Arthur Hais shot a third of his essay series, and this is exactly what you expect – Raw, Technical and Unpogetically Direct.

Under the name “Kiss of Death”, the essay is bursting into the financial strategy of President Donald Trump, fraud of the federal reserve system, manipulating public debts and what all this means for crypto investors.

The main topic? Debt, liquidity and control. The essay breaks through the dynamics between Scott Besent in the Treasury, Jerom Powell in the Fed and the economic plays of Trump.

Trump’s debt game and Powell’s role

Arthur retained this real: he reminded the readers that Trump is a real estate guy. He builds empires with cheap debts and bold claims. That is how he controls America, no interest in reducing expenses actually, without love for the lumbar. Instead, Trump doubles the expansion of debt.

“Trump is not here to be Herbert Hoover. He is here to be FDR, ”says Arthur. FDR printed money and spent a way out of economic collapse.

Trump, Arthur claims, will do the same. If Trump had any intention to allow the market to clean a bad loan, he would allow depression in the 1930s to erase everything cleanly. He will not. The seal of money supports the game, Arthur said.

The key question is who controls this cash flow? Enter Scott Immentine (Minister of Treasury) and Jerome Powell (chairman of the federal reserve system).

“The defect was appointed Trump 2.0, and judging by his past and real interviews, he very much shares the same world point of view as the emperor. Powell was appointed Trump 1.0, but he is a traitor to the cross -countryside.

Arthur added that:

“Powell destroyed the slight reliability that he left, introducing a shift with a score of 0.5% in September 2024. The US economy, which the growing is higher than the trend and still contained the coals of inflation, did not need to reduce the rate. ”

Arthur also notes that Powell was stuck. It is assumed that the Fed will fight inflation, but this also cannot allow the economy to explode. If the repayment of the debt becomes too expensive, Powell will be forced to reduce the rates and restart the stamp of money, even if he does not want to.

Debt restructuring and global game

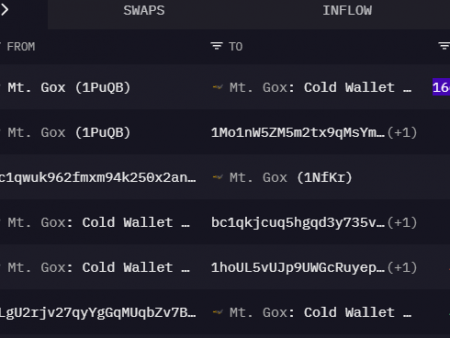

In his essay, Arthur publishes numbers. The US is drowning in debt. If nothing changes, interest payments will eat everything. The treasury should extend the timing of loan repayment and lower rates, a decision called “setting out the debt.” This is just a bizarre way to say: “To postpone the problem and make it cheaper.”

This is exactly what the defect wants. It is registered, saying that the United States needs a new debt. Problem? The restructuring of the debt on a global scale is a nightmare. The United States owes money to China, Japan and Europe. All of them have their own agenda. The process will be slow, painful and political, Arthur said.

But this is not a direct concern for the crypto -investors. Short -term liquidity is important. Powell controls this. Powell has four main levers to manipulate money supply:

- The reverse repo program (RRP) –Clits short-term cash movements.

- Interest on reserve residues (iorb) – pay to banks in order to keep money, and not lend it.

- Fed Funds Lower Border – Minimum Banks are charged with each other.

- FRS Funds Upper Border – the maximum rate before the Fed.

Arthur says that Powell can flood the market in dollars at any time. The Fed can buy a debt, lower rates and print money at will. If Trump leads to a recession, Powell will have no choice but to loosen the crane.

Trump strategy: will force a recession, printed money, crypto pump

Arthur does not play guessing games. He sets out a direct path: “The FRS recession law: if the US economy is in recession, or the Fed is afraid that the US economy will enter one, it will reduce bets and / / or money.”

“At the fundamental level of Pax America and the world economy, which it is laid, are funded by debts. Large enterprises finance the expansion of future production and current operations by releasing debt. If the growth of cash flow significantly slows down or frankly decreases, ultimately the repayment of debt obligations regarding banks. ” Arthur said.

Trump maneuvers Powell to facilitate financial conditions by causing a recession or convincing the market that one is right around the corner. To prevent the financial crisis, Powell will then make some or all of the following: reduction in bets, final quantitative tightening (QT), restart quantitative softening (QE) and/or suspend the additional ratio of leverage for banks buying valuable US debt paper.

Enter the Doge Elon Musk – the Department of Government’s Efficiency. Their work? Cut the waste, fire in government workers and kill fraudulent payments. The dog is already beating the numbers:

- 400,000 federal employees are expected to be dismissed by the end of 2025.

- Applications for unemployment in Washington, the district of Colombia, come up.

- DC prices fell by 11% in early 2025.

- The abolition of the state contract is accelerated.

