Bitcoin continues its record bull run, setting a new all-time high (ATH) every few days. The cryptocurrency recently climbed close to the long-awaited $100,000 mark.

This achievement was fueled by strong activity from whale investors and long-term holders (LTH), who played a key role in Bitcoin’s rally.

Bitcoin whales are piling up

Whale addresses have been steadily accumulating Bitcoin over the past month, adding 56,397 BTC worth approximately $5.42 billion. This constant buying pressure has significantly supported Bitcoin’s price action, pushing it to new highs. Whale activity is considered a bullish indicator as these large investors often influence market trends.

This accumulation demonstrates the growing confidence of both institutional and retail investors. Sustained bullish sentiment from whales indicates strong belief in Bitcoin’s potential to cross the $100,000 mark. This behavior adds resilience to Bitcoin’s current rally, helping it withstand potential market corrections.

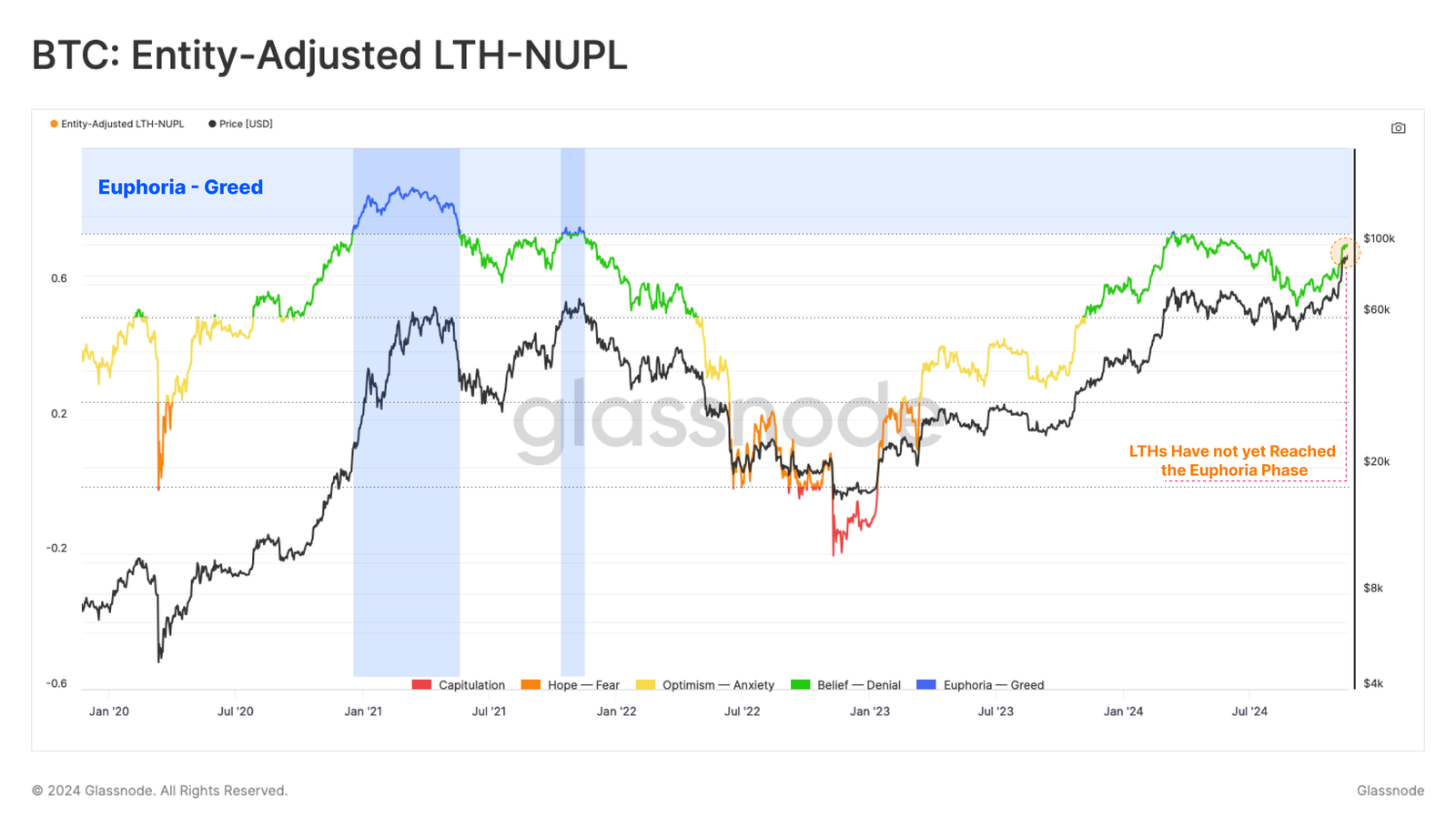

Long Term Holders’ Net Unrealized Gain/Loss (LTH NUPL) remains below the Euphoria threshold, suggesting more room for growth. Historically, when LTHs hold significant unrealized gains without peaking in euphoria, the market has further upside potential.

