Amid the decline in the Bitcoin and altcoins due to the Japanese yen and US dollar parity, Coinshares has published its weekly cryptocurrency report.

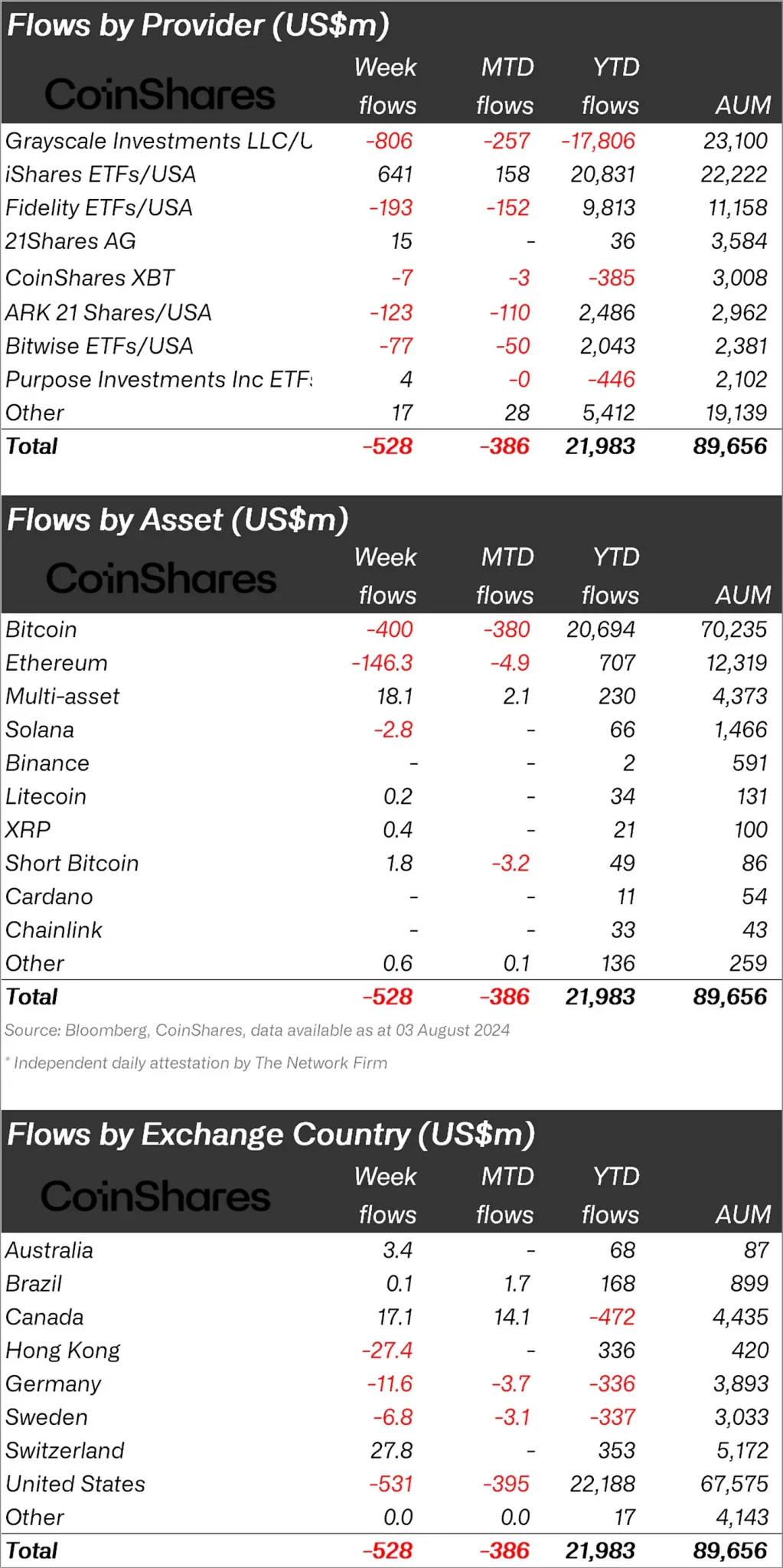

Coinshares reported that crypto investment products saw $528 million in outflows last week, marking the first time Bitcoin has seen an outflow after five weeks of inflows.

“Cryptocurrency investment products saw their first total outflow in 4 weeks, totaling $528 million, in response to US recession fears, geopolitical concerns and the subsequent general market liquidation across most asset classes.

“Total Ethereum outflows were $146 million, with net outflows since the US ETF launch reaching $430 million.”

Bitcoin and Ethereum sales accelerated!

When looking at cryptocurrency funds individually, it was noted that the majority of inflows were in Bitcoin.

While BTC inflows totaled $400 million, the largest altcoin Ethereum (ETH) outflows totaled $146.3 million.

The Bitcoin Short Fund, which indexes the decline in BTC, also saw inflows of $1.8 million.

Looking at other altcoins, Solana (SOL) saw outflows of $2.8 million, Litecoin (LTC) saw a small inflow of $0.2 million, and XRP saw a small inflow of $0.4 million.

“Bitcoin saw its first $400 million outflow after 5 weeks of inflows, while the Bitcoin short fund saw $1.8 million inflows, the first measurable inflow since June.

Since the launch of the ETF in the US, total outflows from Ethereum have been $146 million, bringing the net outflow to $430 million.

Behind those outflows is a positive $430 million inflow from US startup funds last week.

However, this is offset by an outflow of $603 million from the existing Grayscale Trust.”

When looking at regional inflows and outflows, it was noted that the United States ranked first with an outflow of $531 million.

Hong Kong came in second place after the United States with $27.4 million.

Switzerland lost $27.8 million in outflows; Canada gained $17.1 million.

*This is not investment advice.