Bitcoin Nears Pre-Halving ‘Target Zone’ Towards $50,000 BTC Price

BTC price action has yet to match a Bitcoin trader’s long-term goal, but “patience is key,” he says almost a year later.

Market news

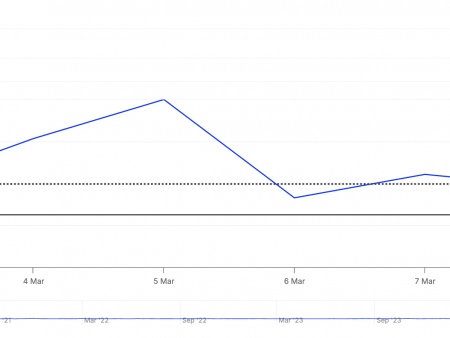

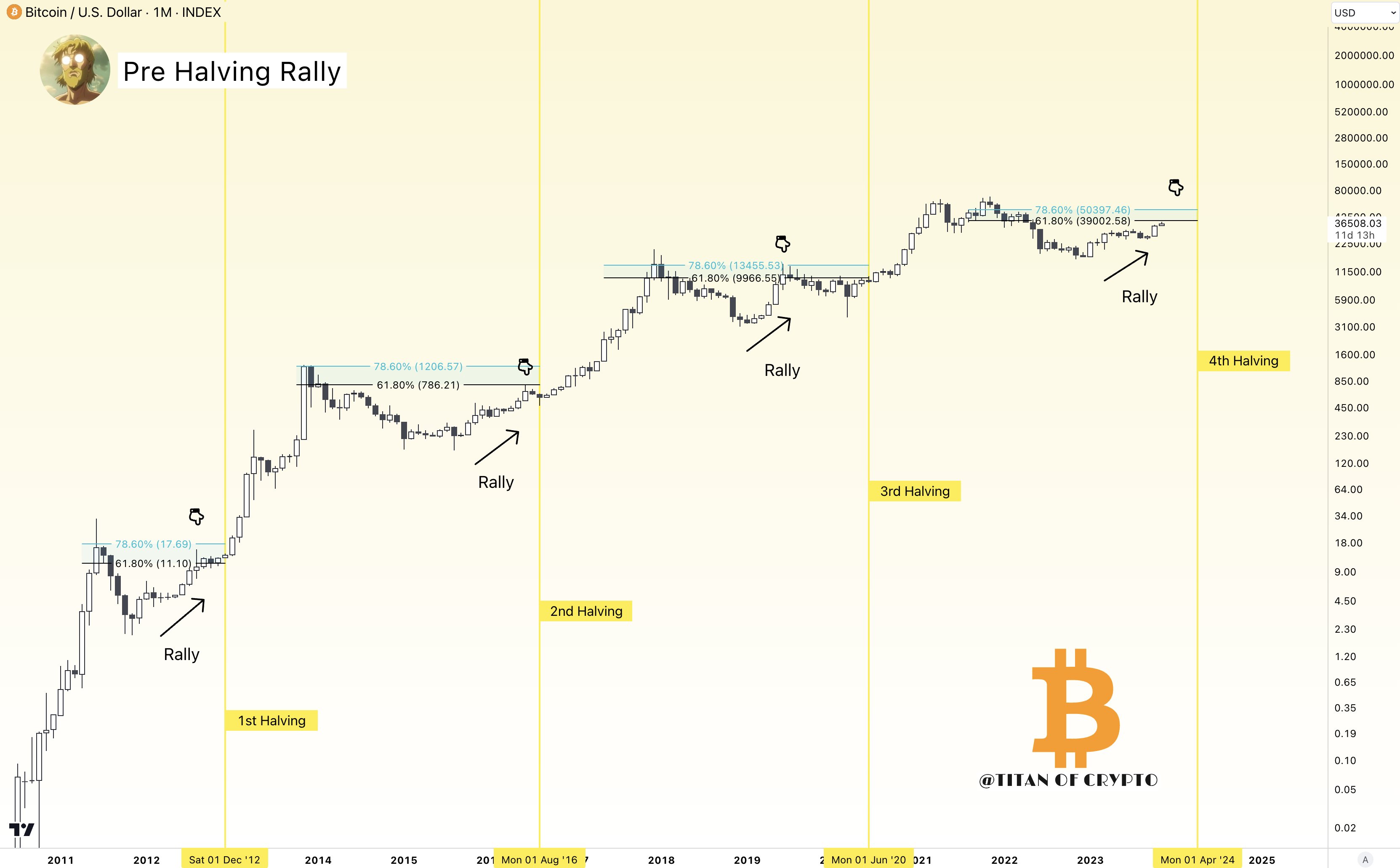

Bitcoin (BTC) is approaching a key Fibonacci retracement level that could mark the top of its “pre-halving rally.”

This is according to popular social media trader Titan of Crypto, who on November 19 reiterated a BTC price target before the halving of up to $50,000.

Trader: $39,000 is the floor of BTC’s price target range before halving

Bitcoin faces strong resistance returning to the $40,000 mark; Several attempts to decipher it have failed in the past week.

As Cointelegraph reported, the area immediately below also holds significance for aggregate market returns, with $39,000 likely a break-even point for those who bought during the 2021 bull market.

Titan of Crypto has also noted $39,000 as an important limit; this time, however, as the bottom where BTC/USD should end up before the April 2024 block subsidy halving event.

“The pre-halving rally I told you about a year ago is about to reach its target zone between $39,000 and $50,000,” he told X subscribers, adding that “patience is key.”

The update referenced an original post from December 2022, when Bitcoin was still preparing to recover from a trip to two-year lows of $15,600.

Titan of Crypto then used Fibonacci retracement levels to predict a pre-halving peak as high as $50,000, at the time a 220% rise.

“Every cycle, BTC had a rally before its halving occurred. “Those rallies culminated within the 61.8% to 78.6% Fibonacci retracement area,” part of the commentary. noted At the time.

Consensus grows on Bitcoin’s advance

Other BTC price predictions give similar targets before the halving.

Related: Institutional Bitcoin inflows to surpass $1 billion in 2023 amid shrinking BTC supply

Filbfilb, co-founder of the DecenTrader trading suite, continues to view an area around $46,000 as “likely,” despite not ruling out the likelihood of a BTC price drop between now and then.

However, what could happen after the halving is a more optimistic question for many, with forecasts including $130,000 or more by the end of 2025.

Meanwhile, on the immediate downside, $30,900 has entered as a floor for Bitcoin’s next potential correction. Some argue that a move lower to test liquidity would be healthy, as well as being a classic part of Bitcoin market bullish trends.

BTC/USD is currently trading at $36,500, according to data from Cointelegraph Markets Pro and TradingView, having continued sideways throughout the weekend.

This article does not contain investment advice or recommendations. Every investment and trading move involves risks, and readers should conduct their own research when making a decision.

Add reaction