Bitcoin news about Avalon Labs’ recently released Bitcoin-backed stablecoin USDa has quickly gained traction in the market. Within just two weeks of release, it had amassed over 200 million copies.

Positioned as the world’s first over-collateralized stablecoin backed by Bitcoin, USDa is now considered the third-largest CDP (collateralized debt position) stablecoin. USDa is only behind established players such as MakerDAO and JustStables.

Released by Avalon Labs, USDa is a remarkable innovation in the stablecoin space. It is attractive because of the promise of over-collateralization. It provides stability and reliability by backing each USDa token with a higher Bitcoin value.

This strong support was intended to ensure that the stablecoin would maintain its peg. As the Bitcoin news cycle intensified, these events took over.

Avalon Labs is known for its pioneering efforts in Bitcoin-centric online financial platforms. They gained additional credibility and fame after winning the second round of the Binance BNB Incubation Alliance.

This award underscored the company’s commitment to innovation. He also looked at the USDA’s potential to improve Bitcoin’s liquidity and its adoption into the broader financial ecosystem.

The introduction of USDa is a defining event for Bitcoin in the stablecoin sector. The move aims to bridge the gap between decentralized finance (DeFi) and traditional financial mechanisms by leveraging Bitcoin’s market value and stability.

USD exchange volume hits three-year high in US as Avalon Labs expands BNB network

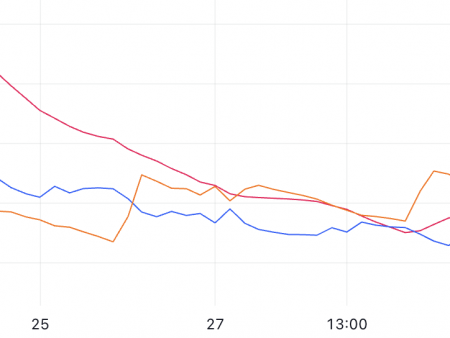

At the same time, the volume of support for the US dollar on major exchanges in November showed a sequential increase in total volume. The increase was particularly noticeable on Kraken, Coinbase and Crypto.com, with the latter two making the largest contribution to the total volume.

Bitstamp and Bitfinex, although contributing less volume compared to leading exchanges, are also seeing growth.

The “12 Others” category indicated active and diverse participation, suggesting growing interest in USD-denominated trading activities using stablecoins.

The steady growth in exchange volumes on these platforms highlights the growing demand for USD transactions in the cryptocurrency space. USDa may be ready to instantly gain market, especially from the US.

Avalon Labs is expanding its presence on the BNB network by launching the first Lista DAO marketplace. This is an important event for crypto enthusiasts looking for high rewards with low risk.

Avalon Labs expands its scope of activities

With a $10 million strategic investment from Binance Lab, Lista DAO is poised to redefine liquid staking for BNB with its innovative CDP protocol.

This launch was part of Avalon Labs’ broader strategy to deepen integration into the BNB Chain ecosystem.

Lista DAO aimed to set new standards not only in the BNB network, but in the entire DeFi environment. It provides a permissionless betting solution that promises to increase profit opportunities for its users.

The launch details revealed an exciting opportunity: using slisBNB as collateral for USD borrowing to significantly enhance the yield play.

In addition, Lista DAO has introduced a unique conversion where one stardust is equal to one US dollar, which will soon be available on the Avalon platform.

This initiative marks a new beginning for Avalon Finance: there is now a Lista DAO market supporting a wide range of assets, including BTCB, BNB, ETH, USDC, USDT, LisUSD, slisBNB, Lista and FDUSD, with the goal of facilitating significant growth and expansion in the number of users. participation in the BNB network.

Bitcoin News: Avalon Labs BTC Price Prediction

Avalon Labs continued to spark excitement in the crypto community by launching a carnival series of Token Generation Events (TGE) on the BNB network. It involved collaborations with LorenzoProtocol, StakeStone, PellNetwork and Pumpbtcxyz.

Dubbed the “BTCFi Cabal,” this initiative marks a significant development, promising a 1,000x opportunity as it showcases Bitcoin’s potential to reach the $100K milestone.

Starting this Monday, enthusiasts will be able to get in on the excitement, with Avalon hinting at a “600K bag” for early entrants.

At the same time, Avalon Labs presented a proposal to rebalance the treasury, which has now been submitted to a community vote.

This proposal prompted the community to voice their opinion on increasing the USDA’s annual percentage yield (APY) to an impressive 25%, as well as adjusting future protocol rewards.

This ambitious move by Avalon Labs aimed to combine high-yield potential with community-driven financial strategies.