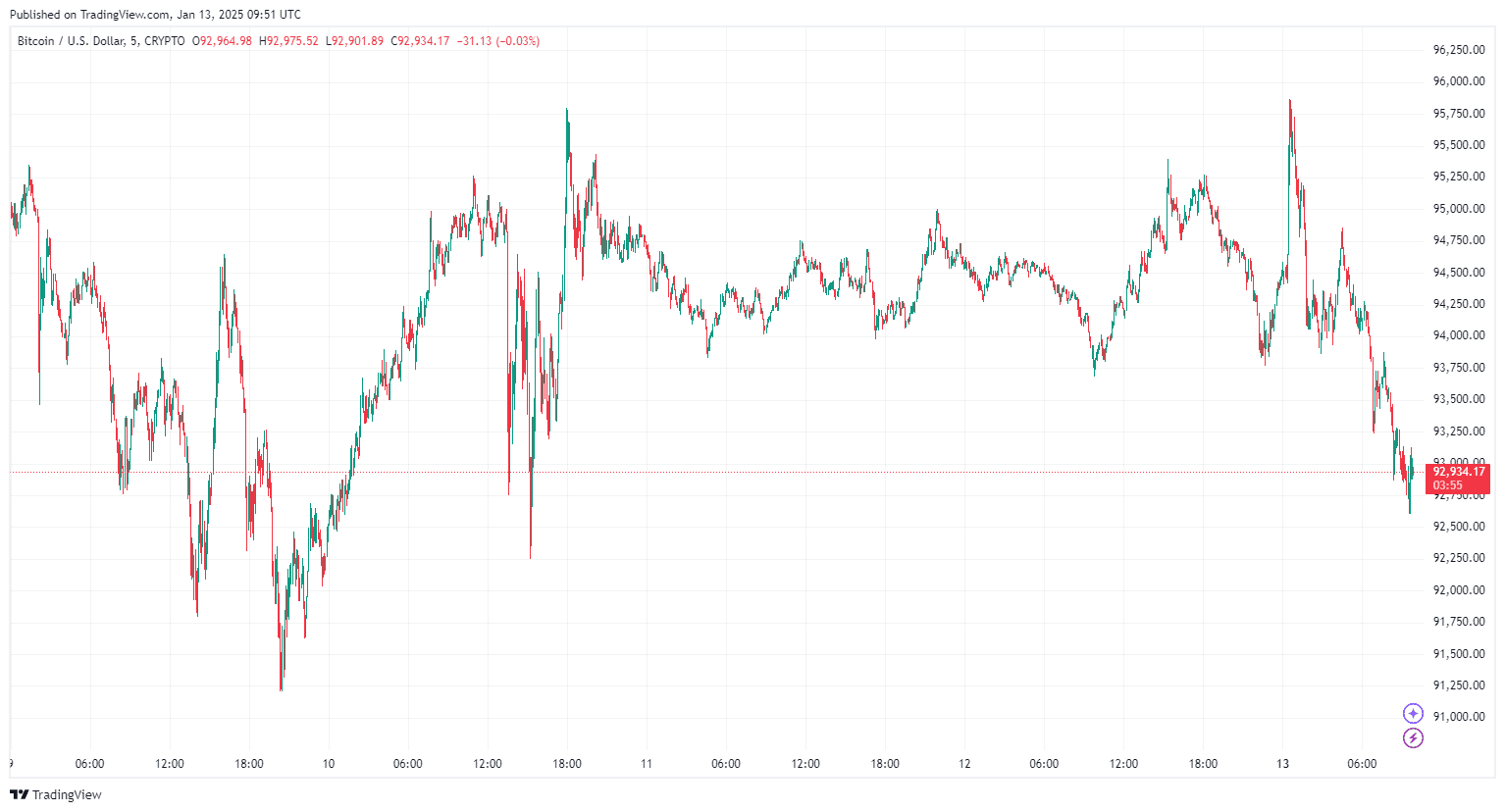

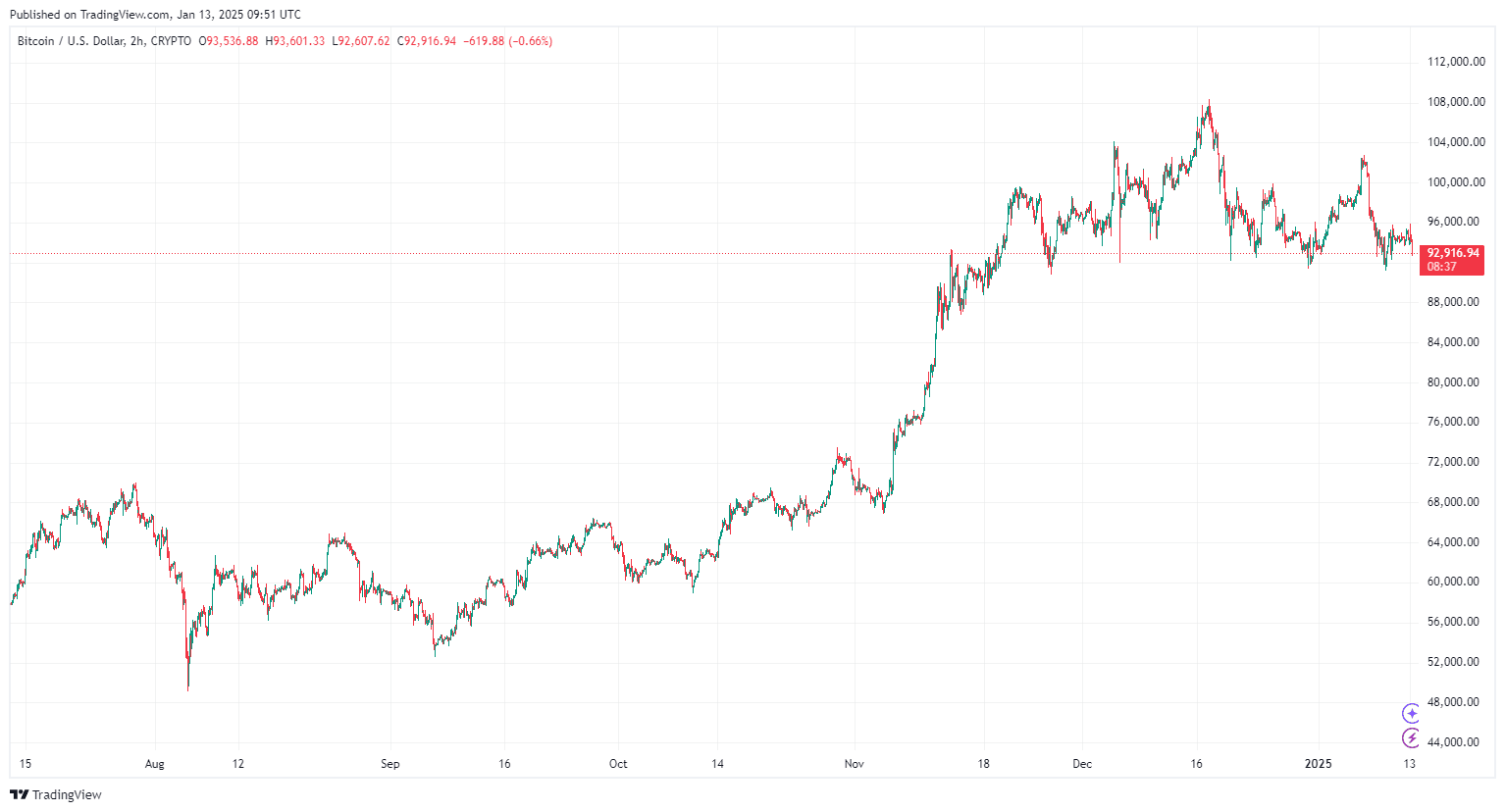

A more attentive look at Bitcoin January 2025 today shows that the Bitcoin price impulse has gone with a bear turn, since BTC is struggling to maintain key support levels. The beautiful Bitcoin trajectory remains uncertain with a decrease in network activity, a decrease in capital influx and macroeconomic pressure bringing to the market. But in order to better understand what can be ahead, a deeper look at BTC levels and indicators are necessary for an accurate analysis of bitcoin prices in combination with key ideas in the market, which ultimately spills light to the forecast of bitcoins this week.

2- Analysis of Bitcoin prices: BTC levels and indicators

Current Bitcoin performance and market data

- BTC price: $ 93,034,76

- Market capitalization: 1.84 trillion dollars

- Circulation proposal: 19.8 million BTC

- 24 hours of trading volume: 32.17 billion dollars

-

Intraday range:

- Short: $ 92 736.77

- High: $ 95 837.00

-

Performance:

- 1 day: -1.00%

- 5 days: -5.53%

- 1 -monthly: -8.41%

The price of Bitcoin decreased below $ 94,000 to the duration of its bear tendency, which is affected by weak network activities and a decrease in investment interest. Global market capitalization of cryptocurrencies also decreased by 2.19%, at the level of 3.22 trillion dollars.

