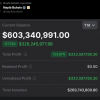

Bitcoin has finally crossed the long-awaited $100,000 mark, leading to explosive growth in the cryptocurrency market. However, not everyone sees this achievement as a victory for decentralization and free market principles. The cryptocurrency’s latest surge, according to prominent Bitcoin critic Peter Schiff, is more the result of government intervention than a confirmation of its attractiveness to the free market.

Schiff argues that institutional buying and political intrigue, rather than natural market demand, are to blame for Bitcoin’s rise to six figures. He cites growing speculation, especially in the United States, regarding Bitcoin’s inclusion in national reserves as a major motivator for this rally.

He argues that the government’s narrative has become a key selling point for institutional investors, sparking a surge of hope and new investment. MicroStrategy and Michael Saylor’s aggressive accumulation strategy is fueling the rally. According to Schiff, MicroStrategy may have been a big buyer in recent trading, accelerating the uptrend and breaking the $100,000 psychological barrier.

The likelihood of U.S. institutional interest in Bitcoin is bolstered by a reserve that turns it into what Schiff calls a government-backed asset in disguise. Schiff emphasizes the positive aspect of gold’s 0.24% rise today, despite his criticism. He emphasizes that gold remains a reliable store of value, unaffected by the speculative frenzy surrounding Bitcoin.

While Bitcoin supporters rejoice in its latest success, Schiff questions its long-term viability, arguing that relying on official versions contradicts the decentralized philosophy on which Bitcoin was founded. Arguments like these demonstrate divergent views on Bitcoin’s place in the financial industry as it approaches six-figure territory.

Critics like Schiff see this as a departure from Bitcoin’s original intent, while proponents see it as a confirmation of its potential. Either way, the $100,000 milestone marks a turning point in Bitcoin’s history, cementing its influence in both the cryptocurrency and traditional financial sectors.