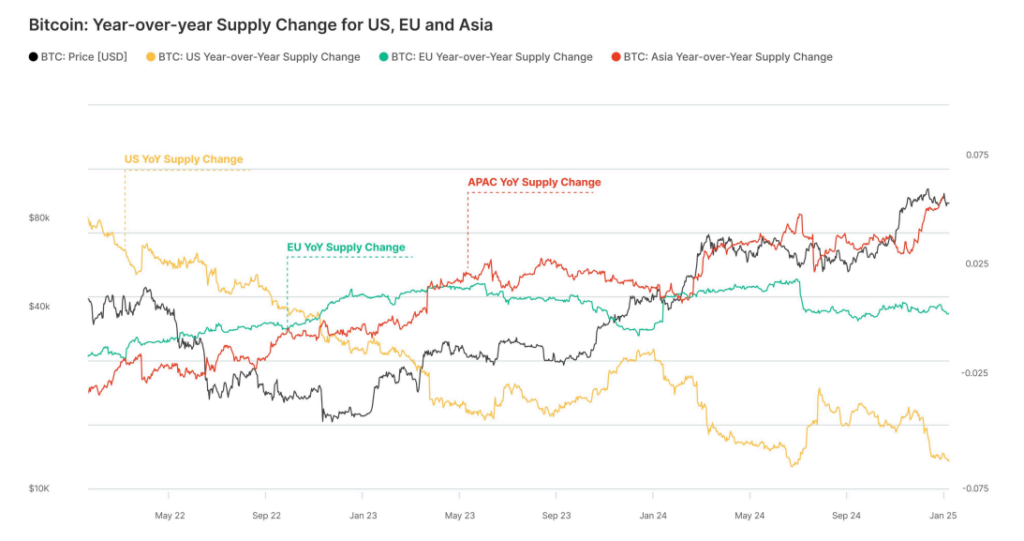

According to Gemini and Glassnode, the retail activity of bitcoins in the APAC was ahead of the United States and Europe, due to non -intentional participation.

Asian-Pacific regional trading merchants are taking steps in Bitcoins (BTC), while the United States is behind. With the exclusion of stock payment and exchange flows, retail activities in Asia are growing faster than in the USA and Europe, according to the latest Gemini research report, made in cooperation with Glassnode.

Glassnode studies analyzed temporary transaction marks connecting BTC activity on working hours in different regions. The results show that “retail activity in the APAC region has grown in a faster video than other geography.”

Since the low level of Bitcoin in December 2022, the review shows that the increase in the supply of APAC reached 6.4%. For comparison, the United States observed a decrease by 5.7%, while Europe fell by 0.7% for the same time.

“This observation is interesting, reflecting the reverse behavioral activity between the United States and

APAC areas, involving a change in dominance in retail activity between the two regions. ”Glassnode

Institutional investors played a large role in the bitcoans of the United States, especially after the launch of Spot ETF. But outside the ETF and exchanges, APAC traders take the initiative. Analysts say that “probably” that the launch of Spot ETF in the United States in January 2024 played a key role in this trend, opening “new opportunities for retail and institutional investors to get acquaintance with bitcoins”.

In addition, the education and understanding of the class of assets “has been largely improved”, which led to

“Ripening of the profile of the investor,” says Glassnod.