Bitcoin implemented CAP, claimed a new record, despite the fact that the market indicating a more slow tributary of capital recently.

Bitcoin’s implemented capsule reached a record $ 832 billion, according to a market understanding from GlassnodeThis growth continues in an impressive rate of 38.6 billion dollars. The United States a month, even though the assets are experiencing a slower influx of capital since exceeding $ 100,000.

These slow influx of capital are preserved, despite the wonderful results from ETF market recently. Between 8 to January 14, Bitcoin-Birzhevoy tradition funds (ETFS) Recorded An outflow of 1.21 billion dollars for four consecutive days.

However, this trend Turned over January 15, when the Bitcoins market, indicating a tributary totaling 3.26 billion dollars. USA. In particular, only on January 17, an influx exceeding $ 1 billion arrived daily, which celebrates the largest tributary during the year at the moment.

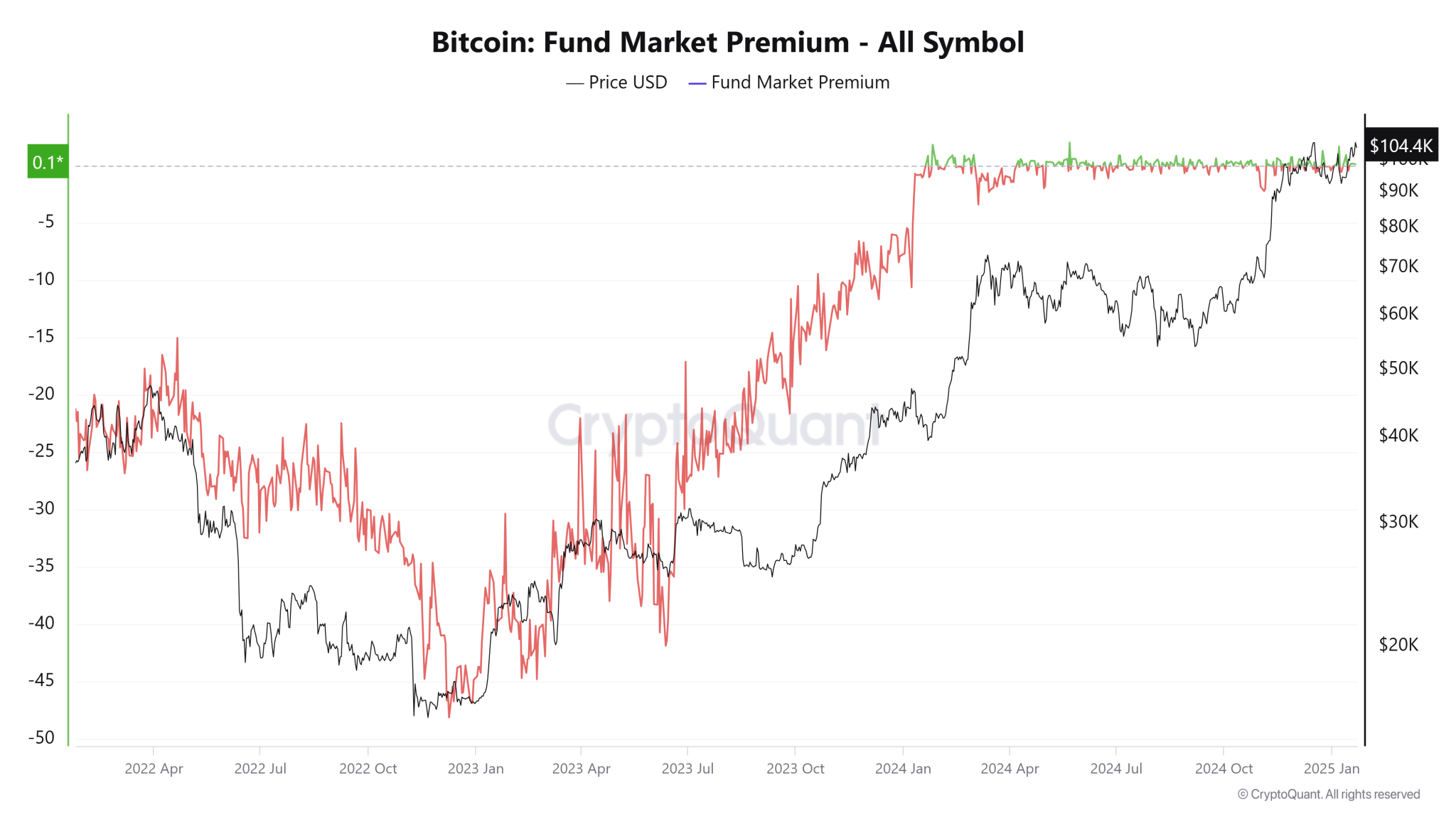

It is noteworthy that the fund of the fund of the fund reflects this bull tendency. The metric, which monitors the demand for investment products, such as means and trusts, increased to 0.1026.

Reject Upon receipt of profit in bitcoins and pressure on the sale side

Meanwhile, Glassnode Also I confirmed that the pressure on the market has decreased significantly. In particular, net selling profit decreased from $ 4.5 billion. USA in December 2024 to 316.7 million dollars. The United States is 93%, showing that the market is moving towards a healthier balance with the requirements of the supply.

Net earned income profit reached $ 4.5 billion in December 2024, and has currently decreased to $ 316.7 million. USA (-93%). This decrease in pressure on the sales side suggests that the market is dumped into a state of balance sheet: https://t.co/xyvzwqtsm pic.twitter.com/byn1rbbwwwen

– Glassnode (@glassnode) January 22, 2025

However, according to In Glassnode, despite the total volume of the accident by 65% in the profit and loss of $ 4 billion. USA to 1.4 billion dollars. USA, the metric remains historically increased. This involves consistent everyday demand for bitcoins Absorbs The ongoing streams of capital.

