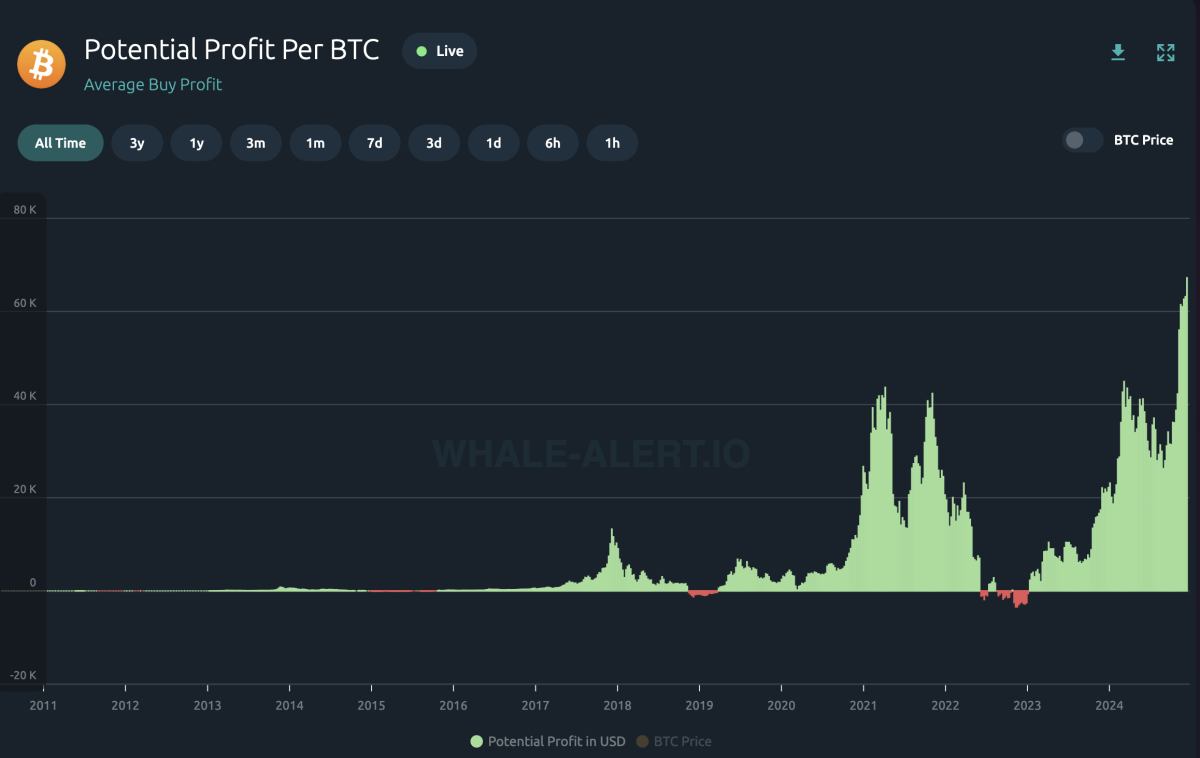

According to Whale Alert, at the time of writing, the average profit per BTC is at an all-time high of $67,088.

“The potential profit per token graph shows the potential profit that holders could make for a token if they were to sell it at a certain time,” explains the Whale Alert website. Whale Alert has additional calculations for this metric, which can be found here.

By comparison, that’s more than the average U.S. salary in 2024, which is $62,027. Imagine your savings growing and surpassing your annual salary with just one Bitcoin.

Every day you exchange hours of your life at work for money (fiat money in most cases). You are constantly working more and more for this currency, whose purchasing power is constantly depreciating, forcing you to work more hours to compensate.

But Bitcoin turns this dynamic on its head. With Bitcoin, you work (trade your time for money) and then watch the money increase in value rather than lose it.

People can then use this extra purchasing power that Bitcoin provides to buy a house or car, afford university tuition, work less and/or spend more time with their family, etc. Your options open up for how you want to spend your time and money. much more as a result of buying and holding Bitcoin and for me that is true financial freedom.

This is another reason why using Bitcoin as a store of value is so important. This allows people to become financially free and secure their future.

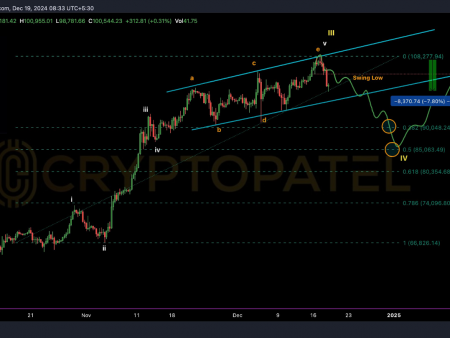

And this is just the beginning. Over time, Bitcoin could rise even above its current price of $100,000, giving investors the opportunity to further increase their purchasing power and therefore giving them more time to follow their passions and interests.

And all you have to do is keep your Bitcoin and HODL secure consistently. Even if you don’t have a whole Bitcoin, you still benefit from the dynamics of it improving your purchasing power over time, and the more you can add to your stack, the more this will be the case.

Every person on the planet can now create their own bitcoin reserve, watch it grow, and choose how they want to spend their free time.

This article is Take. The opinions expressed are entirely those of the author and do not necessarily reflect the views of BTC Inc or Bitcoin Magazine.