Bitcoin has shown remarkable resilience over the past few weeks, recovering from a dip to $92,000 and rising back to $99,100. However, this recovery has raised concerns among analysts about a potential market correction, especially with Bitcoin’s repeated failure to clear the $104,000 resistance level.

Recent Bitcoin Performance and Resilience Issues

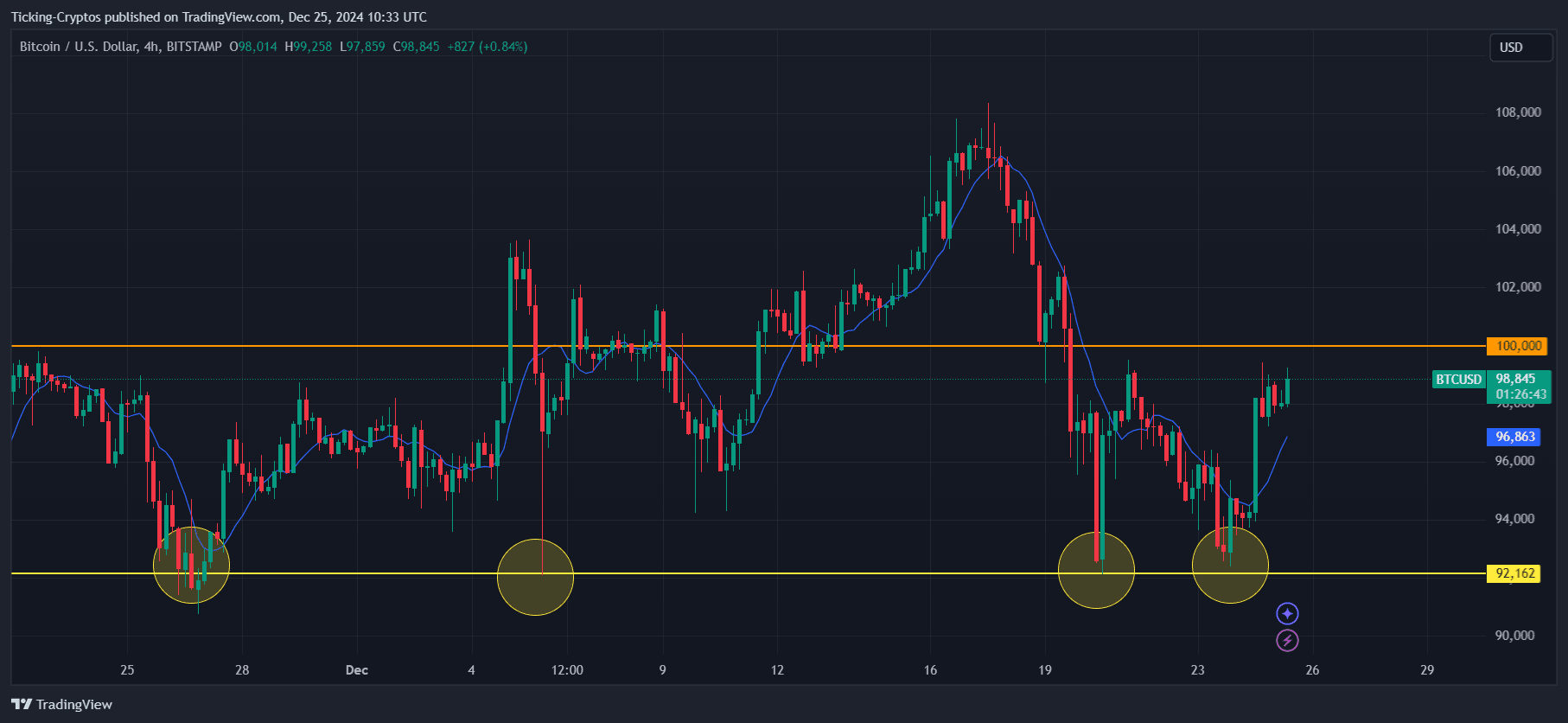

After weeks of bullish momentum, Bitcoin tested support at $92,000 and quickly recovered to $99,100. Despite this recovery, the $104,000 resistance level remains a major barrier. Numerous attempts to break this level have failed, leaving traders unsure of Bitcoin’s short-term direction.

