Bitcoin (BTC) once again surpassed the $100,000 mark, hitting an intraday high of $102,514, its first break above this psychological level since mid-December 2024.

Resistance 103 thousand dollars. US looms as Bitcoin rises to $102,514 amid volume surge

This latest Bitcoin surge reflects strong bullish momentum as buyers decide to push prices higher decisively. The 1-hour BTC/USD chart indicates a sustained uptrend with clear signs of accumulation in the $97,000-$98,000 range, as evidenced by the consolidation zone seen earlier in the week.

Following this consolidation, BTC erupted with a strong rally accompanied by a significant surge in volume during 9:54 a.m. Eastern Time (ET), pushing the price past $100,000 and reaching a high of $102,514 around 11:25 a.m. – The $100,000 range represents a strong demand area supported by recent price action and volume profile.

If BTC moves into this zone, it could offer a favorable buying opportunity for day traders, especially if it is accompanied by a strong and bullish candlestick pattern or continuation of higher trading volumes. The $103,000 to $103,500 level represents immediate resistance where selling pressure is more prominent.

Short-term traders can make partial profits around this level. For long-term holders, monitoring price action at $103,500—another potential resistance level—can help identify exits. The move above $100,000 on Monday follows MicroStrategy’s latest BTC purchase. The public Business Intelligence (BI) firm now has 447,470 BTC.

Volume during the breakout above $100,000 and $101,000 is a fairly bullish indicator. However, the four-hour and one-hour charts also show minor overextension, indicating a possible short-term pullback or consolidation before further moves higher. This happened after an intraday peak. Momentum-driven traders should keep a close eye on confirmations above $103,000 to ensure continued bullish strength.

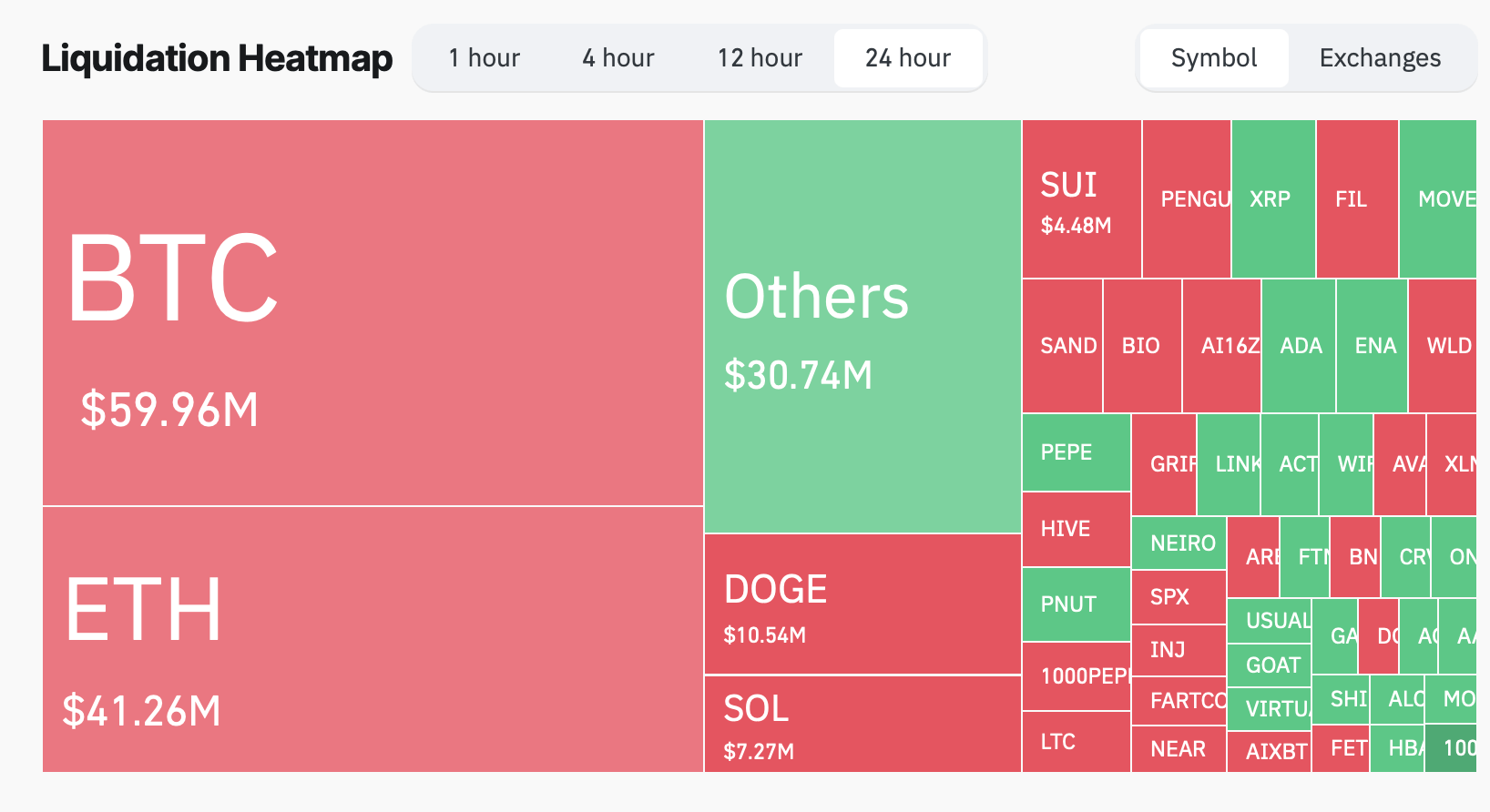

Bitcoin break above $100k. This week reflects renewed market optimism and strong buying interest. Strategic entries close to support levels and vigilant monitoring of resistance zones will be critical to navigating Bitcoin’s dynamic value action. Within 24 hours, $48.13 million was liquidated. US in Bitcoin, due to the rapid increase in BTC prices from 10:00 am to 1:30 pm ET, approximately 74,997 traders were liquidated during the last 24 hours across the entire crypto market.