Bitcoin price is faced with strong bear pressure from an increase in sales dominance below 85 thousand dollars. As a result, the price of BTC decreased below FIB levels and touched a minimum of $ 81,500. However, buyers soon appeared and restored the price. Over the past 24 hours, Bitcoin trading volume has increased by more than 8.6%in a total of $ 70.25 billion.

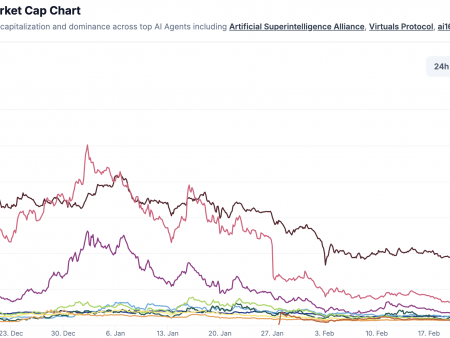

In a wider perspective, Bitcoin fell below 100,000 US dollars on January 7 and demonstrated a trend towards a decrease. On January 13, he reached a low level of $ 89,397. In recent days, the price was on a serious descending trend. Over the past 24 hours, the total market capitalization has increased by 1.1%, settling by 1.74 trillion dollars.

Bitcoin eliminates the liquidation of $ 350 million

The cryptocurrency market experiences significant volatility, with bitcoins leading cryptocurrency, which falls below the mark of 81.5 thousand dollars. USA. Nevertheless, buyers soon restored the price from this minimum and called a strong rebound to 88 thousand dollars.

The recent Coinglass data show that almost 350 million US dollars in Bitcoin in a total of the last 24 hours, while buyers liquidated $ 240 million, and sellers – about 110 million dollars, indicating a significant increase in long -term liquidation.

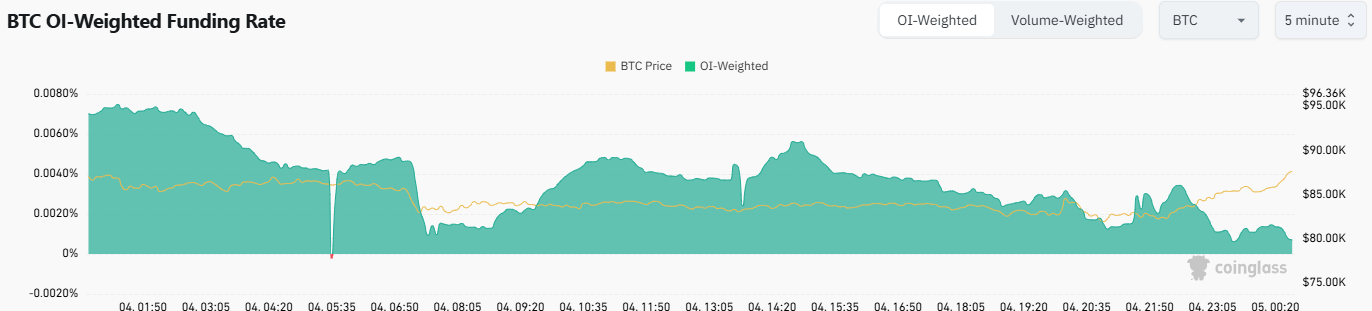

In addition, an open percentage for bitcoins fell by 3.7%, touching more than $ 48.5 billion over the past 24 hours. Nevertheless, the Bitcoin financing rate is traded at a speed of +0.002%, which indicates that customers remain optimistic. This can help customers continue to push the BTC price up.

Bitcoin price forecast: Technical analysis

The price of Bitcoin experiences strong bull pressure, since it continues to grow above the direct level of the hill. Sellers loaded the price to a minimum of 81.5 thousand dollars. USA, but buyers quickly restored the price of up to 88 thousand dollars. Bitcoins are currently trading at 87,409 dollars, which reflects an increase of 1.1% over the past 24 hours.

The BTC/USDT trade pair will now strive for a second test at $ 95 thousand. USA. As the purchase pressure increases, buyers will continue to protect further decline. If Bitcoin will grow above 95 thousand dollars, we can see the recovery of up to $ 100,000.

On the other hand, if Bitcoin does not satisfy customers’ demand about 95 thousand dollars, we can see a further decline in minimum of $ 81 thousand.

Bitcoins price forecast: what to expect further?

Short term: According to BlockchainrePorter, the price of BTC can be directed at 95 thousand dollars. If it rises above this level, we could see $ 100,000. On the other hand, 81 thousand dollars are the lower range.

Long -term: According to Coincodex Bitcoin Prices, it is expected that Bitcoin’s price will increase by 35.22% and reach 112,726 US dollars by April 3, 2025. Their technical indicators involve bear in the current mood, and the index of fear and greed shows level 15, which indicates extreme fear. Bitcoin survived 13 out of 30 (43%) green days with the volatility of prices by 4.80% over the last month. Based on the Coincodex forecast, at present this is not a good time to buy bitcoins.

Investment risks for bitcoins

Investments in bitcoins can be risky from the volatility of the market. Investors must:

- Conduct a technical and built -in analysis.

- Evaluate their financial situation and tolerance to risk.

- If necessary, consult your financial consultants.