Crypto markets have observed a subtle but notable shift in Bitcoin (BTC) flows from Binance to Coinbase Pro amid Binance’s recent regulatory challenges and anticipation of a spot Bitcoin ETF in the United States.

Data from CryptoQuant reveals that, as of 4:00 pm on November 22, approximately 5,000 BTC left Binance and found a new home on Coinbase Pro, which saw an increase of around 12,000 BTC in its reserves.

The catalyst behind this move appears to be the legal issues faced by former Binance CEO Changpeng Zhao. He recently pleaded guilty to anti-money laundering charges brought by U.S. authorities, leading to a deal that also requires him to resign as chief executive and pay a $50 million personal fine.

Binance, in turn, accepted a hefty fine of $4.3 billion. The news of this has shocked the entire crypto community, leading investors to re-evaluate their positions on several key exchanges. Previous reports confirmed a $1.2 billion outflow from Binance over the past week.

Additionally, the long-awaited approval of a Bitcoin spot ETF has contributed to the recent turnaround. With the possibility of a regulatory green light on the horizon, industry experts are positioning themselves to reap a windfall from potential regulatory changes in the works.

Coinbase, recognized as a leading US exchange with a strong regulatory stance, will benefit as institutional players seek a stable and compliant trading environment. However, Coinbase has not been without run-ins with the US Securities and Exchange Commission (SEC) either.

However, Coinbase remains one of the top US exchanges due to its embrace of regulation and lobbying. Its clientele is predominantly made up of institutional players, entities that will benefit greatly from the potential approval of an ETF.

Despite the moves, it is worth noting that Binance still maintains a considerable lead in global crypto market volume, with almost six times more activity than Coinbase in the last 24 hours.

Bitcoin recovers above $37,000

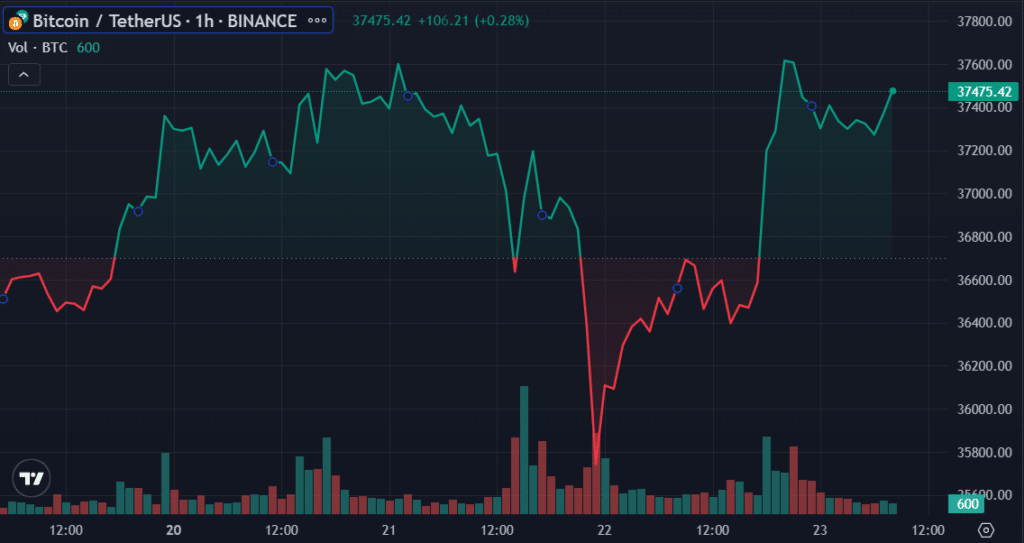

Notably, the shift in BTC funds coincides with a recent period of sustained volatility in the Bitcoin market. Following reports of Binance’s regulatory issues, BTC broke the $37,000 and $36,000 psychological support levels.

The asset eventually fell to a low of $35,735 on November 21, posting an intraday loss of 4.56%. However, Bitcoin recovered the next day, recovering losses caused by bearish reports, the asset regained the $36,000-$37,000 level, remaining at $37,861 at the end of November 22.

The rally campaign extended until November 23, reviving optimism in the broader market as several altcoins also posted impressive gains.

BTC is up 2.42% in the last 24 hours and is currently trading at $37,452.