This indicator indicates that LTHs are not engaging in widespread profit-taking, maintaining their belief in Bitcoin’s upward trajectory. This is a strong macro signal that supports a continuation of the current bullish trend, making Bitcoin’s path to $100,000 more achievable.

Bitcoin Price Forecast: ATH Rising

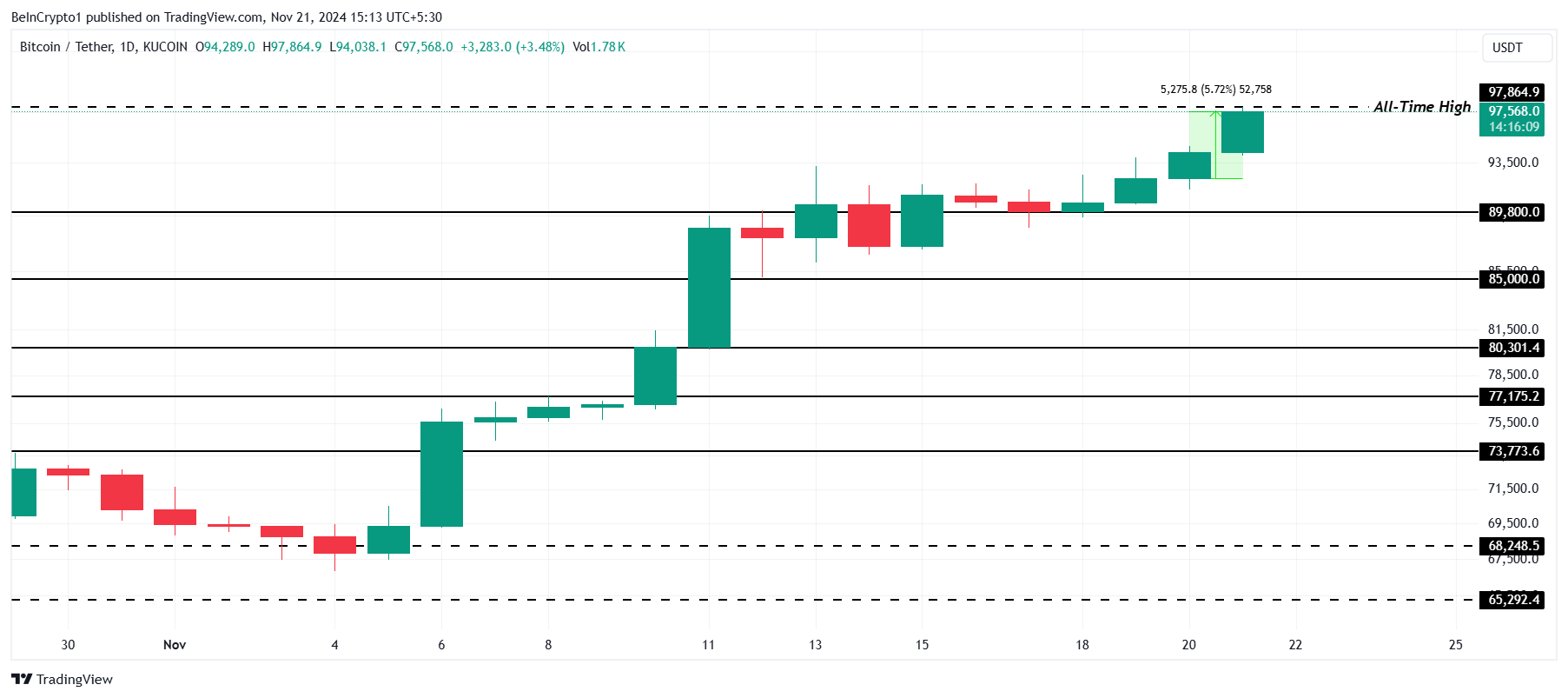

Earlier today, Bitcoin hit an all-time high of $97,864, recording a 5.7% gain over the past 24 hours. This jump reflects growing demand and market confidence in Bitcoin’s upward momentum.

To reach $100,000, Bitcoin must maintain its bullish momentum and establish $97,864 as a new support level. A successful transition from this resistance to support, coupled with whale accumulation and LTH belief, could propel Bitcoin to its historical milestone.

However, if profit taking begins or if whales and LTH change their positions, a price correction may occur. A fall below $89,800 would invalidate bullish forecasts, potentially delaying Bitcoin’s rise to $100,000.