Arkham Intelligence reported through the post of X that BlackRock, the world’s largest asset manager, is currently selling Bitcoins (BTC) from its IBIT exchange fund, not purchases. The update was accompanied by a visual representation of transaction flows, which indicates a significant departure from the BlackRock asset.

Crypto -market activity tracker said: “Guys, I have bad news, BlackRock does not buy. In fact, they sell. ”

The effect of BlackRock in the crypto sector increased after the launch of the Bitcoin -ETF, called ISHHARES BITCOIN TRUST BITCOIN HOLDINGS (IBIT). Analysts believe that the essence is part of why BTC had a year of books. However, following the understanding of Arkham Intelligence, speculation is growing that the asset manager can sell BTC in response to a recent coin market rollback.

BlackRock Bitcoin Market Activity concerns the community

In May 2024, BlackRock reported a significant number of bitcoins to a cold storage, which was perceived by the market as a long -term investment strategy. This step was considered as a bull signal, as investors went on optimism that one of the most conservative financial institutions began to bet on Bitcoin’s durability.

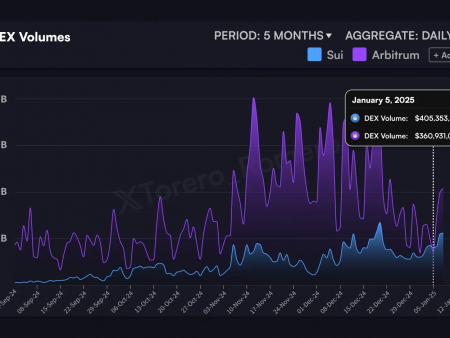

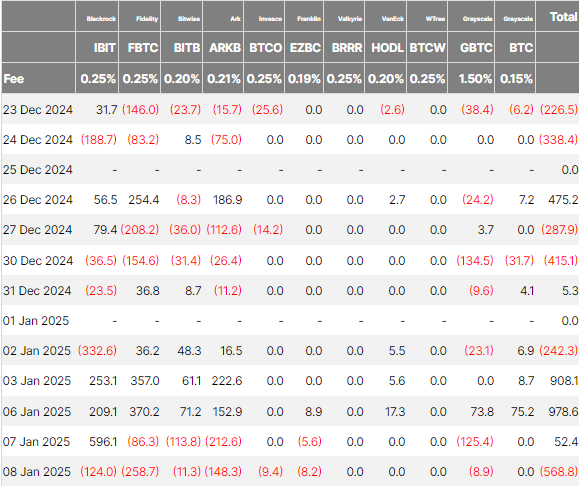

Nevertheless, on December 26, BlackRock fell into the headlines of newspapers when he reportedly sold bitcoins in the amount of 188.7 million dollars. USA, which is the largest sale. On the same day, according to several sources, the asset manager has rolled BTC in the amount of $ 1.88 billion for Coinbase wallets. Transactions were carried out in several tranches, attracting the attention of observers behind the market.

At that time, it was unclear whether the company plans to release possessions or save them on the exchange.

One user on X commented on the potential influence in the market, suggesting that BlackRock sales can lead to short -term bear moods, although long -term investors can consider this as an opportunity to buy at lower prices.

Another added to the conversation, saying: “Institutions are often sold when they think that the market has reached a peak or to re -balance the portfolio, and not necessarily because they are an asset.”

Meanwhile, on January 2, IBIT BlackRock recorded its largest one -day clean outflow, as investors removed $ 332.6 million. The USA, according to Farside Investors. The investment car did not see a negative pure investment flow over the next four days until January 8, where the outflow reached $ 100 million.

IBIT, which has the title of the largest bitcoin ETF with pure assets of about 56.2 billion dollars. USA, was a dominant player in the cryptocurrency market. ETF attracted more than 37 billion dollars of tributary, which, according to analysts, contributed to Bitcoin’s dittle to a new record high level in December more than $ 108,000.

BlackRock: the supply of bitcoins can be changed

In other news, BlackRock published a video explanatory video that casts into question the invariability of 21 million Bitcoin offers. The video that covered the attention of the community after sharing Microstratrategy, shared Michael Seilor, describes the Bitcoin supply limit as a “hard rule” designed to control the offer, preserve customer ability and prevent excessive currency issuance.

Just in: BlackRock releases a 3 -minute educational video explaining what #Bitcoin is. pic.twitter.com/ejqbv0grn

– Bitcoin Magazine (@bitcoinmagazine) December 17, 2024

“There is no guarantee that the 21 million Bitcoin supply will not be changed,” explained the explanatory. The consequences of the video caused a discussion about whether the growing effect of BlackRock on the bitcoins can lead to the fact that the cryptocurrency was “nuclear”.

Joel Valencuela, Executive Director for Sales and Marketing for The Cryptocurrency Dash, suggests that such messages are preparing the public for a potential increase in supplies.

“They are accustomed to this possible,” said Valensuel. “When an increase in the limit of deliveries occurs, it will always be part of the plan.” And today, in 2024, people have the courage to say that Bitcoin was not captured. ”

From Zero to Web3 Pro: your 90-day career plan