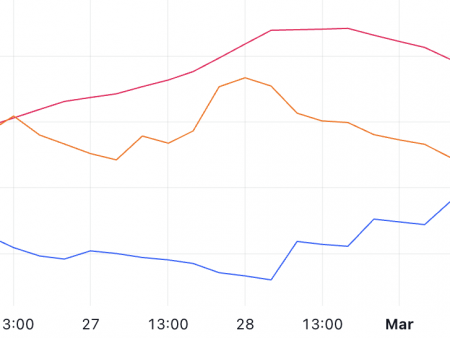

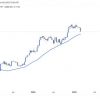

- APT is currently trading at 6.20 US dollars, which has decreased by 4.85% in 24 hours.

- Above $ 6.24, US dollars can increase to $ 6.30, while below $ 6.18 risk up to 6.10 US dollars.

Aptos (APT) currently costs $ 6.20, which reflects a decrease of 4.85% over the past 24 hours. Market capitalization is 3.65 billion dollars, which is 4.83% compared to the previous day. The 24-hour volume of bidding fell significantly by 43.89%, reaching $ 144.1 million. USA. The market capitalization coefficient is 3.95%, which indicates lower trade activity compared to previous days.

Technical indicators and price levels

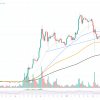

The price action of the APT shows the phase of consolidation with low volatility. The support level is about $ 6.18, and the resistance level is $ 6.24. If APT is torn above $ 6.24, it can check the next resistance of about $ 6.30. Nevertheless, the fall below $ 6.18 can lead to further appeal to $ 6.10.

The relative force (RSI) index is 40.54, signaling the soft bear pulse. The average RSI value is 40.59, which indicates that APT is not yet in the resold territory. The movement above 50 may offer a potential change in trend. If the RSI falls below 30, this will indicate the terms of the overabundance, increasing the chances of the rebound.

The CHAIKIN (CMF) cash indicator is -0.16, which reflects the weak pressure of the purchase. This involves the outflow of capital from APT, which can limit upward movement if demand does not increase. If CMF becomes positive, this will indicate a growing accumulation, possibly raising prices above.

APT is currently trading close to its short -term sliding average. The bull crossover, where the short -term sliding average intersects above the long -term sliding average, can signal the shift towards the rising trend.

Aptos (APT) is struggling to restore the impulse, since market moods remain weak. Key levels for viewing are $ 6.24 for a breakthrough up and $ 6.18 for a potential risk of reduction. RSI and CMF indicate weak demand, while sliding medium -sized do not show a clear shift of the trend. With an increase in the purchase pressure, APT can re -check $ 6.30, but the inability to hold support can push it.