4-hour BTC/USD chart – TradingView

Analysts Warn of Potential Bitcoin Crash

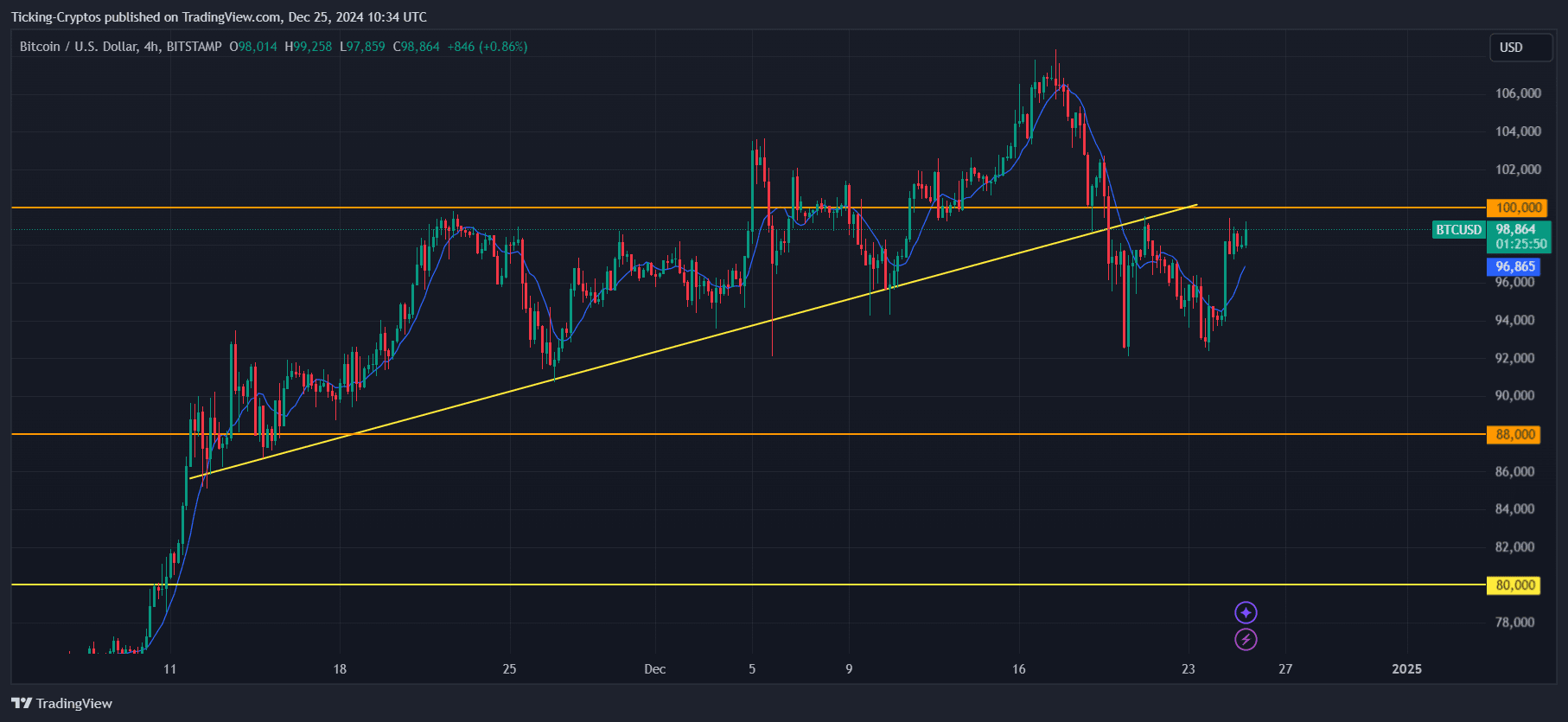

While Bitcoin’s rise has many investors excited, analysts are sounding the alarm about a potential market correction. The rapid rise in prices has led to concerns that the current trend may not be sustainable. A drop in trading volume could trigger a serious downturn.

Short term Bitcoin price forecast

If trading volume continues to decline, Bitcoin could see a significant price drop. Analysts predict the following levels of support in the event of a correction:

- First goal: $92,000 – testing this strong support again.

- Second goal: $88,000 – deeper correction from current levels.

- Third goal: $80,000 is a major bearish move that could signal the end of the current cycle.

4-hour BTC/USD chart – TradingView