Animoca Brands has outperformed other venture capital firms in both numbers and funds invested. The fund has transformed from a gaming ICO and switched to supporting Web3 projects, NFTs and additional games.

Animoca Brands plans to end 2024 with a doubling of its average monthly investment. Having been the most active venture capital fund for months on end, Animoca Brands has also expanded to 33 sectors for decentralized startups.

Animoca Brands continued to keep its finger on the pulse of Web3, choosing high-profile projects such as chubby penguins. Throughout 2024, Animoca Brands continued its track record of offering new offerings every month, participating in mid-size rounds of up to $10 million.

In addition to providing funds, Animoca Brands also helps select the best potential players in Web3, gaming and other network technology sectors.

Overall, crypto finance has responded positively in 2024 to the awakening of the bull market. While 2021 and 2022 were far from the investment frenzy, venture funding was up compared to 2023, the most stagnant year of the bear market.

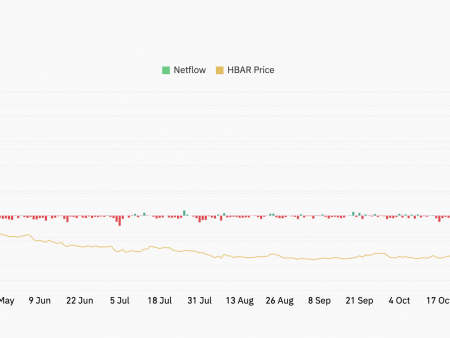

Animoca Brands continued its funding success in the third quarter, with investments reaching $2.4 million. In the first three quarters of 2024, funds invested $8 billion in crypto startups, matching and slightly exceeding 2024 funding levels. Animoca Brands has expanded its portfolio and above-average funding efforts for other funds.

In 2024, the total number of investment rounds will rise to 3,308, up from 2,589 in 2023. Most of the funding went to projects in the United States. Animoca Research has also expanded the fund’s impact, focusing on TON ecosystem.

Animoca Brands to exceed 100 rounds in 2024

As of December 1, Animoca Brands had completed more than 101 rounds, but continued with new investments in the final 2024 period. The company also served as a smart money indicator by identifying potentially popular games and platforms.

On average, venture capital funds joined 85 rounds per year.

The funding pace continued in December with Neptune Protocol at $3.9 million. Previously, Animoca Brands has collaborated with startups such as Bounty Bay, Haven 1 and GAIB. The largest funding round in recent memory was for the BLIFE protocol, where Animoca Brands helped raise $7 million.

As in previous months, the venture fund focused on seed-stage startups, although it also participated in undisclosed funding rounds for general purposes.

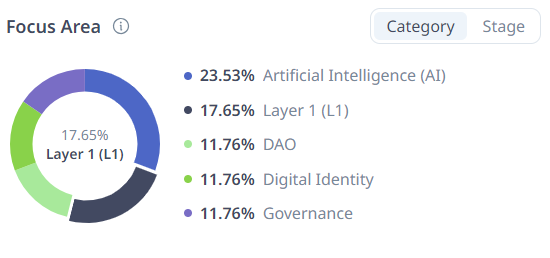

Animoca Brands completed an average of nine rounds in 2024, compared to four rounds in 2023. This year, the venture fund also diversified its portfolio of projects. While Animoca Brands remains a supporter of Web3 games, it has reduced its stake in gaming projects from 40% in 2023 to 30% this year.

Animoca Brands has also cut back on its share of lead storytelling, switching instead to artificial intelligence. The fund participated in a broader selection of brands and fewer top-tier rounds.

Animoca Brands has sponsored some of the largest financing deals in 2024. The deals included Monad Labs ($225 million), Berachain ($100 million), and OG Labs ($40 million).

Smaller funds will maintain momentum in 2024

The years of large-scale venture capital-backed projects appear to be over. While Pantera Capital, Andreessen Horowitz and others were still active, the largest number of rounds came from crypto funds.

OKX Ventures and Binance Labs were among the top five investors this year. Robot Ventures has also gained prominence, raising a total of 52 rounds this year.

Over the past 30 days, Coinbase Ventures, Pantera Capital and Vitalik Buterin have joined the series of rounds. Over the past month, the top three deals included StakeStone ($22 million), OG Labs and Suilend ($4 million).

For now, venture capital funds are staying away from the meme token trend, which is too volatile for any strategic intent. Venture capital firms are also looking for new models to avoid accusations of token dumping in the community and price collapse.

Get a High Paying Job at Web3 in 90 Days: The Ultimate Action Plan