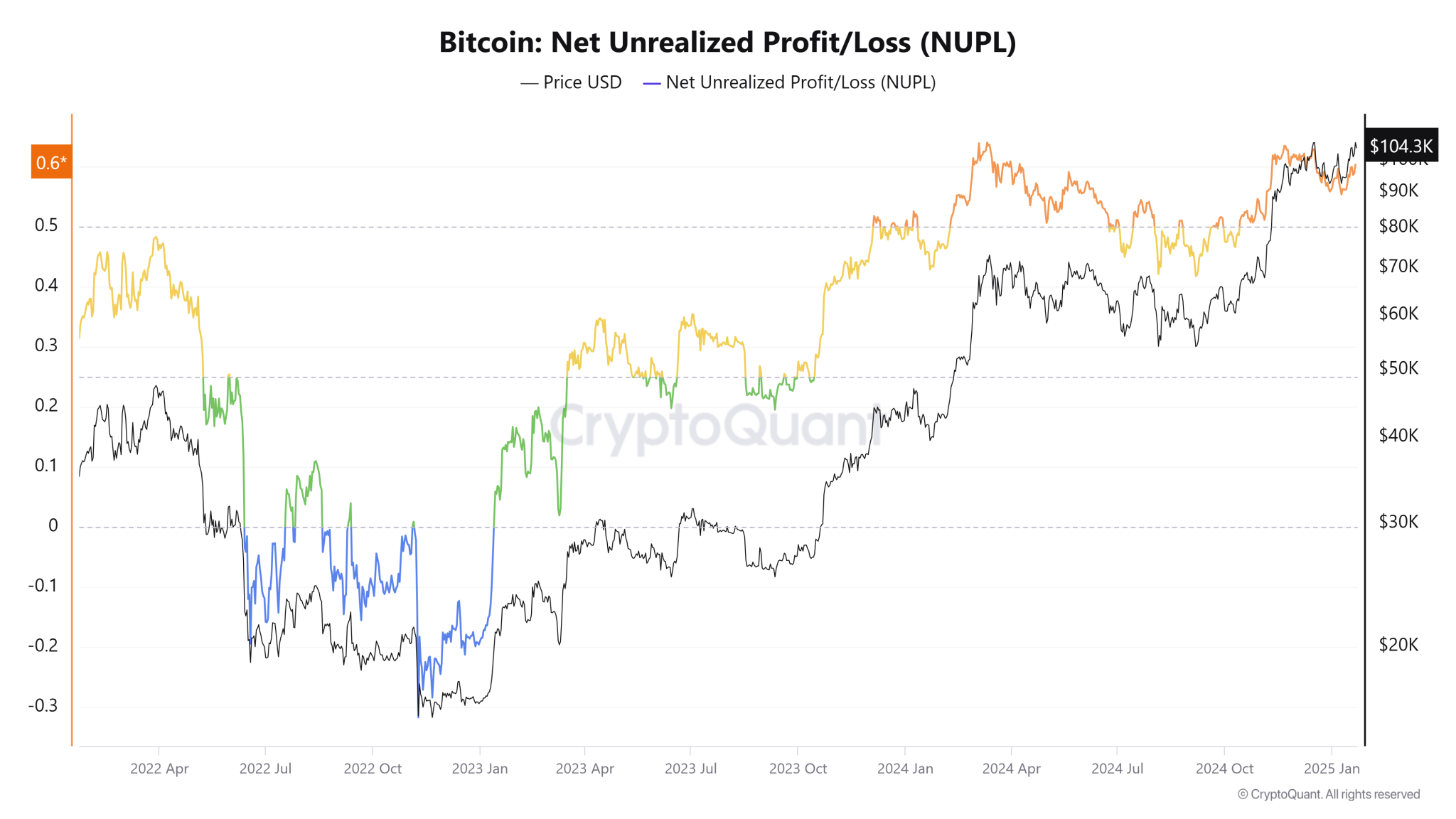

In order to additionally confirm this trend, the Cryptocquant indicator of clean unrealized profits and losses (NUPL) is 0.6, which indicates that many investors have a significant unrealized profit. For context, this corresponds to the “belief” phase in market cycles.

Analysts remain optimistic

Among these conditions, market observers remain optimistic on bitcoins. The DarkFost analyst recently announced a huge shift in the mood of investors on Binance.

After a short period of sales associated with the absence of crypto-membranes during Inauguration of Donald TrumpThe volume of the network on Binante has become negative, reflecting pessimism. Nevertheless, shortly before the opening of the US markets, the net volume of the tucker Turned over positively. Darkfost believes that if this trend continues, Bitcoin can soon surpass it all the time.

In addition, Cryptobatman noted that The current position of Bitcoin On the heat card days when the market is far from the bicycle peak. As a rule, Bitcoin’s largest price rallies occur when they are the farthest from the next double, the pattern shown in the red and orange zones on the heat map.

The heating card $ BTC in the days in swimming makes it clear that we are far from close to the top of the cycle.

Historically, the most explosive rallies happen when the BTC is at a height from the next prowl, shown by red and orange zones on a thermal map.

We are still in the first position for growth, with … pic.twitter.com/c7kal5hyru

– Batman ⚡ (@cryptosbatman) January 22, 2025

Cryptobatman believes that in the coming months, Bitcoin, probably with a large number of potential growth potentials, Bitcoin will most likely record huge successes.

Meanwhile, Michael Van de Poppe predicts A market cycle resembling 2017. He expects that the market will reach an assessment comparable to the DOT-COM bubble, evaluating the total market capitalization from 15 to 25 trillion dollars. In particular, for bitcoins, it predicts a price exceeding $ 300,000. Bitcoin is currently trading for $ 104,304, which is 0.62% over the past 24 hours.