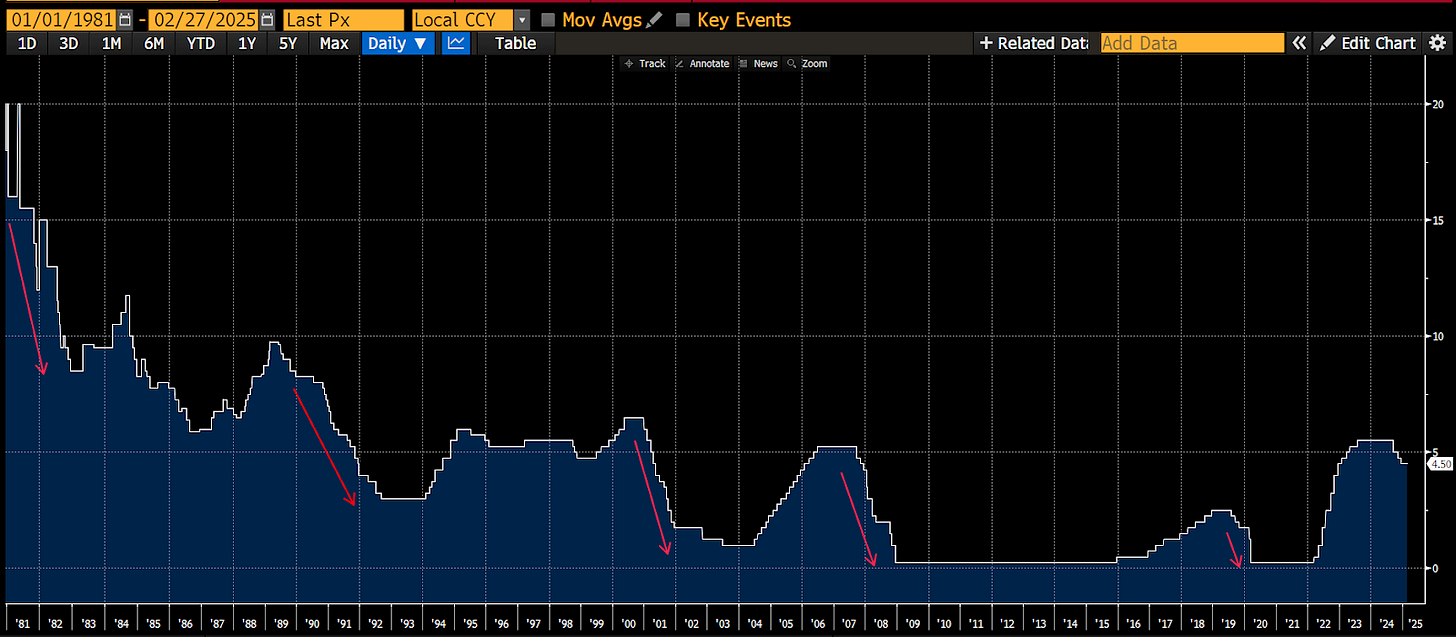

Arthur calls this “the murder of chicken to scare the monkey.” Mass dismissals send a message: Free riding is over. The more the market panic, the more Powell feels the pressure to reduce the rates and print money. Why? Each US recession since 1980 has led to a decrease in bets. Arthur pulls historical graphs:

- Red arrows = every time the Fed reduces bets from the recession.

- Everyone led to liquidity.

- Each of them pumped assets.

How great will the printing will be?

Arthur makes mathematics. Potential stimulus? From 2.74 trillion to 3.24 trillion dollars.

Accident:

- Reducing rates: 1.7 trillion dollars in liquidity

- End Qt: 540 billion dollars added

- Restanating QE + Bank leverse Loophol: from 500 to 1 trillion US dollars.

For comparison: the stimulus of the era of the protruding era was 4 trillion dollars. Arthur predicts that the seal of the money caused by DOGE can reach 80% of this.

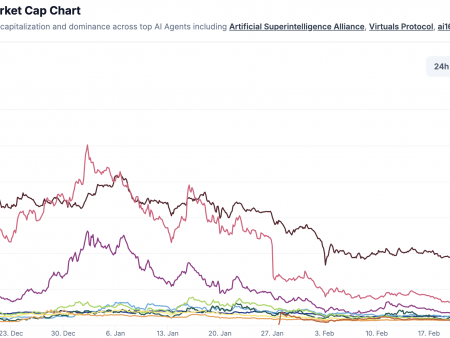

What does it mean for bitcoins?

- Bitcoin made 24 times from 4 thousand to 69 thousand dollars. USA in 2020-2021

- Bitcoin market capitalization is now larger, so let’s call it 10 times

- 3.24 trillion.

Meanwhile, Trump continues to tease the “strategic crypto -USA of the USA”. If the United States begins to buy bitcoins, the market can go crazy. Problem: the government has no free money. The only way that happens is if:

- Congress increases the ceiling of debt.

- Gold is overestimated to match market prices.

The market jumped to Trump’s tweet, but Arthur calls him a rebound of a dead cat. Bitcoin reached 110 thousand dollars before Trump’s inauguration. It crashed to 78 thousand dollars when liquidity has dried up. Arthur sees two opportunities:

- The stock market of the landfill 20-30%, panic Powell, prints, BTC Rips is higher.

- A large financial player collapses, forcing the liquidity of emergency accidents.

In any case, Bitcoin moves the first. Arthur call? “Buy a fall, without a lever and wait for the next step of the Fed.”

The legendary trader finished his essay, clarifying that he “firmly believes that we are still in the bull cycle, and therefore the bottom, in the worst case, will surpass a record maximum of $ 70,000. I’m not sure that we will get this low.