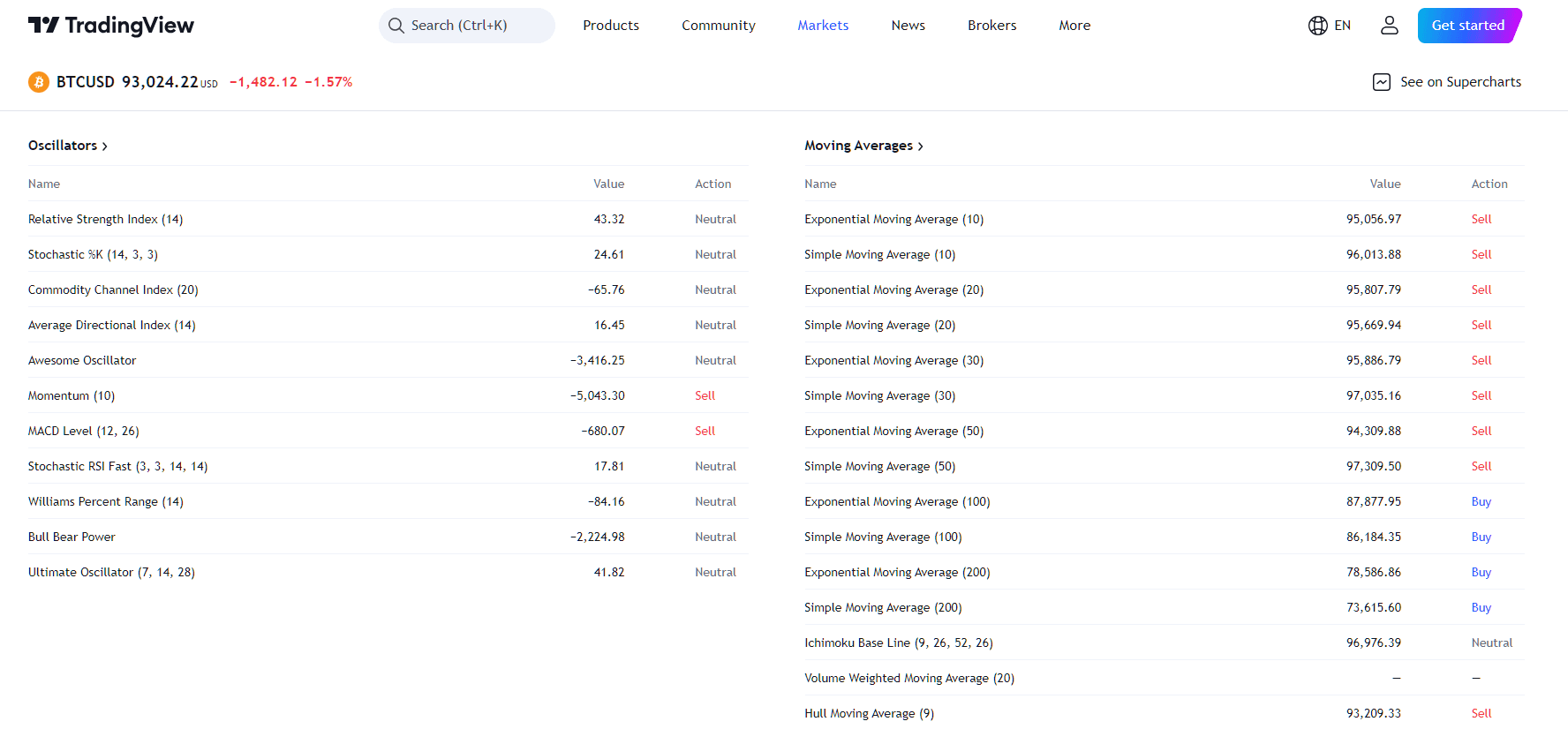

Technical indicators and support levels

Technical indicators from TradingView reflect bear mood for bitcoins:

- Oscillators: Pulse (-5 043.30) and MACD level (-680.07) Signal A sell Trend.

- The movement is medium: Most of the moving medium (for example, EMA 10, SMA 50) also show sell Signals.

Key levels of support and resistance for viewing this week:

- Support: $ 90,000, 87,500 dollars

- Resistance: 94 500 US dollars, $ 96,000, US dollars, $ 97,000

3-key ideas from bitcoin-sulfur activity

Recent messages from crypto -analyst Ali Martinez on X Ty up metric for bitcoins:

Large transactions are reduced:

- Large transactions in the Bitcoins network fell by 51.64% last month, from 33,450 to 16 180. This signals a significant decrease in whale activity.

Falling active addresses:

- Bitcoin network activity is the lowest since November 2024, and only 667 100 active addresses.

Reducing the influx of capital:

- The influx of capital on the cryptocurrency market fell by 56.70%from 134 billion dollars to $ 58 billion. This indicates a sharp decrease in investment interest.

Critical resistance zone:

- Bitcoin is faced with a key resistance area of $ 97,000 to $ 99 500, where 1.26 million addresses previously accumulated 1.22 million BTK. The gap of this level can be the key to bull reversal.

4- Forecast of Bitcoin prices this week

Bitcoin’s performance this week will largely depend on its ability to hold the support level of $ 90,000 and break through the zones of immediate resistance. Here are the scenarios:

Bitcoin Bear Scenario:

- If the BTC cannot contain $ 90,000, it can check the lower levels of about $ 87,500. Weak network activity and a decrease in the influx of investments can aggravate a decrease.

Bitcoin bull script:

- The image above 94,500 dollars can lead to BTC to 96,000–97,000 US dollars. A breakthrough in the resistance zone of $ 97,000–99 $ 500 will require a strong purchase impulse, is currently absent.

Bitcoin is probably a range:

- It is expected that the BTC will trade from $ 91,000 to $ 94,000, which reflects the movement associated with a careful market mood.

Will BTC Price Crash be below $ 90,000 this week?

Bitcoin of price action remains under pressure, since bear factors affect the dynamics of the market. Although the long -term prospects of bitcoins in 2025 remain optimistic, short -term indicators suggest a cautious approach for traders. This week, the support level of $ 90,000 will be crucial, and any violation can lead to significant drawbacks.