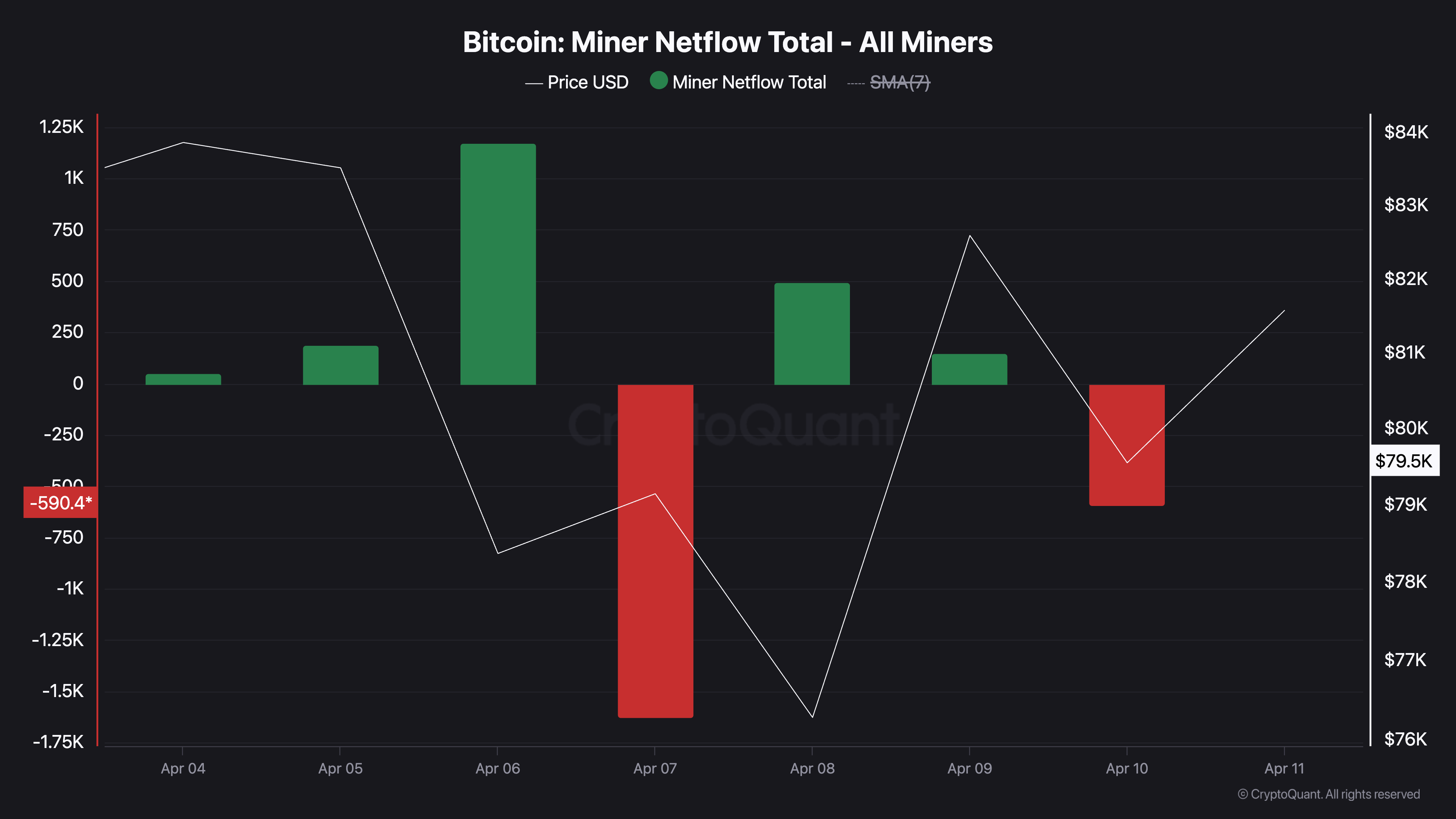

As leading monetary bitcoin stamps, it is one of the most bear weeks from the beginning of the year, the data in the chain show that the miners have made a significant contribution to the spreading pressure on the sales side.

The data on the chain show that miners in the Bitcoins network increased their activities in the sale of coins, a trend that can aggravate the downward pressure on the price of the coin.

Bitcoin -Meddy take control when the cobweb weaves Shakhtar

According to Cryptoquant, this week the Miner BTC reserve was steadily reduced. At the time of writing this article, it is 1.80 million BTC, which is 1% compared to the previous week.

The Miner Reserve BTC monitors the number of coins held in the wallets of miners. He represents coins of reserves that miners have not yet sold.

When the metric rises, the miners hold more of their mines mined, often signaling the future increase in prices. And vice versa, when the reserve decreases, like this, the miners take out coins from their wallets, usually for sale, confirming the tutorials growing in bearish against BTC.

The negative miner of the Netflow coin additionally confirms this trend. As of April 10, it was -590.40. Miner from BTC Netflow monitors the difference between the number of coins sent to the exchanges compared to what is removed.

When its value is negative, more, more coins moves from miner wallets in exchange, as a rule, the predecessor of the sale.

With the addition of descending pressure from this segment of BTC holders, the price of the coin can see deeper corrections in the short term if the interest on the purchase cannot balance the continuing liquidation.

Bitcoin Bear Tender can see how the price falls up to $ 74,000

In the daily BTC diagram, Super Trend remains significantly lower than its indicator, which forms dynamic resistance above its price at the level of $ 90,911.

This indicator monitors the direction and strength of the price of the asset. It is displayed in the form of a line on the price graph, changing color to indicate the trend: green for subspress and red for a descending trend.

When the price of the asset is traded below its super -trend indicator, the sales pressure dominates the market. This bear trend can even more encourage BTC holders to sell, aggravating its price. If this happens, the price of the coin may fall below the key support of $ 80,776 for trade at $ 74,389.

However, if market moods improve and coin holders will reduce their sale, BTC can change its descending trend and rally to $ 86,172.